Payroll Check Template in PDF

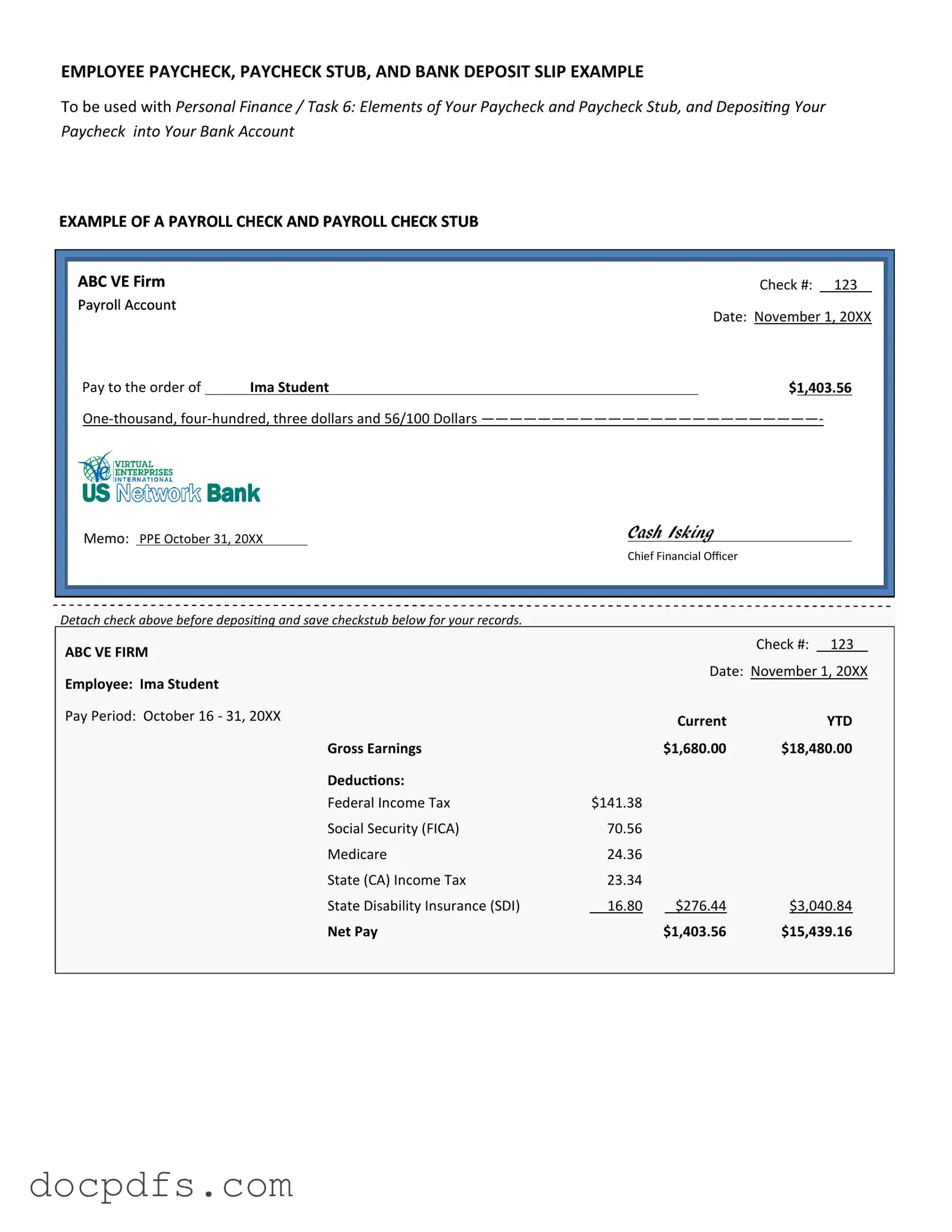

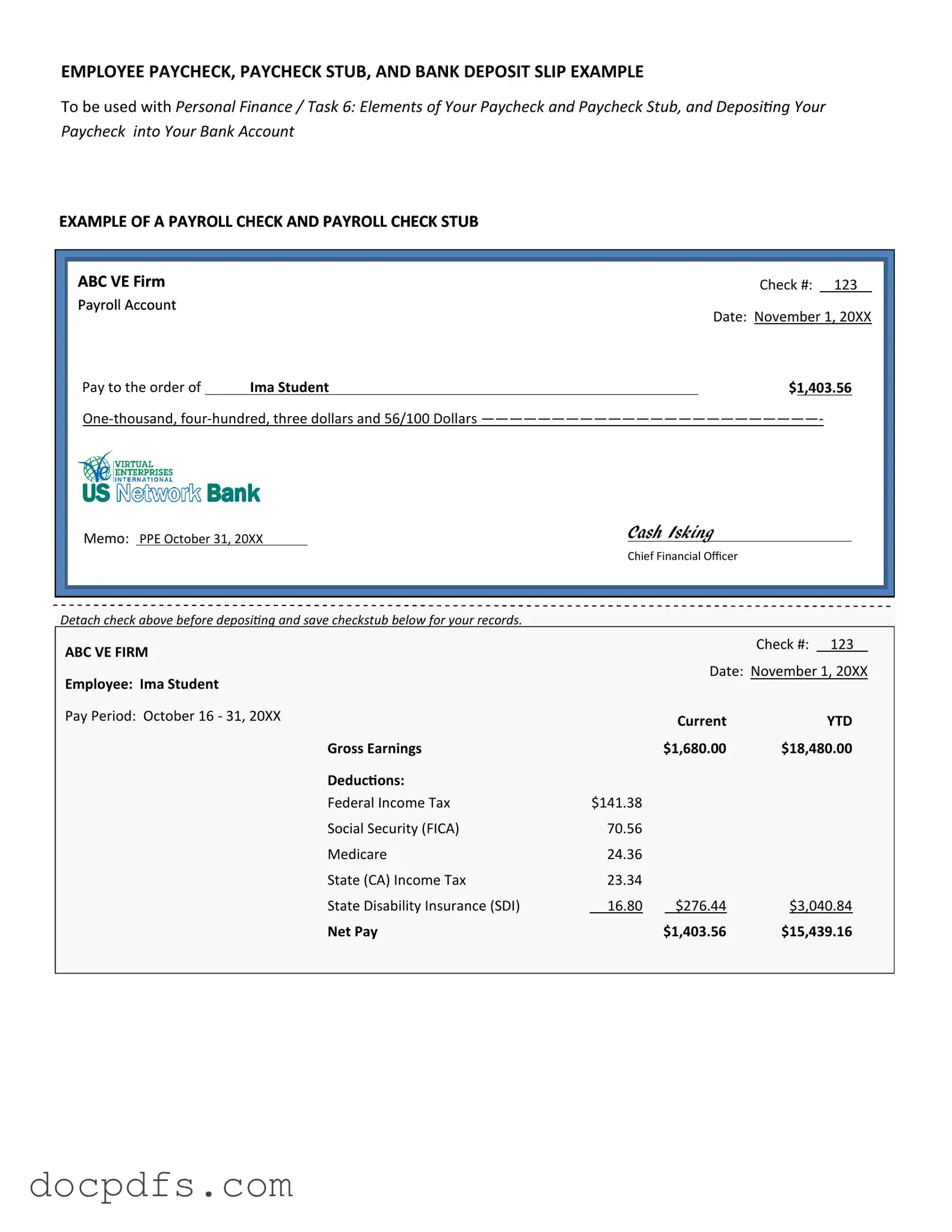

The Payroll Check form is a document used by employers to issue payments to their employees for work performed during a specific pay period. This form typically includes essential details such as the employee's name, hours worked, pay rate, and deductions. Understanding how to properly complete and manage this form is crucial for ensuring accurate and timely payroll processing.

Open Payroll Check Editor Now

Payroll Check Template in PDF

Open Payroll Check Editor Now

Open Payroll Check Editor Now

or

⇓ Payroll Check

Finish this form the fast way

Complete Payroll Check online with a smooth editing experience.