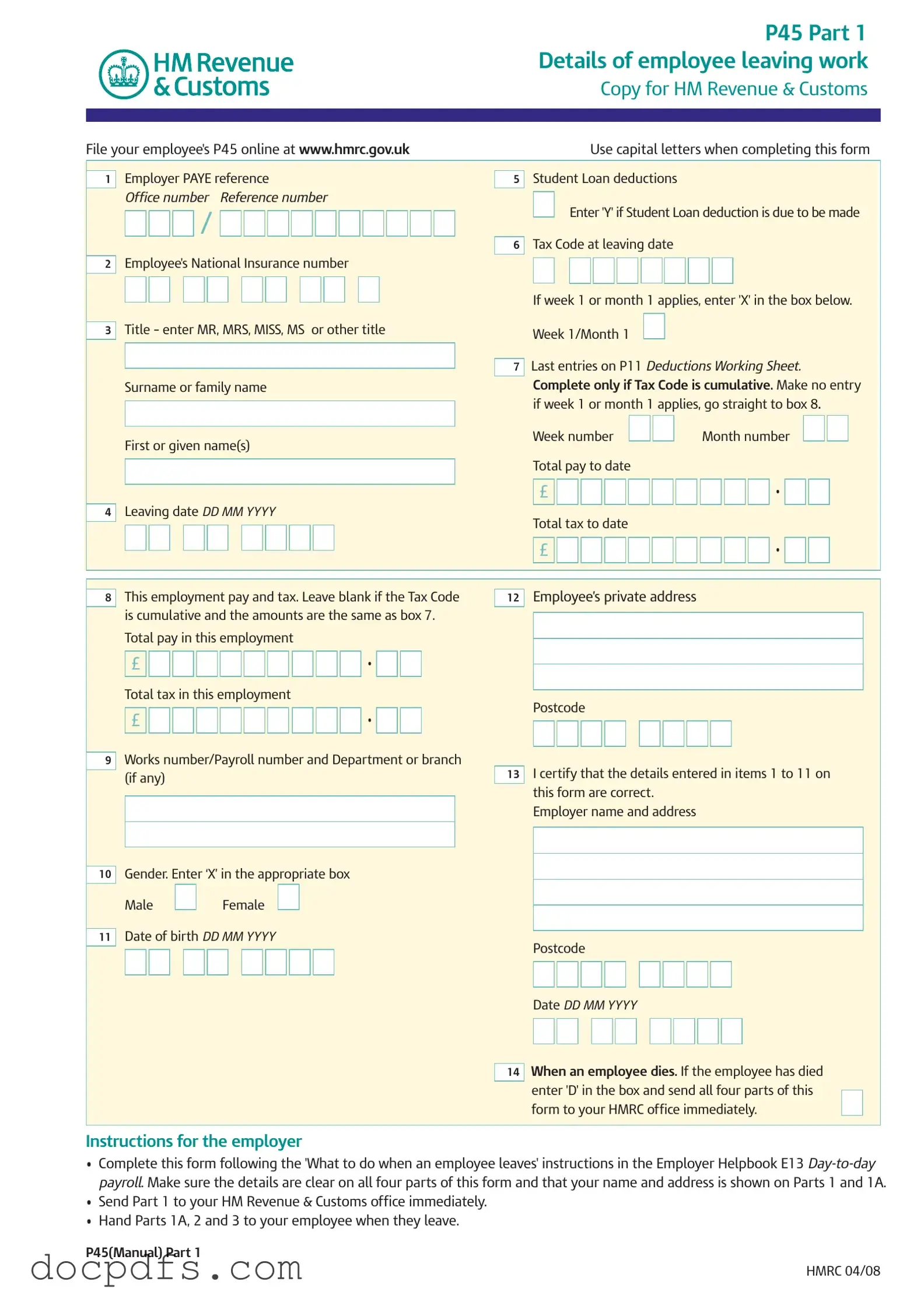

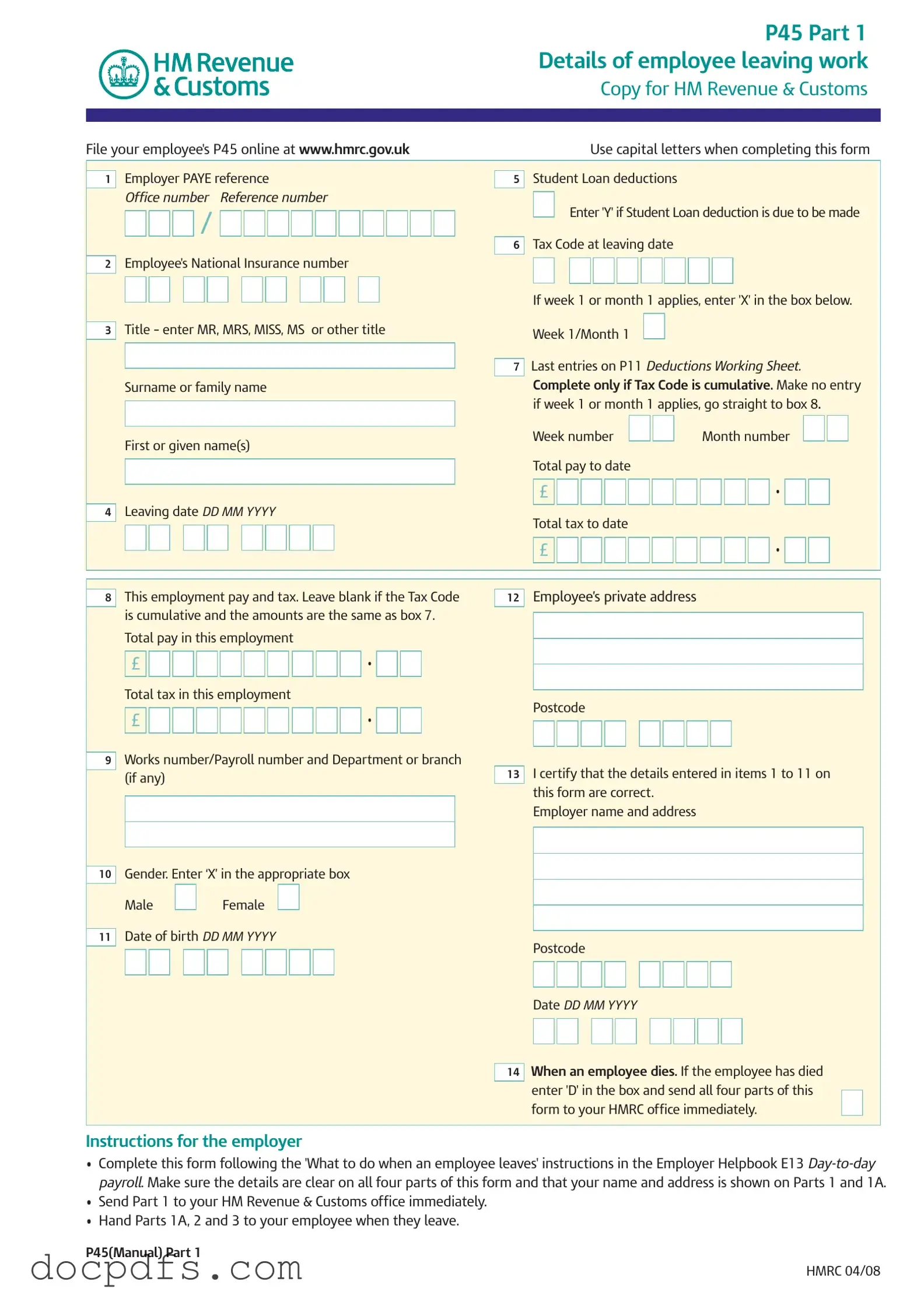

P 45 It Template in PDF

The P45 It form is an official document issued by an employer when an employee leaves a job. This form serves multiple purposes, including providing essential information to HM Revenue & Customs (HMRC) regarding the employee's tax and pay details. Understanding how to properly complete and use the P45 is crucial for both employees and employers to ensure accurate tax reporting and compliance.

Open P 45 It Editor Now

P 45 It Template in PDF

Open P 45 It Editor Now

Open P 45 It Editor Now

or

⇓ P 45 It

Finish this form the fast way

Complete P 45 It online with a smooth editing experience.