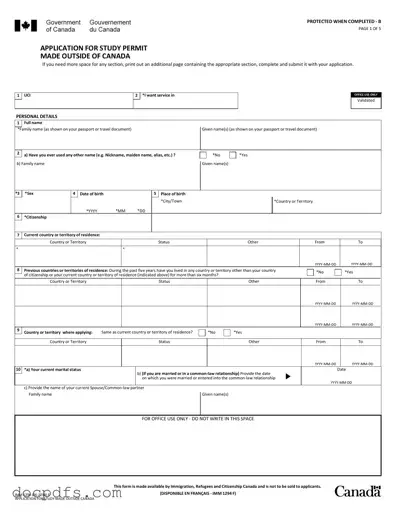

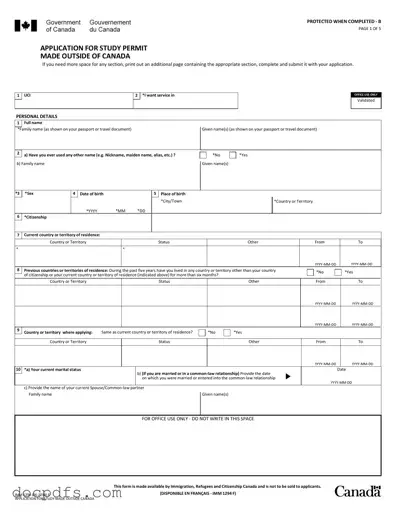

The IMM 1294 form is an application for a study permit for individuals who wish to study in Canada from outside the country. This form collects essential personal information, details about intended studies, and background information to assess eligibility for...

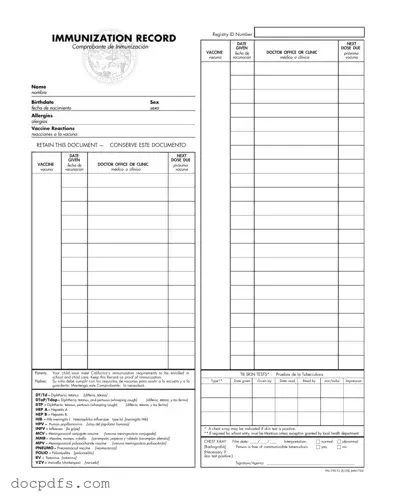

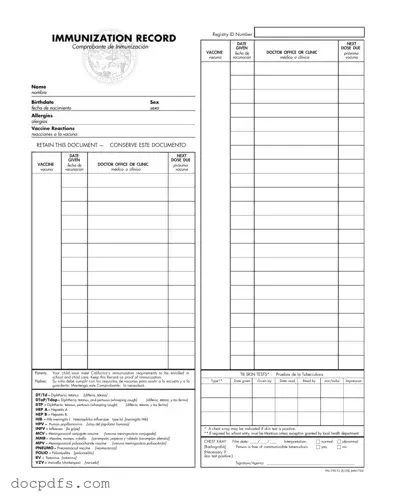

The Immunization Record form serves as an essential document that tracks a child's vaccination history. This form is crucial for parents, as it verifies compliance with California's immunization requirements necessary for school and childcare enrollment. Keeping this record ensures that...

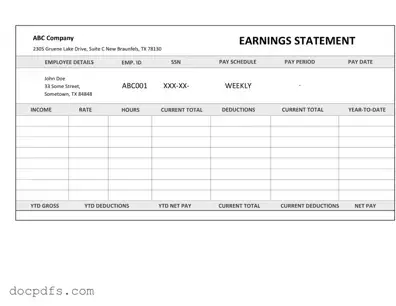

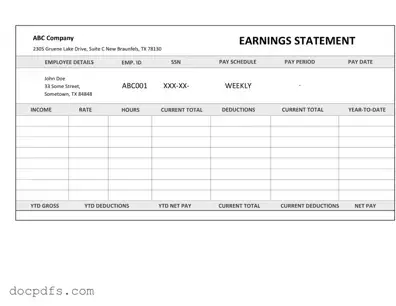

The Independent Contractor Pay Stub form is a document that outlines the earnings and deductions for independent contractors. This form serves as a record of payment for services rendered, ensuring transparency and clarity in financial transactions. Understanding this form is...

