What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. This option can help both parties, as it allows the homeowner to escape the financial burden of a mortgage they can no longer afford, and it provides the lender with a quicker resolution than the foreclosure process.

Who is eligible for a Deed in Lieu of Foreclosure in Ohio?

Eligibility typically includes homeowners who are facing financial difficulties and are unable to keep up with mortgage payments. Lenders may require that the homeowner has tried other options, such as loan modification or short sale, before considering a Deed in Lieu. Additionally, the property must be free of other liens for the process to proceed smoothly.

What are the benefits of a Deed in Lieu of Foreclosure?

-

It can help avoid the lengthy and costly foreclosure process.

-

Homeowners may be able to walk away from their mortgage debt without a deficiency judgment.

-

The process can be less damaging to a homeowner's credit score compared to a foreclosure.

-

It allows for a quicker resolution, enabling homeowners to move on with their lives.

What are the drawbacks of a Deed in Lieu of Foreclosure?

While there are benefits, there are also drawbacks to consider. Homeowners may lose their home and any equity they have built. Additionally, lenders may report the deed transfer to credit bureaus, which can impact credit scores. Finally, not all lenders accept Deeds in Lieu, and homeowners may need to negotiate terms.

How does the process work?

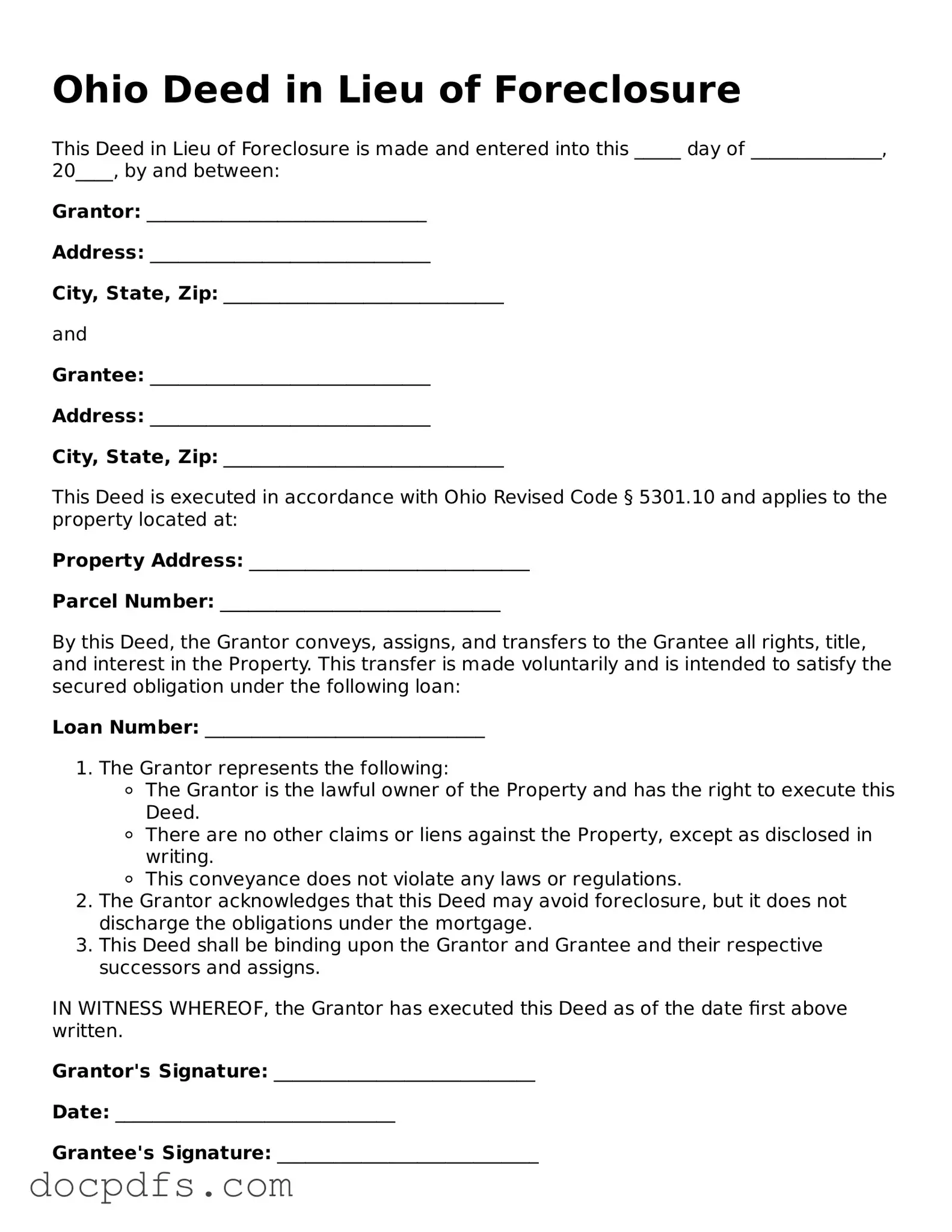

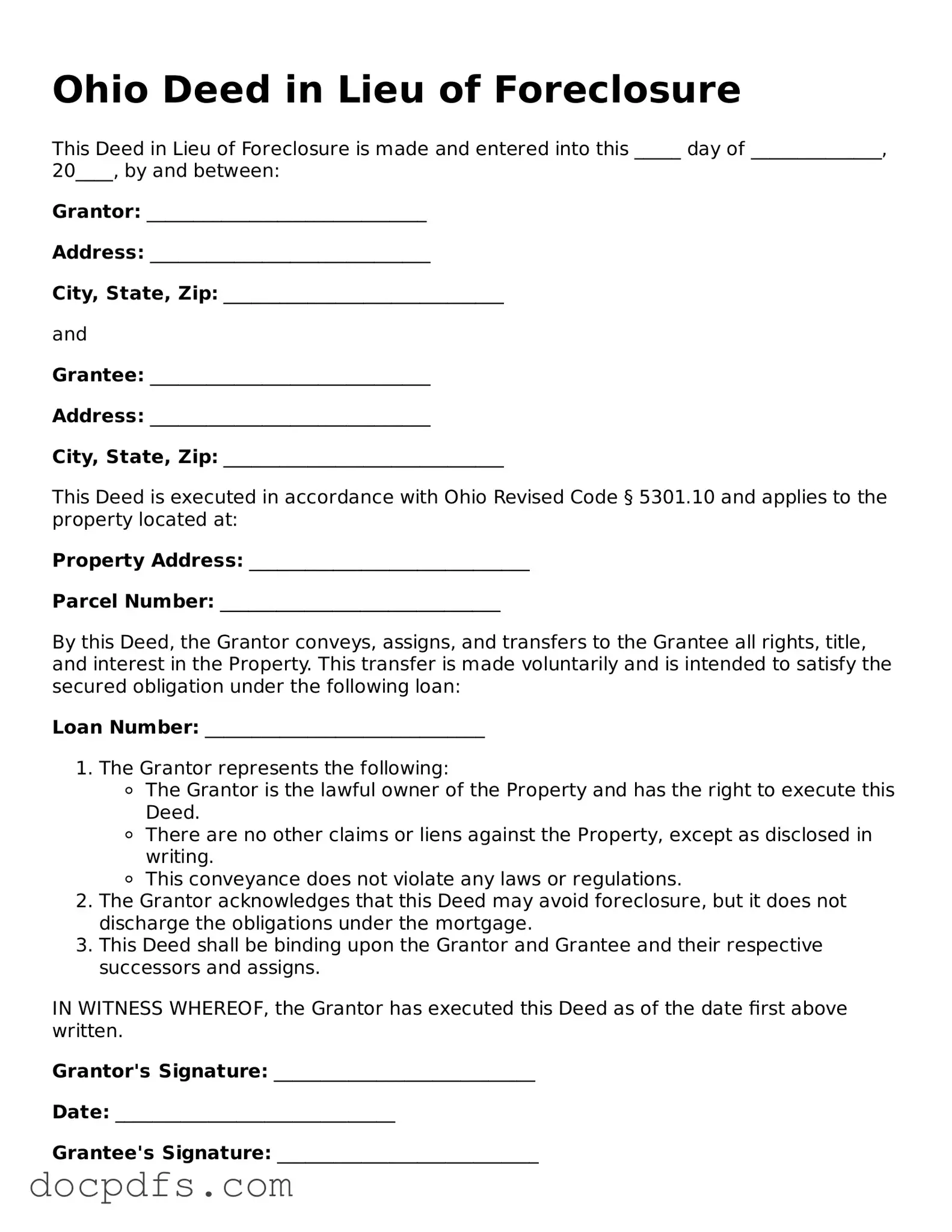

The process generally involves the following steps:

-

Contact the lender to discuss the option of a Deed in Lieu.

-

