What is a Michigan Promissory Note?

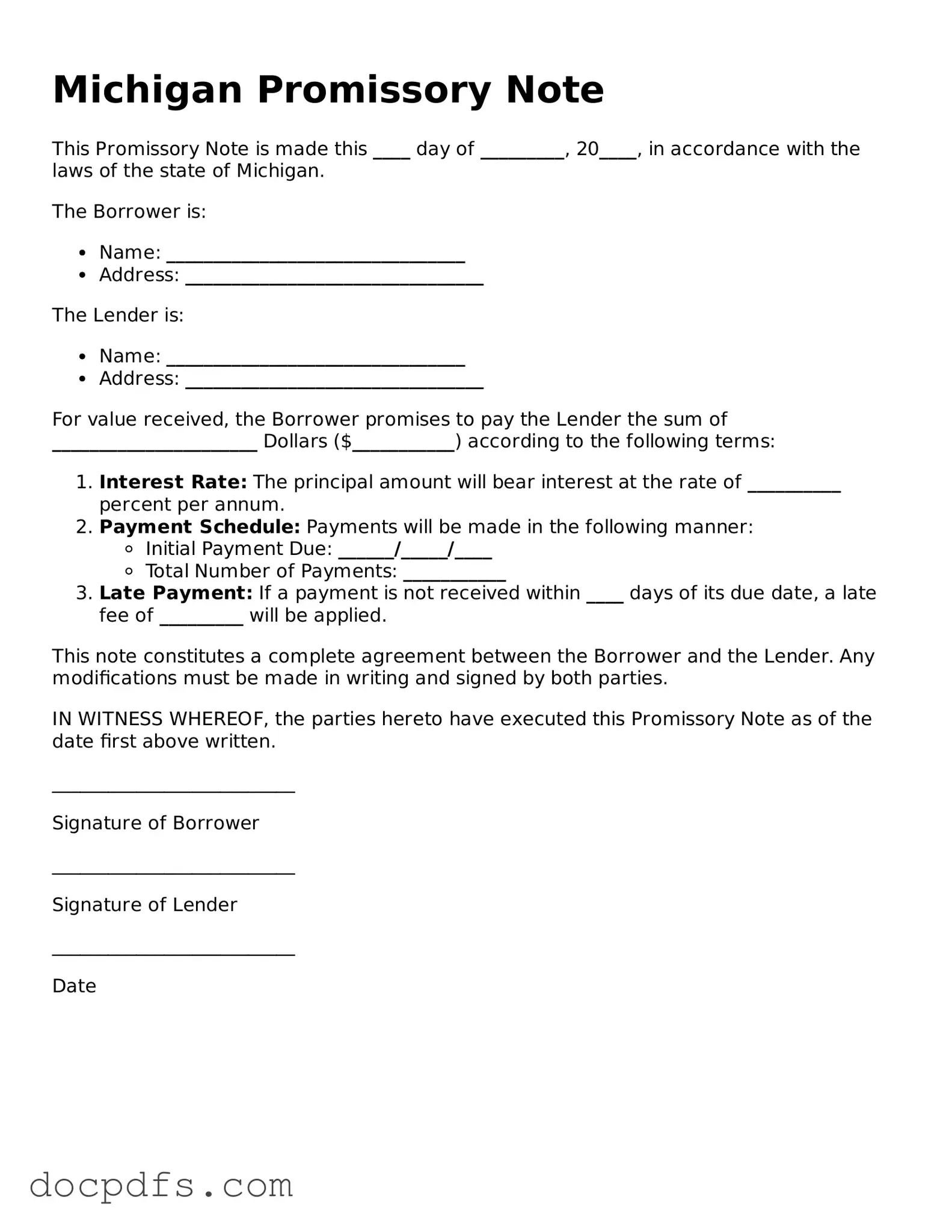

A Michigan Promissory Note is a legal document in which one party promises to pay a specific amount of money to another party under agreed-upon terms. It outlines the details of the loan, including the principal amount, interest rate, repayment schedule, and any penalties for late payments.

Who uses a Promissory Note?

Individuals and businesses often use Promissory Notes. For example, a person borrowing money from a friend or family member may use this document to formalize the loan. Similarly, businesses may issue Promissory Notes to secure financing from investors or lenders.

What are the key components of a Michigan Promissory Note?

A typical Michigan Promissory Note includes the following components:

-

The names and addresses of the borrower and lender.

-

The principal amount of the loan.

-

The interest rate, if applicable.

-

The repayment schedule, including due dates.

-

Any late fees or penalties for missed payments.

-

Signatures of both parties.

Is a Promissory Note legally binding?

Yes, a properly executed Promissory Note is legally binding. It creates an enforceable obligation for the borrower to repay the loan according to the terms outlined in the document. If the borrower fails to repay, the lender may take legal action to recover the owed amount.

Do I need a lawyer to create a Promissory Note?

While it is not required to have a lawyer draft a Promissory Note, it is often recommended. A lawyer can help ensure that the document meets legal standards and protects the interests of both parties. However, templates are available for those who prefer to create their own notes.

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified if both parties agree to the changes. It is important to document any modifications in writing and have both parties sign the amended note to ensure clarity and enforceability.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender may take several actions, including:

-

Contacting the borrower to discuss repayment options.

-

Assessing late fees as outlined in the note.

-

Taking legal action to recover the owed amount.

It is important for both parties to understand the consequences of default before entering into a Promissory Note.

Are there any tax implications associated with a Promissory Note?

Yes, there may be tax implications for both the borrower and lender. For instance, the lender may need to report the interest income received, while the borrower may be able to deduct the interest paid, depending on the circumstances. Consulting a tax professional is advisable to understand the specific implications.

Where can I find a Michigan Promissory Note template?

Templates for Michigan Promissory Notes can be found online through legal websites or document preparation services. It is important to choose a template that complies with Michigan laws and suits your specific needs.