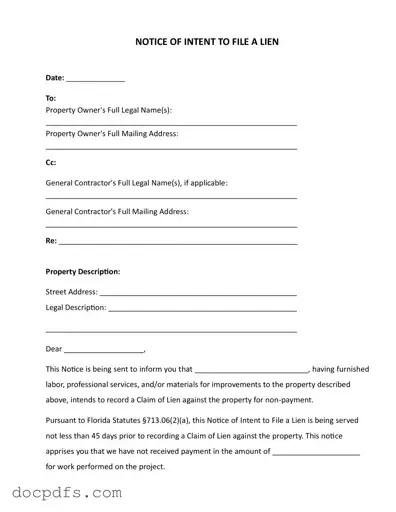

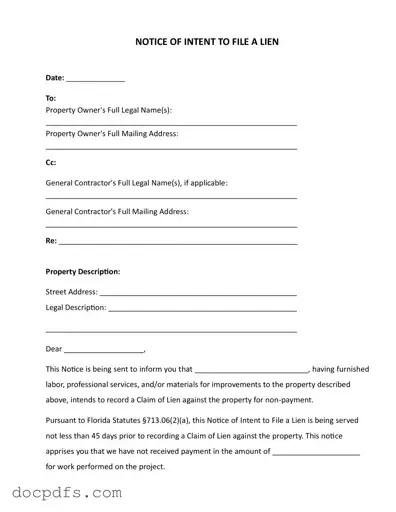

The Intent to Lien Florida form serves as a formal notice indicating a party's intention to file a lien against a property due to non-payment for services or materials provided. This document is crucial for property owners to understand, as...

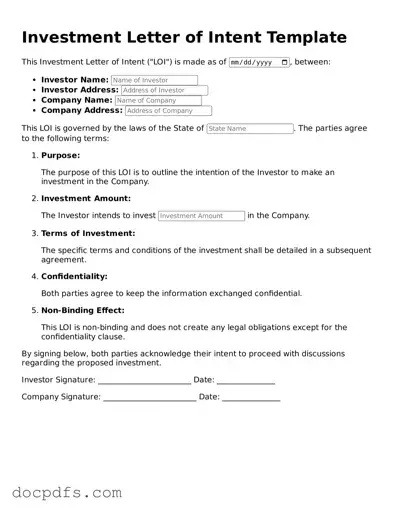

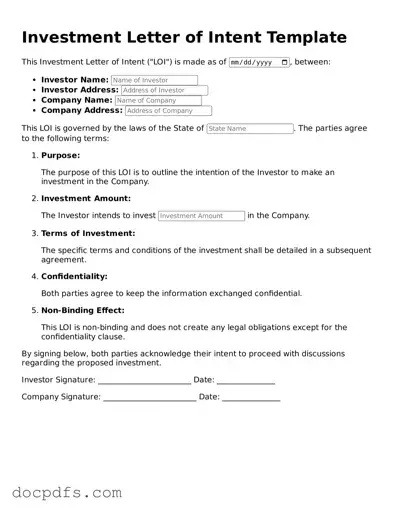

An Investment Letter of Intent form is a document that outlines the preliminary terms and conditions of a potential investment agreement between parties. This form serves as a foundation for negotiations and helps clarify the intentions of both investors and...

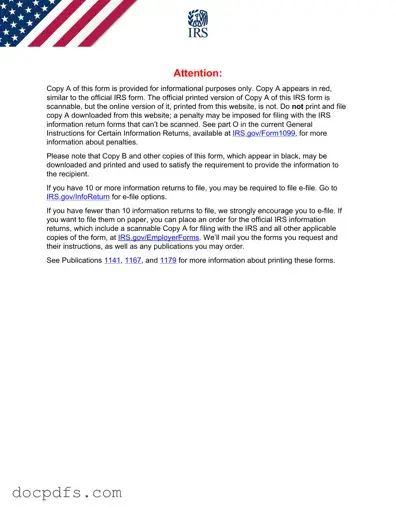

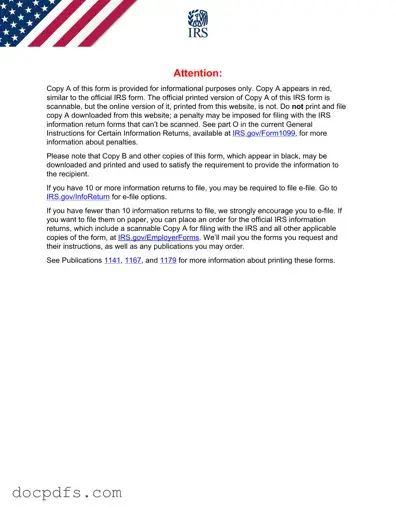

The IRS 1099-MISC form is a tax document used to report various types of income other than wages, salaries, and tips. This form is primarily issued to independent contractors, freelancers, and other non-employee service providers. Understanding its requirements is essential...