Submit a formal request along with any required documentation, such as financial statements.

-

Negotiate the terms of the deed transfer with the lender.

-

Once an agreement is reached, sign the Deed in Lieu of Foreclosure form.

-

The lender will then file the deed with the county recorder's office.

Will I still owe money after a Deed in Lieu of Foreclosure?

In many cases, homeowners may not owe any additional money after the deed transfer, especially if the lender agrees to waive any deficiency. However, this is not guaranteed, and it is crucial to clarify this point with the lender before proceeding.

What should I do before signing a Deed in Lieu of Foreclosure?

Before signing, homeowners should consider consulting with a legal or financial advisor. Understanding the implications of the deed transfer is essential. Additionally, homeowners should ensure they have exhausted all other options, such as loan modifications or short sales, before proceeding with this option.

Can I still apply for a mortgage after a Deed in Lieu of Foreclosure?

While it may be possible to apply for a mortgage after a Deed in Lieu, it can be challenging. Lenders typically look at credit history, and a Deed in Lieu can negatively impact your credit score. Homeowners may need to wait several years before qualifying for a new mortgage, depending on the lender's policies.

Is a Deed in Lieu of Foreclosure the same as a short sale?

No, a Deed in Lieu of Foreclosure and a short sale are different processes. In a short sale, the homeowner sells the property for less than the amount owed on the mortgage, with the lender's approval. In contrast, a Deed in Lieu involves the homeowner transferring the property back to the lender without a sale. Each option has its own advantages and disadvantages.