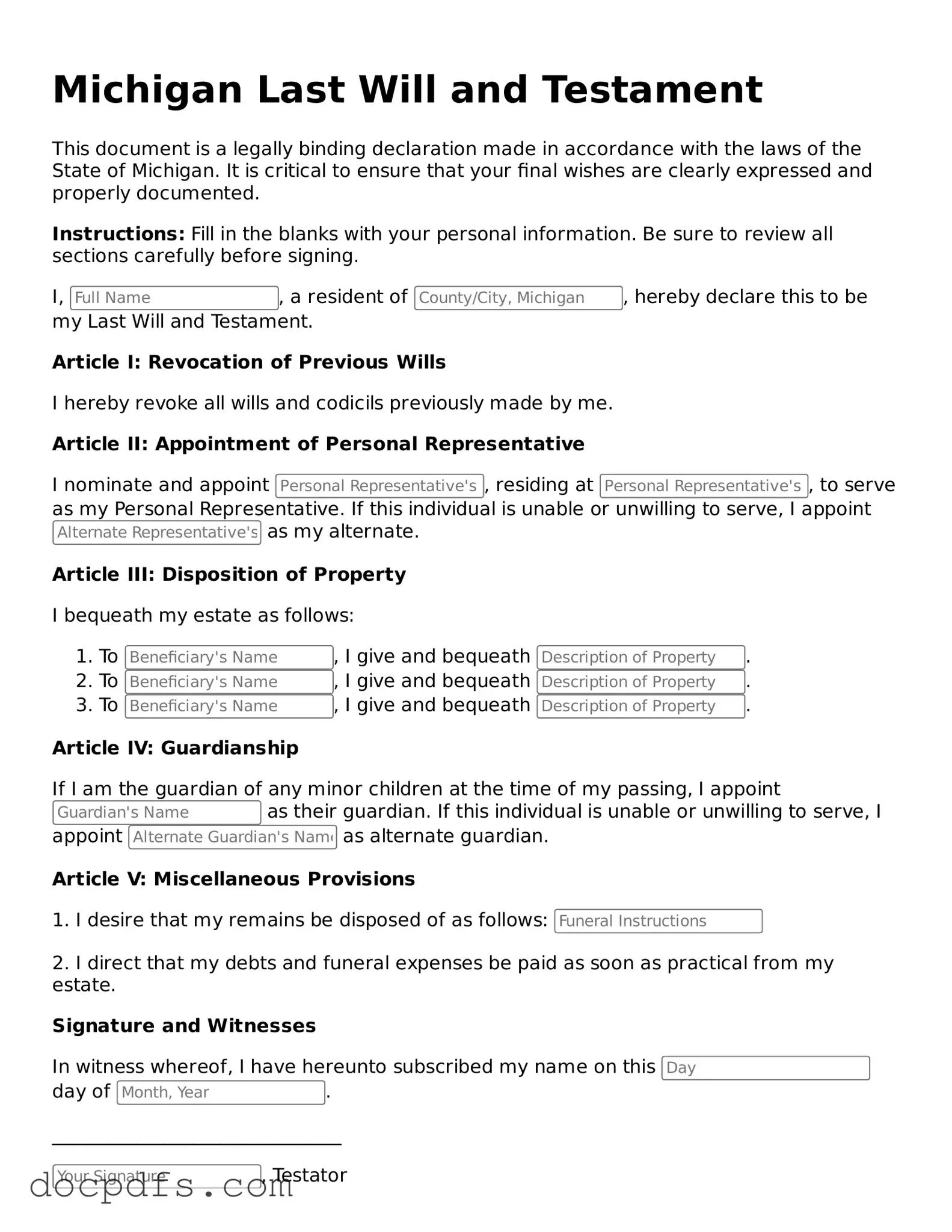

What is a Last Will and Testament in Michigan?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. In Michigan, this document allows individuals to specify beneficiaries, appoint guardians for minor children, and designate an executor to manage the estate. It ensures that a person's wishes are followed and can help avoid disputes among family members.

Who can create a Last Will and Testament in Michigan?

In Michigan, any individual who is at least 18 years old and of sound mind can create a Last Will and Testament. Sound mind means that the person understands the nature of the document they are signing and the implications of their decisions. It is important that the will reflects the true intentions of the person making it.

What are the requirements for a valid will in Michigan?

For a will to be valid in Michigan, it must meet several criteria:

-

The will must be in writing.

-

The person creating the will must sign it at the end.

-

At least two witnesses must sign the will, attesting to the fact that the person creating the will was of sound mind and signed the document voluntarily.

It is also advisable to have the will notarized, although this is not a legal requirement in Michigan.

Can I change or revoke my will in Michigan?

Yes, you can change or revoke your will in Michigan at any time while you are still alive. To make changes, you can create a new will that explicitly revokes the previous one or add a codicil, which is an amendment to the existing will. Ensure that any changes are executed following the same formalities required for creating a valid will.

What happens if I die without a will in Michigan?

If a person dies without a will, they are considered to have died intestate. In this case, Michigan's intestacy laws will determine how the deceased's assets are distributed. Typically, assets will go to the closest relatives, such as a spouse, children, or parents. This process can be complicated and may not reflect the deceased's wishes, highlighting the importance of having a will in place.

Can I write my own will in Michigan?

Yes, individuals can write their own will in Michigan, often referred to as a "holographic will." However, it is essential that the document meets all legal requirements to be considered valid. While writing your own will can save costs, it is advisable to consult with an attorney to ensure that your wishes are clearly articulated and legally enforceable.

How do I ensure my will is executed properly?

To ensure that your will is executed properly, follow these steps:

-

Clearly state your intentions and be specific about the distribution of your assets.

-

Choose an executor you trust to carry out your wishes.

-

Store the will in a safe place and inform your executor and family members where it can be found.

-

Review and update the will regularly, especially after major life events such as marriage, divorce, or the birth of children.

Taking these steps can help prevent confusion and disputes after your passing.

What should I do if I need help with my will?

If you need assistance with your will, consider consulting with an estate planning attorney. They can provide guidance tailored to your individual circumstances, ensuring that your will complies with Michigan law and accurately reflects your wishes. Additionally, they can help with other estate planning documents, such as trusts or powers of attorney, to create a comprehensive plan for your future.