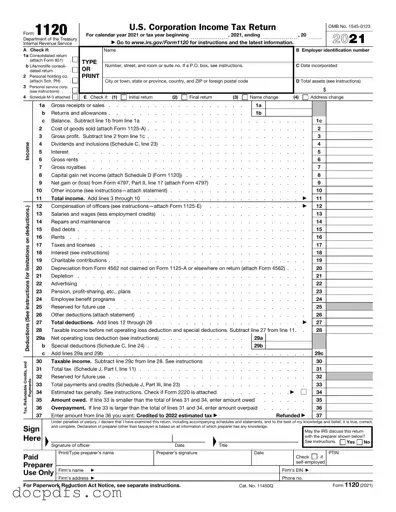

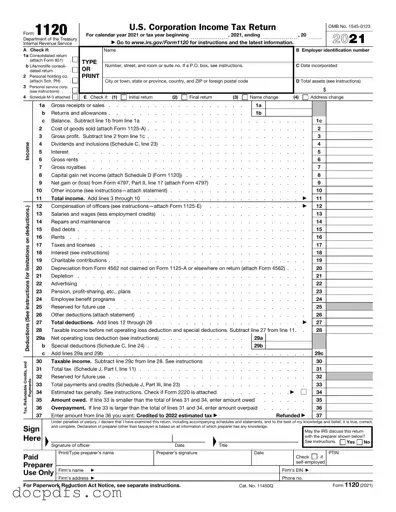

The IRS 1120 form is a tax return form used by corporations to report their income, gains, losses, deductions, and credits to the Internal Revenue Service. This form is essential for C corporations, as it determines their tax liability for...

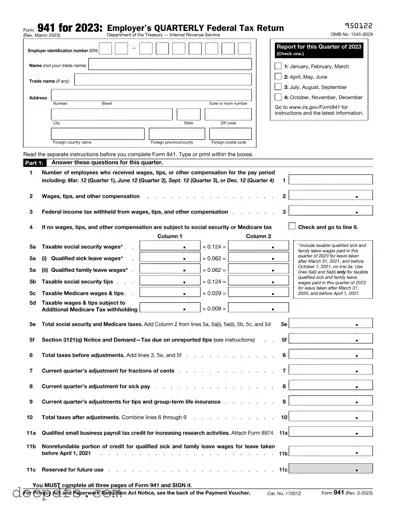

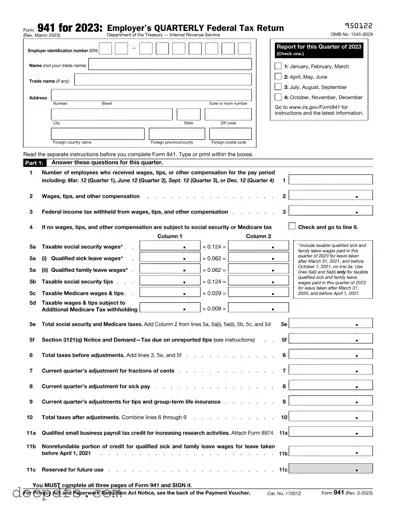

The IRS Form 941 is a crucial document that employers must file quarterly to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form not only helps the IRS track tax obligations but also ensures...

