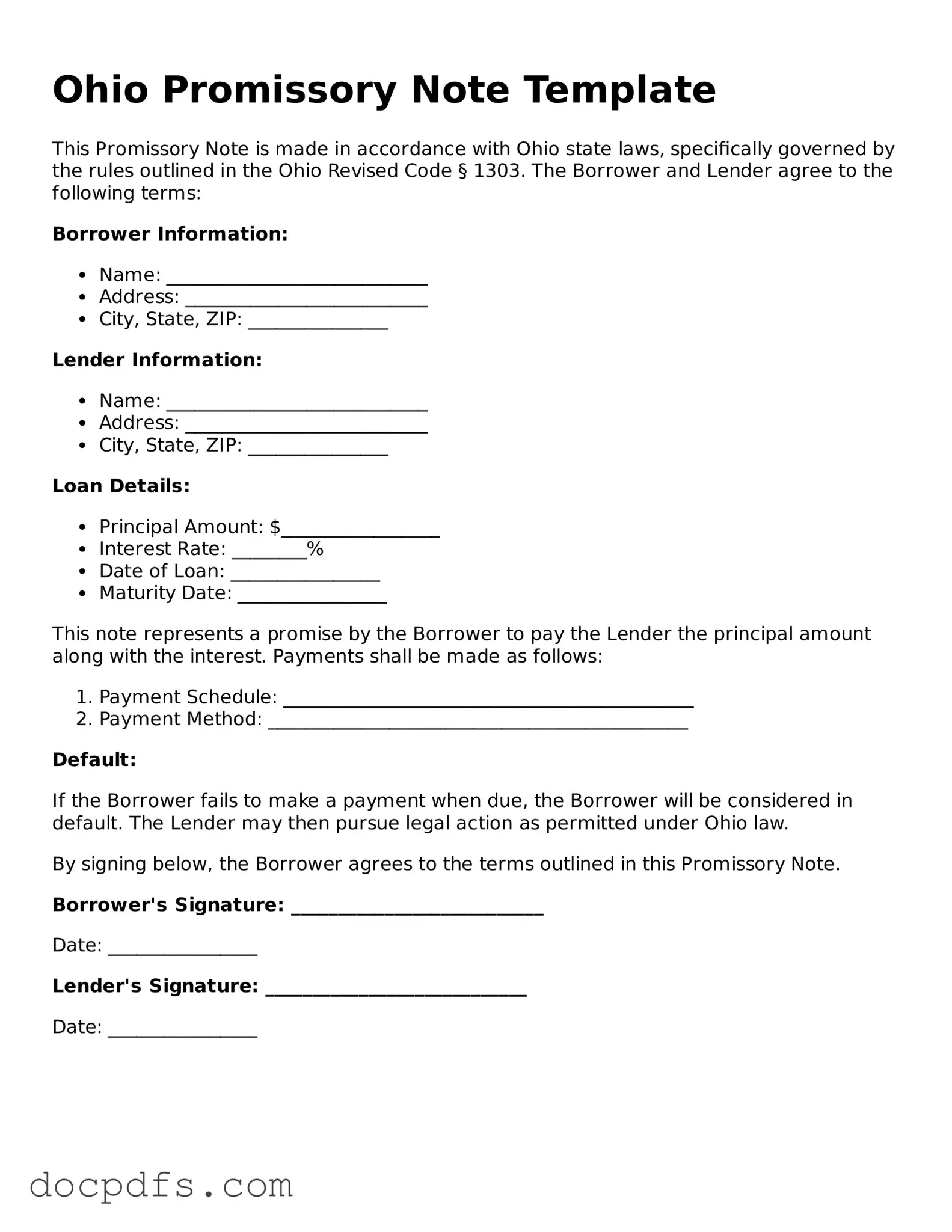

What is a promissory note in Ohio?

A promissory note in Ohio is a written promise to pay a specified amount of money to a designated person or entity at a specified time or on demand. This legal document serves as a binding agreement between the borrower and lender, outlining the terms of the loan, including the interest rate, repayment schedule, and any penalties for late payments. It provides clarity and protection for both parties involved in the transaction.

What are the essential elements of an Ohio promissory note?

For a promissory note to be valid in Ohio, it generally must include the following key elements:

-

Parties Involved:

Clearly identify the borrower and the lender.

-

Amount:

Specify the principal amount being borrowed.

-

Interest Rate:

State the interest rate, if any, that will be charged on the loan.

-

Repayment Terms:

Outline the schedule for repayment, including due dates and amounts.

-

Signatures:

Both parties must sign the document to indicate their agreement.

Do I need to have my promissory note notarized in Ohio?

While notarization is not strictly required for a promissory note to be enforceable in Ohio, it is highly recommended. Having the document notarized adds an extra layer of authenticity and can help prevent disputes regarding the validity of the signatures. If a dispute arises, a notarized note can serve as stronger evidence in court.

What happens if the borrower fails to repay the loan?

If the borrower fails to repay the loan as outlined in the promissory note, the lender has several options. First, the lender can attempt to negotiate a new repayment plan. If that fails, the lender may initiate legal action to recover the owed amount. This could involve filing a lawsuit in a local court. If the court rules in favor of the lender, they may be able to obtain a judgment, which could lead to wage garnishment or liens on the borrower’s property.

Can a promissory note be modified after it has been signed?

Yes, a promissory note can be modified after it has been signed, but both parties must agree to the changes. Modifications should be documented in writing and signed by both the borrower and the lender to ensure clarity and enforceability. This prevents any misunderstandings about the new terms and conditions of the loan.

Is a promissory note the same as a loan agreement?

While a promissory note and a loan agreement are related, they are not the same. A promissory note is a simple document that outlines the promise to repay a loan, focusing primarily on the repayment terms. In contrast, a loan agreement is typically more comprehensive, detailing additional terms and conditions such as collateral, default provisions, and covenants. A loan agreement may include a promissory note as part of its documentation.

Promissory note forms can be obtained from various sources, including online legal document providers, local office supply stores, or through an attorney. It is essential to ensure that the form complies with Ohio laws and is tailored to the specific terms of your agreement. Consulting with a legal professional can also provide guidance and ensure that all necessary elements are included.