What is a Transfer-on-Death Deed in Michigan?

A Transfer-on-Death Deed (TODD) is a legal document that allows a property owner to designate one or more beneficiaries to receive their real estate upon their death. This deed enables the property to transfer directly to the beneficiaries without going through probate, simplifying the process and potentially saving time and money for the heirs.

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in Michigan can use a Transfer-on-Death Deed. This includes homeowners and property investors. However, it's important to note that the property must be solely owned by the individual, as joint ownership arrangements may require different considerations.

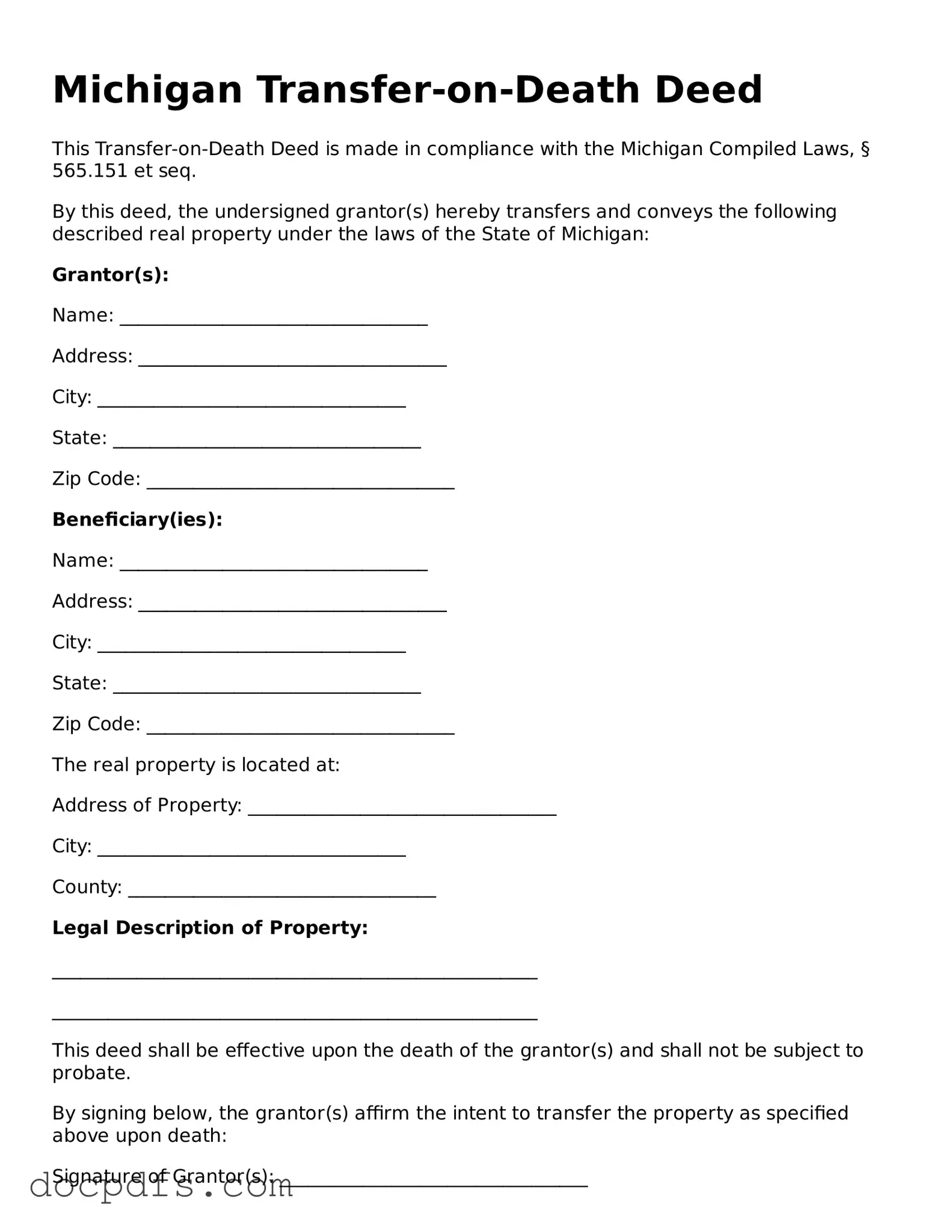

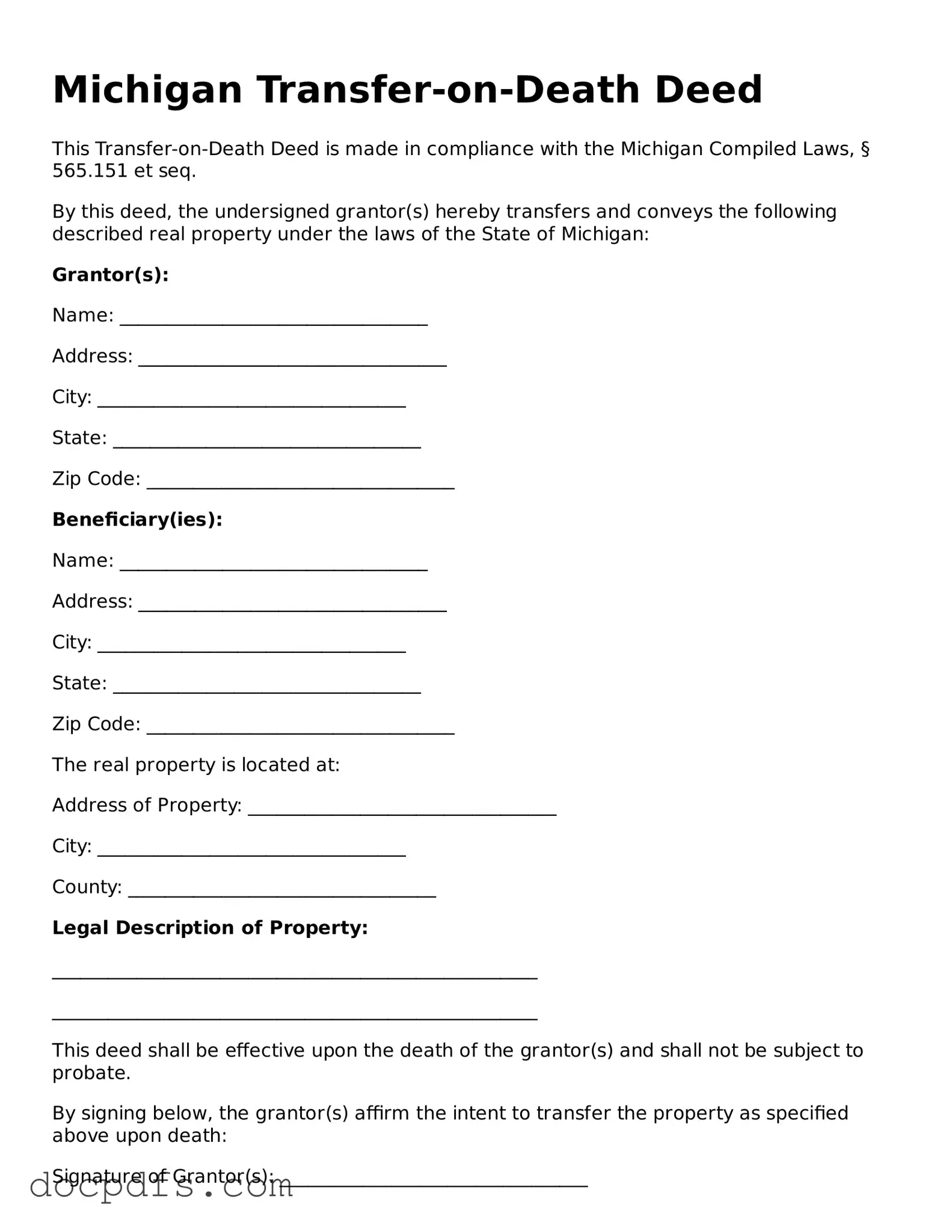

How do I create a Transfer-on-Death Deed?

Creating a Transfer-on-Death Deed involves several steps:

-

Obtain the appropriate form, which can usually be found online or through a legal office.

-

Fill out the form with accurate information about the property and the beneficiaries.

-

Sign the deed in front of a notary public.

-

File the deed with the local register of deeds office in the county where the property is located.

It's advisable to consult with a legal professional to ensure everything is completed correctly.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time while you are still alive. To do this, you would need to create a new deed that specifies the changes or explicitly states the revocation of the previous deed. This new deed must also be filed with the local register of deeds office to be effective.

What happens if I sell the property after creating a Transfer-on-Death Deed?

If you sell the property after creating a Transfer-on-Death Deed, the deed becomes void. The transfer of the property will occur through the sale, and the beneficiaries listed in the deed will not receive the property. It's important to understand that the deed only takes effect upon your death and does not impact your ability to sell or manage the property while you are alive.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when creating a Transfer-on-Death Deed. The property will not be subject to estate taxes until the owner passes away. However, beneficiaries may be responsible for property taxes once they inherit the property. It's wise to consult with a tax professional to understand any potential tax consequences based on individual circumstances.

Is a Transfer-on-Death Deed the right choice for me?

Whether a Transfer-on-Death Deed is the right choice depends on your specific situation and goals. This option can be beneficial for those looking to simplify the transfer of property to heirs and avoid probate. However, it may not be suitable for everyone, especially if there are complex family dynamics or other estate planning needs. Consulting with a legal or financial advisor can help you make an informed decision.