What is a Transfer-on-Death Deed in Ohio?

A Transfer-on-Death Deed (TODD) allows property owners in Ohio to transfer real estate to beneficiaries upon their death, without going through probate. This deed is revocable and can be changed or canceled at any time during the owner's lifetime.

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in Ohio can utilize a TODD. This includes homeowners and property owners of various types of real estate, such as residential, commercial, or vacant land. However, the property must be solely owned by the individual, as joint ownership may require different considerations.

How do I create a Transfer-on-Death Deed?

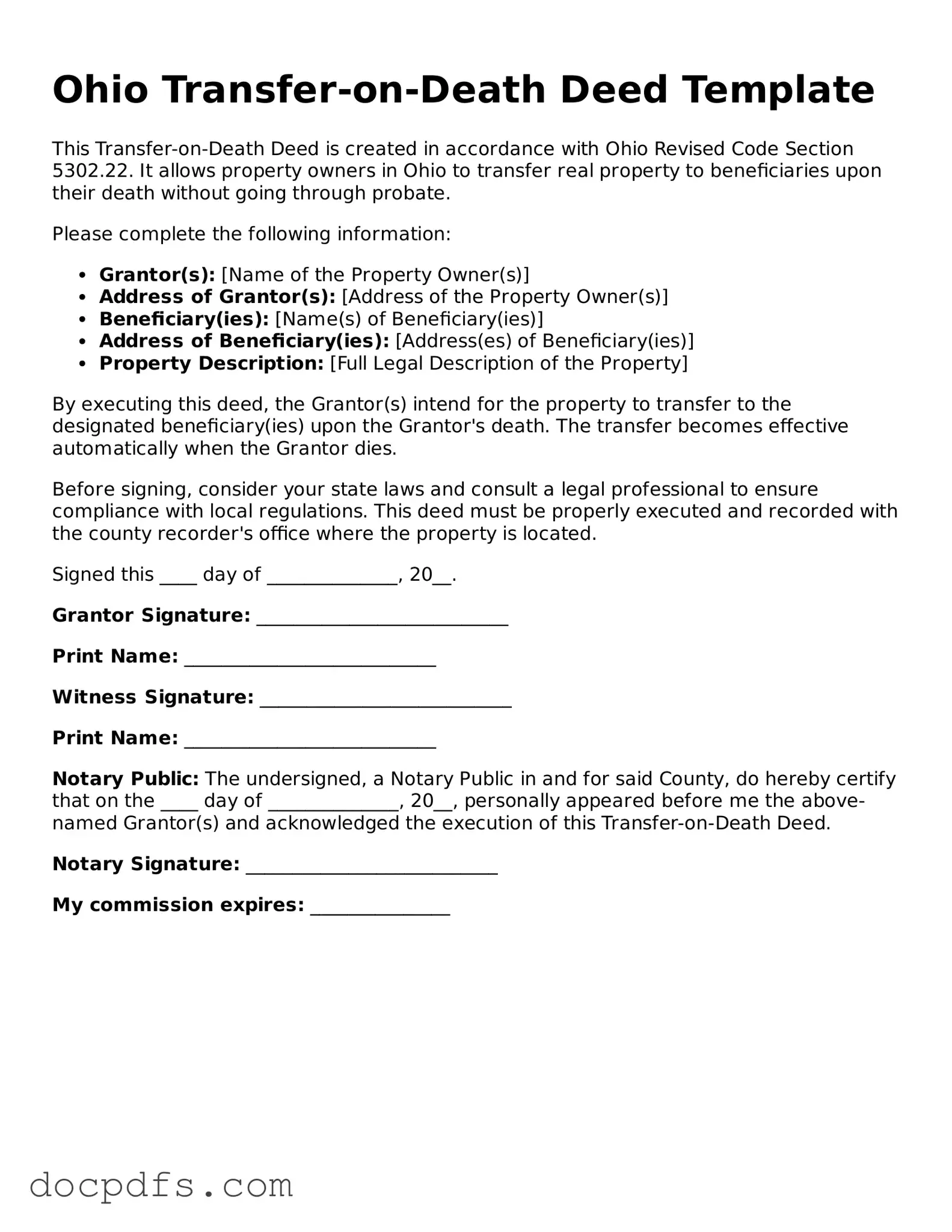

To create a TODD, follow these steps:

-

Obtain the Transfer-on-Death Deed form, which is available through the Ohio Secretary of State's website or local county recorder's office.

-

Fill out the form with the required information, including your name, the names of your beneficiaries, and a description of the property.

-

Sign the deed in the presence of a notary public.

-

Record the signed deed with the county recorder's office in the county where the property is located.

Can I change or revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed is revocable. You can change or revoke it at any time before your death. To revoke the deed, you must file a new deed that explicitly states the revocation or record a formal notice of revocation with the county recorder's office.

What happens if I do not name a beneficiary?

If you do not name a beneficiary on your Transfer-on-Death Deed, the property will not transfer to anyone upon your death. Instead, it will become part of your estate and will be distributed according to your will or, if you do not have a will, according to Ohio's intestacy laws.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger immediate tax consequences. However, beneficiaries may be responsible for property taxes after the transfer occurs. It is advisable to consult a tax professional to understand any potential tax implications fully.

Can I use a Transfer-on-Death Deed for all types of property?

A Transfer-on-Death Deed can be used for most types of real estate, but it cannot be used for personal property, such as vehicles or bank accounts. Additionally, properties held in certain types of trusts or properties subject to mortgage restrictions may not be eligible.

Is legal assistance necessary to complete a Transfer-on-Death Deed?

While legal assistance is not required to complete a Transfer-on-Death Deed, it can be beneficial. Consulting with an attorney can help ensure that the deed is filled out correctly and that your wishes are clearly stated. An attorney can also provide guidance on how the deed fits into your overall estate planning strategy.