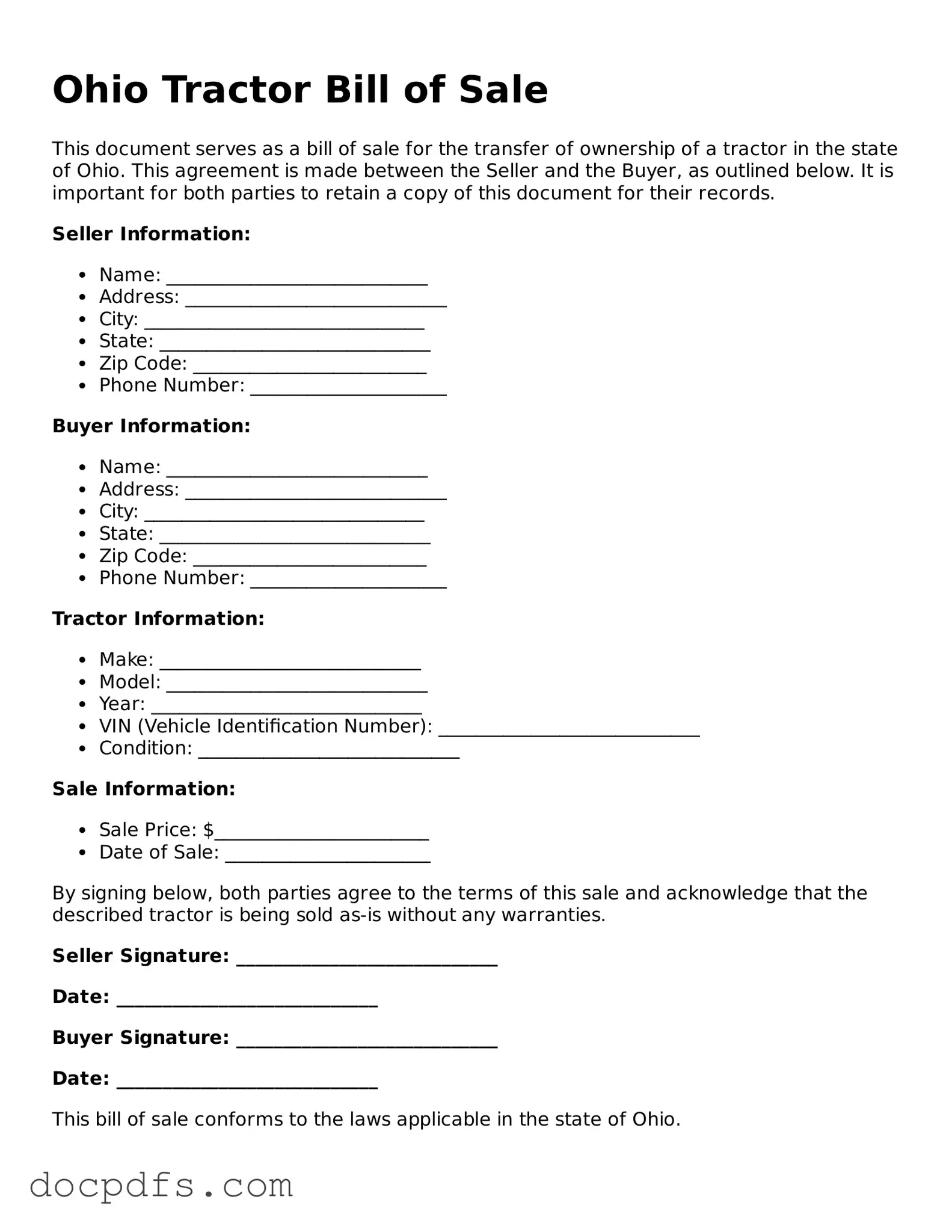

Free Ohio Tractor Bill of Sale Form

The Ohio Tractor Bill of Sale is a legal document used to transfer ownership of a tractor from one party to another in the state of Ohio. This form provides essential details about the transaction, including the buyer's and seller's information, the tractor's description, and the sale price. Completing this form ensures that both parties have a clear record of the sale, protecting their rights and responsibilities.

Open Tractor Bill of Sale Editor Now

Free Ohio Tractor Bill of Sale Form

Open Tractor Bill of Sale Editor Now

Open Tractor Bill of Sale Editor Now

or

⇓ Tractor Bill of Sale

Finish this form the fast way

Complete Tractor Bill of Sale online with a smooth editing experience.