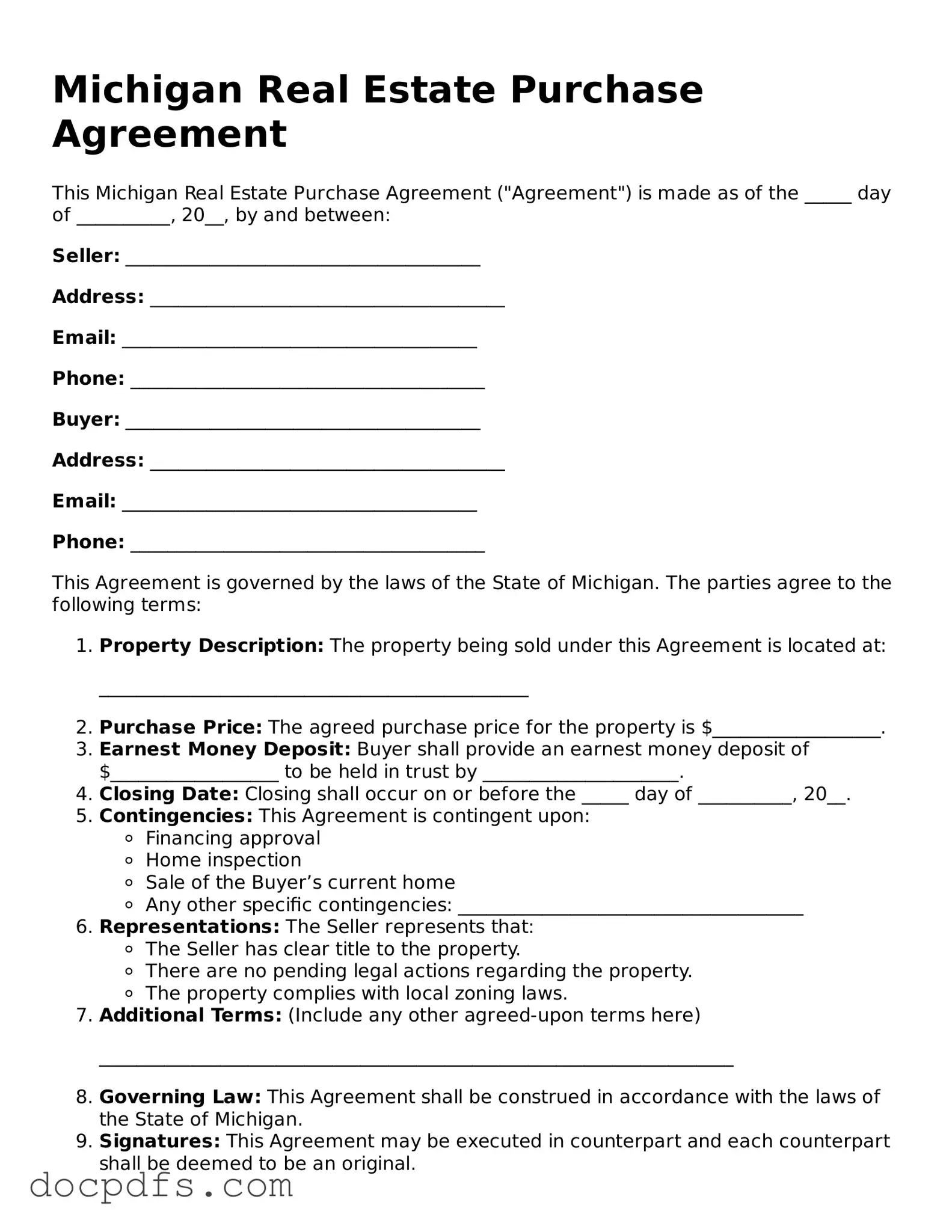

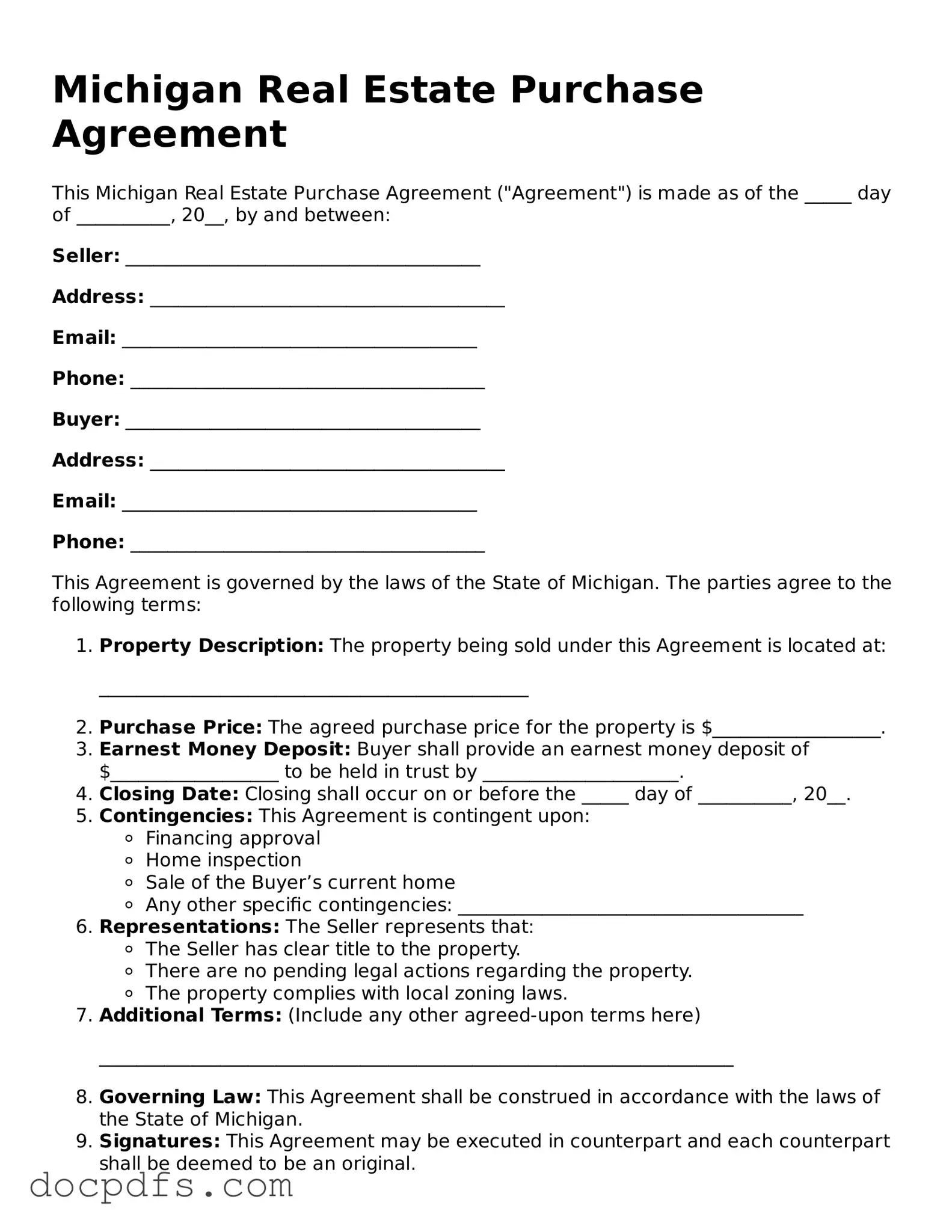

Free Michigan Real Estate Purchase Agreement Form

The Michigan Real Estate Purchase Agreement is a legal document that outlines the terms and conditions for buying and selling real estate in Michigan. This form serves as a crucial tool for both buyers and sellers, ensuring that all parties understand their rights and obligations throughout the transaction. Understanding this agreement is essential for anyone involved in a real estate deal in the state.

Open Real Estate Purchase Agreement Editor Now

Free Michigan Real Estate Purchase Agreement Form

Open Real Estate Purchase Agreement Editor Now

Open Real Estate Purchase Agreement Editor Now

or

⇓ Real Estate Purchase Agreement

Finish this form the fast way

Complete Real Estate Purchase Agreement online with a smooth editing experience.