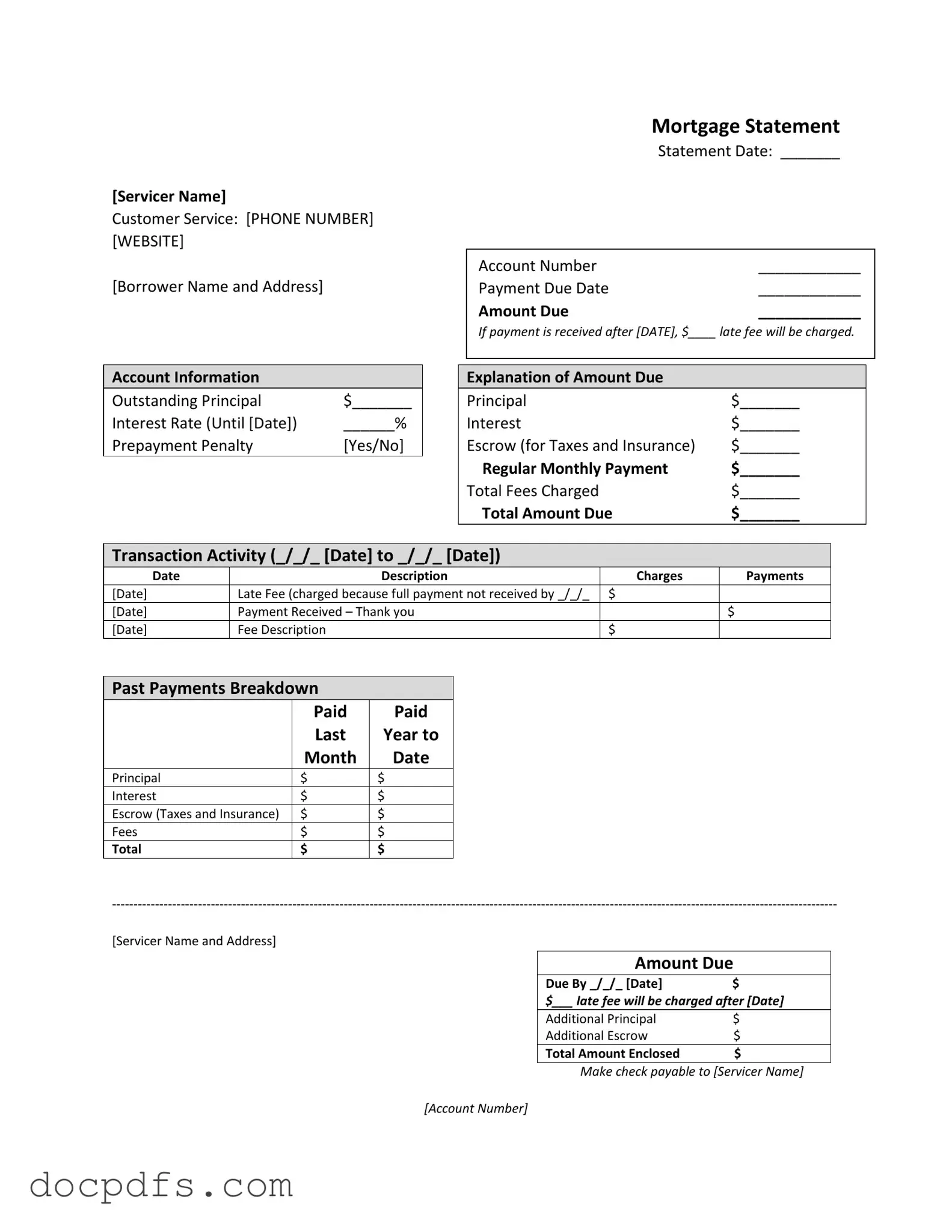

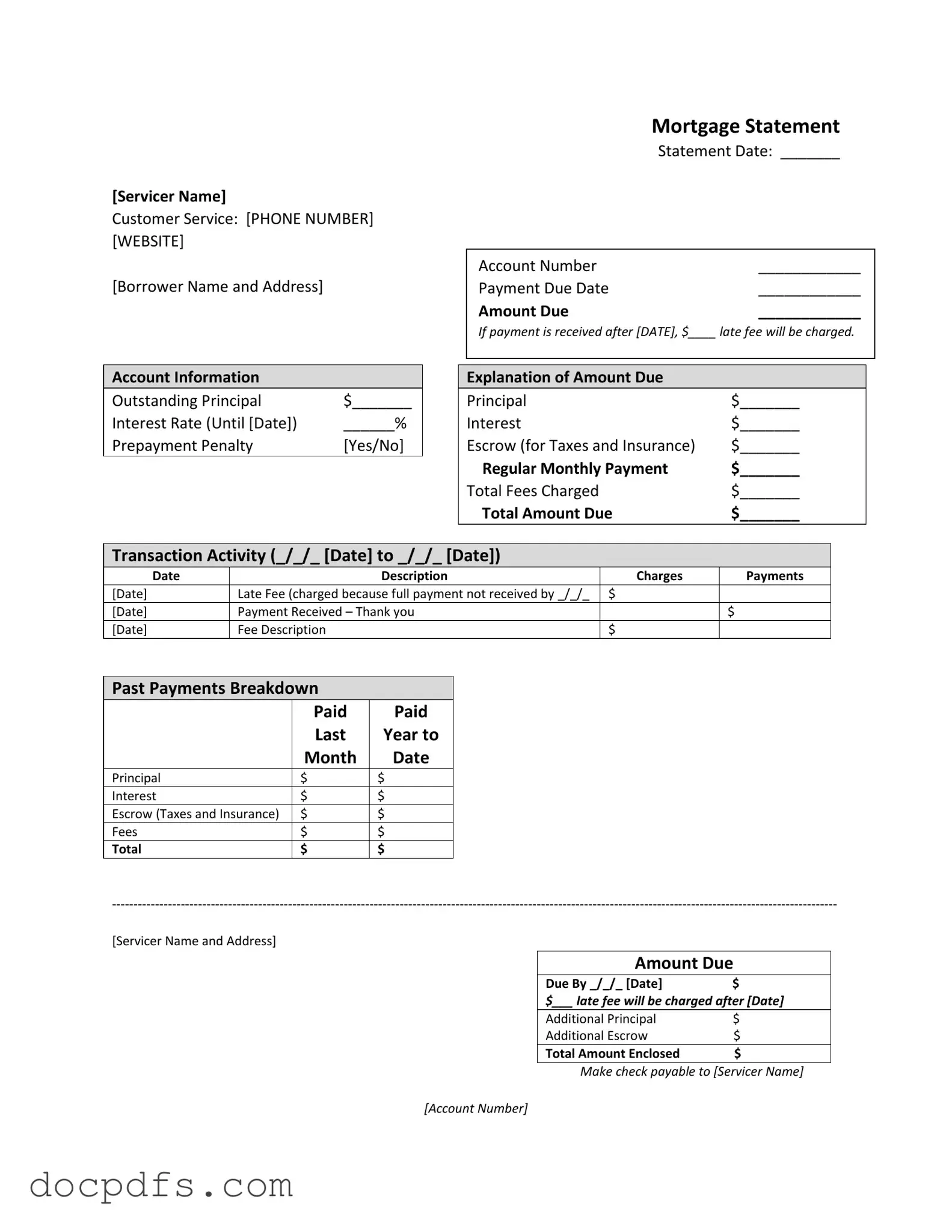

Mortgage Statement Template in PDF

A Mortgage Statement is a document provided by your mortgage servicer that outlines the details of your loan, including payment history and outstanding balances. This statement helps borrowers understand their current financial obligations and any fees that may apply. Reviewing your Mortgage Statement regularly ensures you stay informed about your mortgage status and can help prevent late fees or other penalties.

Open Mortgage Statement Editor Now

Mortgage Statement Template in PDF

Open Mortgage Statement Editor Now

Open Mortgage Statement Editor Now

or

⇓ Mortgage Statement

Finish this form the fast way

Complete Mortgage Statement online with a smooth editing experience.