What is a Trailer Bill of Sale in Ohio?

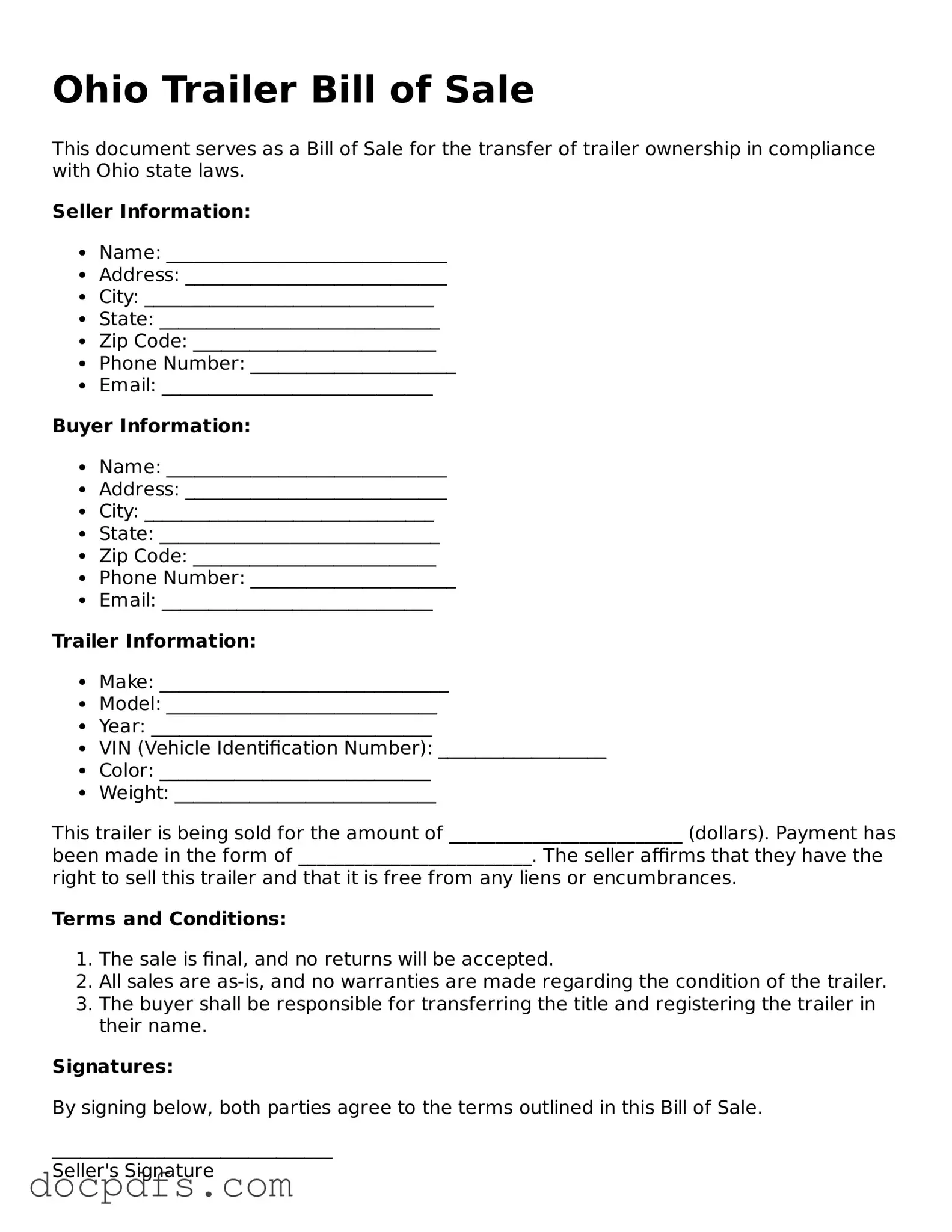

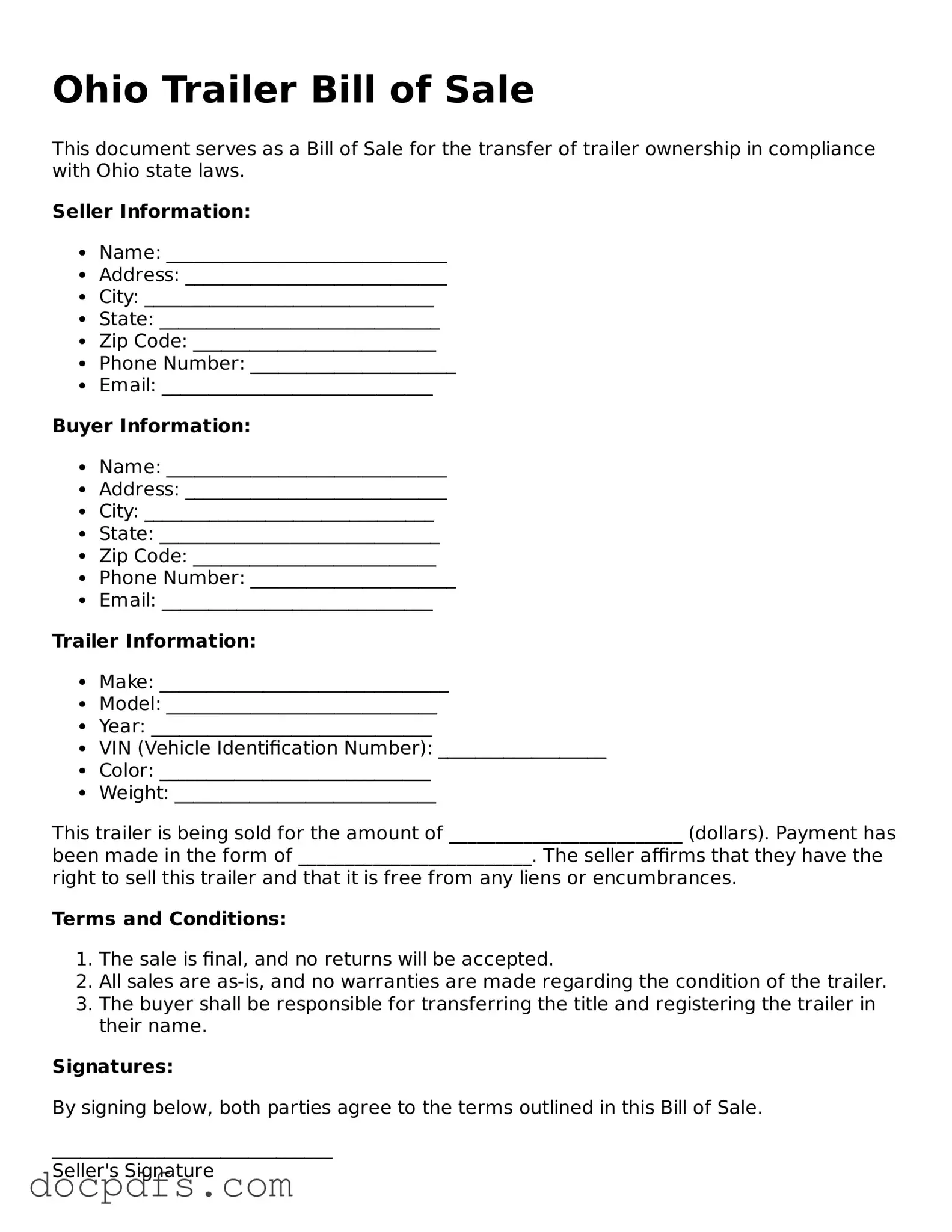

A Trailer Bill of Sale is a legal document that records the transfer of ownership of a trailer from one party to another. This document serves as proof of the sale and includes essential details about the trailer, the buyer, and the seller. It is crucial for ensuring that the transaction is documented properly for future reference.

Why do I need a Trailer Bill of Sale?

Having a Trailer Bill of Sale is important for several reasons:

-

It provides legal proof of the transaction.

-

It helps protect both the buyer and the seller in case of disputes.

-

It is often required for registering the trailer with the state.

-

It can assist in tracking the ownership history of the trailer.

The Trailer Bill of Sale should include the following details:

-

The full names and addresses of both the buyer and the seller.

-

A description of the trailer, including make, model, year, and Vehicle Identification Number (VIN).

-

The sale price of the trailer.

-

The date of the sale.

-

Signatures of both parties involved in the transaction.

Is the Trailer Bill of Sale required by law in Ohio?

While it is not legally required to have a Trailer Bill of Sale for every transaction, it is highly recommended. Having this document can protect both parties and facilitate the registration process with the Ohio Bureau of Motor Vehicles.

Can I create my own Trailer Bill of Sale?

Yes, you can create your own Trailer Bill of Sale. However, it is important to ensure that it includes all necessary information and complies with Ohio state requirements. Many templates are available online that can help guide you in creating a comprehensive document.