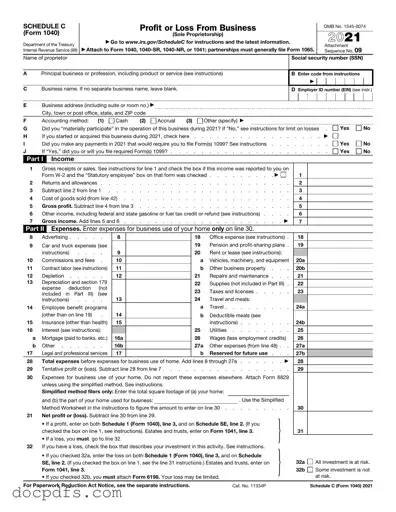

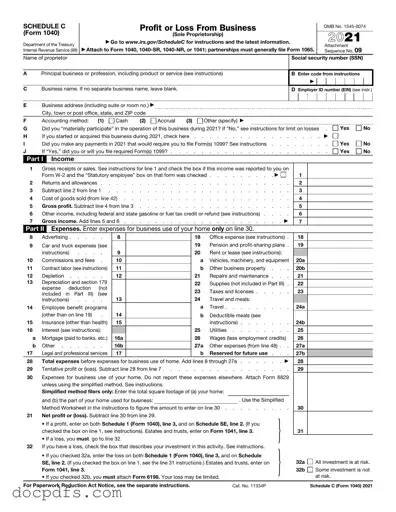

The IRS Schedule C 1040 form is a tax document used by sole proprietors to report income or loss from their business activities. This form allows individuals to detail their earnings, expenses, and deductions, ensuring accurate tax reporting. Understanding how...

The IRS W-2 form is a document that employers use to report wages paid to employees and the taxes withheld from those earnings. Each year, employees receive their W-2 forms, which are essential for accurately filing income tax returns. Understanding...

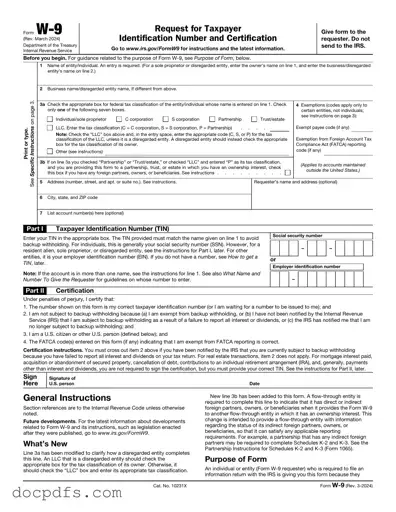

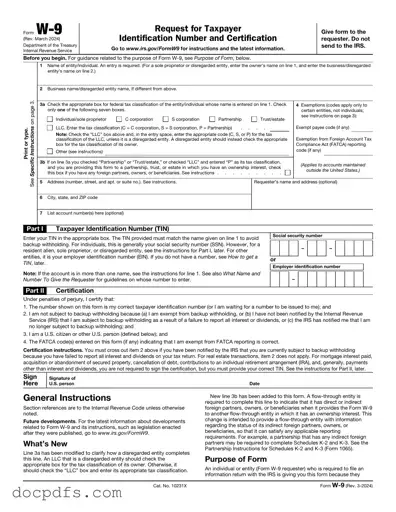

The IRS W-9 form is a document used by individuals and businesses to provide their taxpayer identification information to others. This form is essential for reporting income and ensuring compliance with tax obligations. By filling out the W-9, you help...

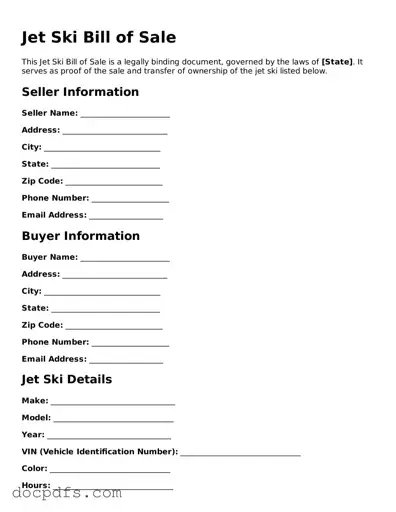

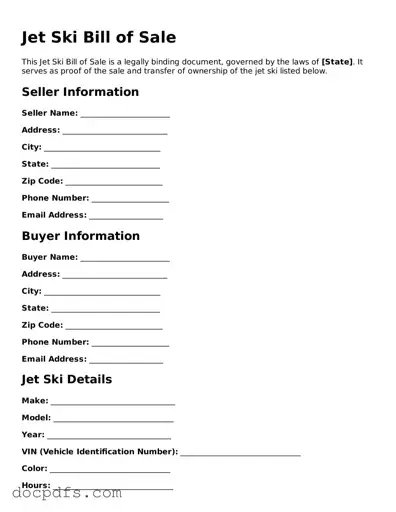

The Jet Ski Bill of Sale form is a crucial document used to record the sale and transfer of ownership of a personal watercraft, commonly known as a jet ski. This form provides essential details about the transaction, including the...