An Ohio Deed form is a legal document used to transfer ownership of real property from one party to another within the state of Ohio. It includes essential details such as the names of the grantor (seller) and grantee (buyer), a description of the property, and the terms of the transfer. This form must be properly executed and recorded to be effective.

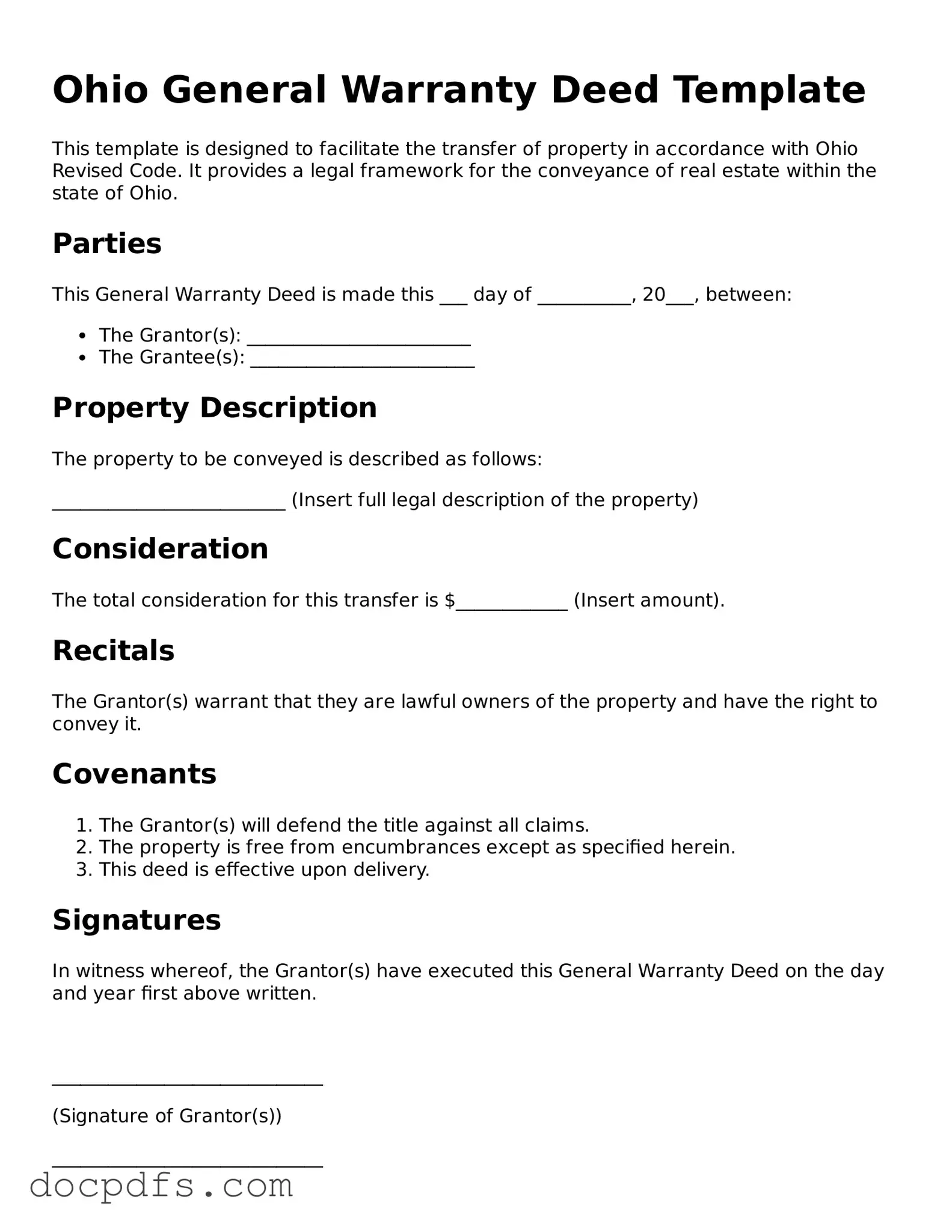

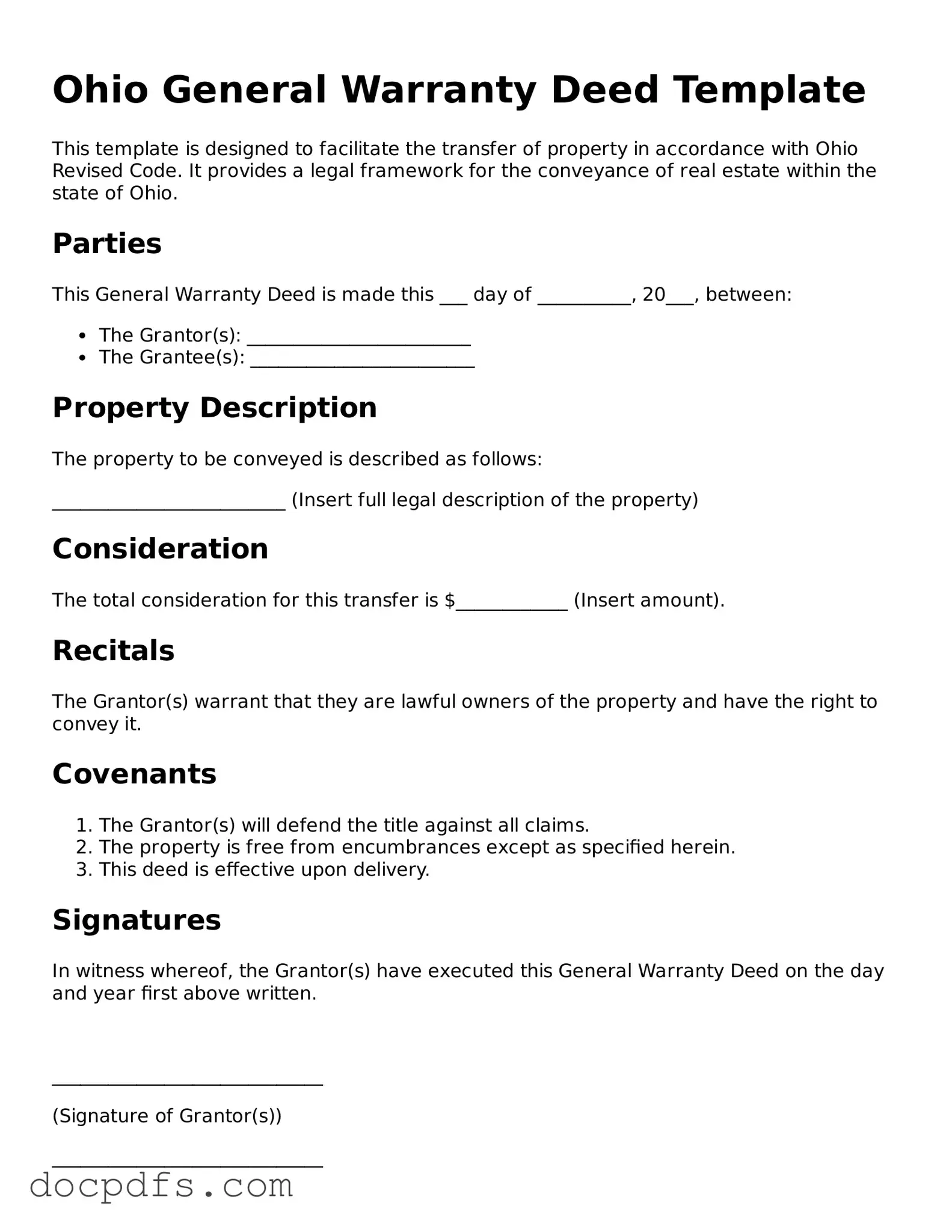

Ohio recognizes several types of Deeds, including:

-

General Warranty Deed:

Offers the highest level of protection to the grantee, ensuring that the grantor has clear title to the property and guarantees against any claims.

-

Special Warranty Deed:

Similar to a general warranty deed but only guarantees the title for the period the grantor owned the property.

-

Quit Claim Deed:

Transfers whatever interest the grantor has in the property without any warranties. This type is often used among family members or in divorce settlements.

-

Transfer on Death Deed:

Allows property owners to transfer their property to beneficiaries upon their death without going through probate.

Filling out an Ohio Deed form involves several steps:

-

Identify the parties involved: Clearly state the names and addresses of the grantor and grantee.

-

Provide a legal description of the property: This includes the parcel number and any specific details that define the property boundaries.

-

Specify the consideration: Indicate any payment or value exchanged for the property, even if it is a nominal amount.

-

Sign the document: The grantor must sign the Deed in the presence of a notary public.

Do I need a notary to execute an Ohio Deed?

Yes, a notary public must witness the signing of the Ohio Deed. The notary verifies the identities of the parties involved and ensures that the document is signed voluntarily. This step is crucial for the Deed to be legally valid.

Where do I file an Ohio Deed after it is completed?

Once completed and notarized, the Ohio Deed must be filed with the county recorder’s office in the county where the property is located. Filing fees may apply, and it is important to ensure that the Deed is recorded promptly to protect the new owner’s rights.

Are there any taxes associated with transferring property in Ohio?

Yes, property transfers in Ohio may be subject to a conveyance fee, which is typically based on the sale price of the property. Additionally, the grantor may need to file a real property transfer tax form. It is advisable to check with local authorities for specific tax obligations related to the transfer.

Generally, a standard Ohio Deed form can be used for most types of real property, including residential, commercial, and vacant land. However, specific properties, such as those held in a trust or subject to certain restrictions, may require customized forms or additional documentation.

If there is an error on the Ohio Deed form, it can lead to complications in the transfer of property. Minor mistakes may be corrected through an amendment or correction deed, but significant errors could invalidate the Deed. It is best to review the form carefully and consult a legal professional if any uncertainties arise.