Do I need to have the Trailer Bill of Sale notarized?

In Ohio, notarization is not a requirement for the Trailer Bill of Sale. However, having the document notarized can add an extra layer of authenticity and may be beneficial if any disputes arise in the future.

How do I register my trailer after the sale?

After completing the sale and obtaining the Trailer Bill of Sale, you will need to register the trailer with the Ohio Bureau of Motor Vehicles (BMV). This process typically involves:

-

Filling out a registration application.

-

Providing the Trailer Bill of Sale as proof of ownership.

-

Paying any applicable registration fees.

What if the trailer has a lien on it?

If there is a lien on the trailer, the seller must disclose this information to the buyer. The lien must be paid off before the sale can be completed, and the lienholder may need to provide a release document. It is important for the buyer to verify that the trailer is free of any liens before finalizing the purchase.

What happens if I lose the Trailer Bill of Sale?

If you lose the Trailer Bill of Sale, it may be challenging to prove ownership. In such cases, you can contact the seller to request a duplicate or create a new bill of sale that includes a statement about the lost document. It is advisable to keep multiple copies of important documents to avoid this issue.

Can I use the Trailer Bill of Sale for tax purposes?

Yes, the Trailer Bill of Sale can be used for tax purposes. It serves as proof of purchase and can be helpful when reporting taxes related to the sale. Keep this document on file for your records, especially if you plan to claim any deductions or report income from the sale.