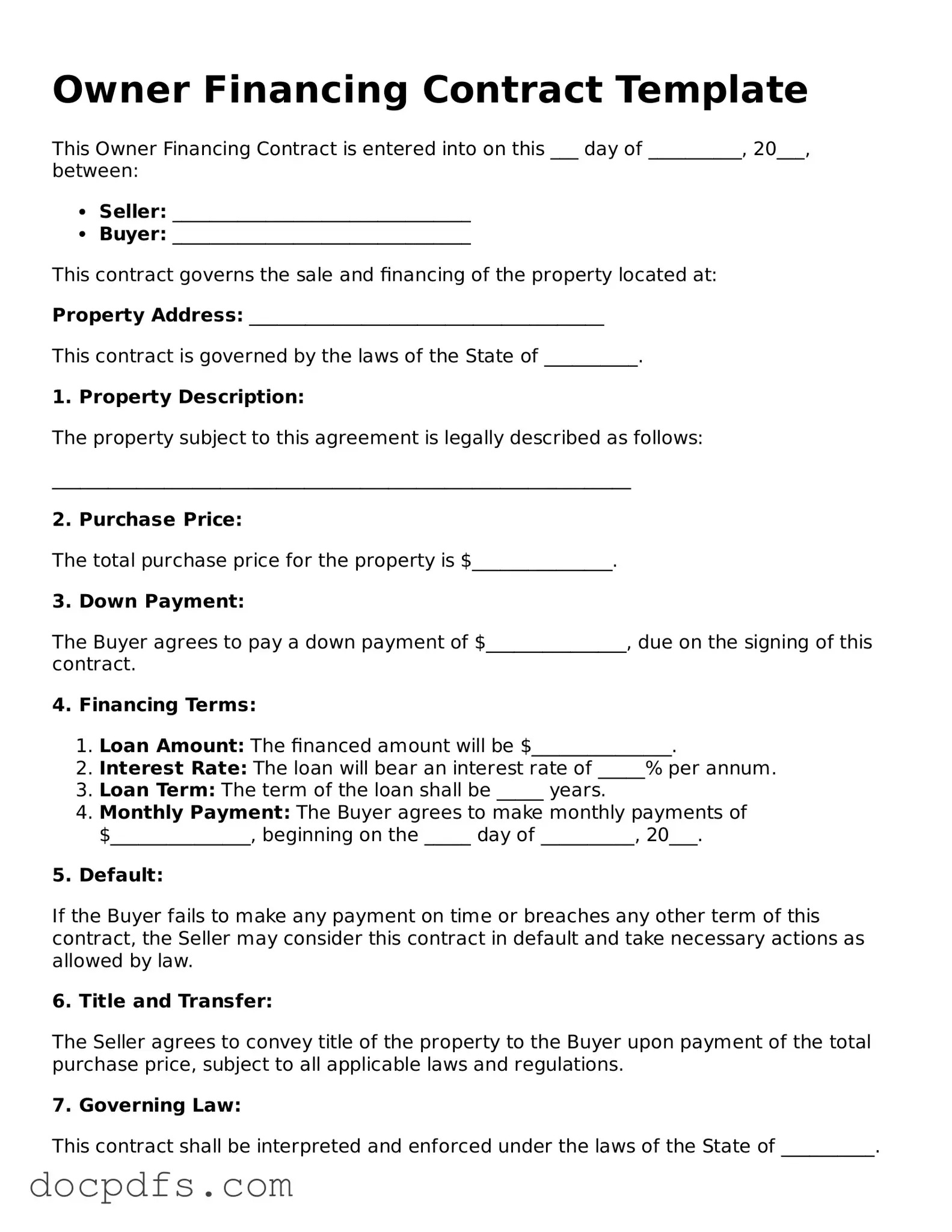

Legal Owner Financing Contract Document

An Owner Financing Contract is a legal agreement that allows a property seller to finance the purchase for the buyer, rather than requiring the buyer to secure a traditional mortgage. This arrangement can make home buying more accessible for those who may not qualify for conventional loans. Understanding the terms and conditions of this contract is crucial for both parties involved.

Open Owner Financing Contract Editor Now

Legal Owner Financing Contract Document

Open Owner Financing Contract Editor Now

Open Owner Financing Contract Editor Now

or

⇓ Owner Financing Contract

Finish this form the fast way

Complete Owner Financing Contract online with a smooth editing experience.