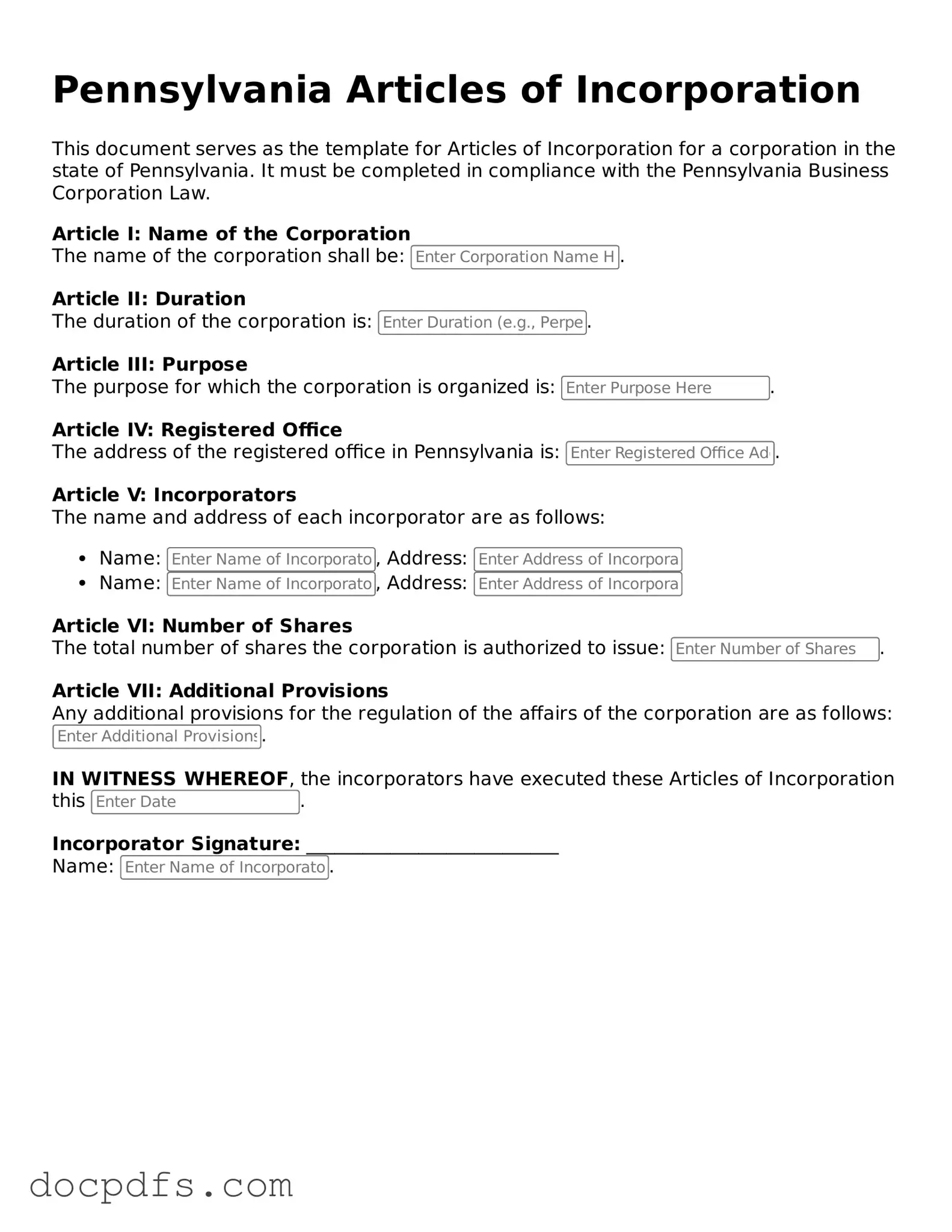

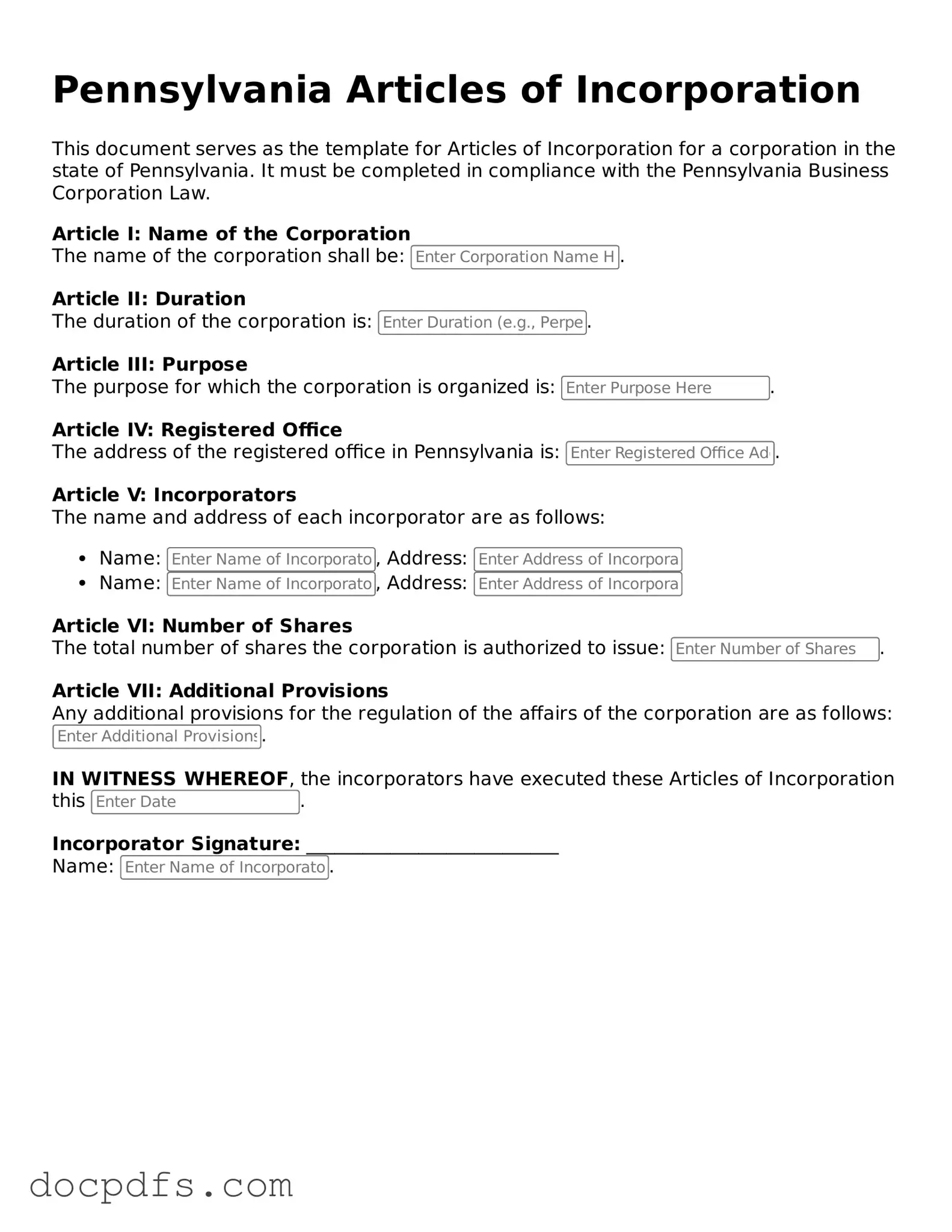

What are the Pennsylvania Articles of Incorporation?

The Pennsylvania Articles of Incorporation is a legal document that establishes a corporation in the state of Pennsylvania. It outlines the basic information about the corporation, including its name, purpose, and registered office address. Filing this document is the first step in forming a corporation in Pennsylvania.

Who needs to file the Articles of Incorporation?

Any individual or group looking to create a corporation in Pennsylvania must file the Articles of Incorporation. This includes businesses of all sizes, from small startups to larger enterprises. If you want to enjoy the benefits of limited liability and formalize your business structure, this document is essential.

What information is required in the Articles of Incorporation?

The Articles of Incorporation must include several key pieces of information:

-

The name of the corporation.

-

The purpose of the corporation.

-

The address of the corporation's registered office.

-

The name and address of the incorporator(s).

-

The number of shares the corporation is authorized to issue.

How do I file the Articles of Incorporation?

Filing the Articles of Incorporation in Pennsylvania can be done online or by mail. To file online, visit the Pennsylvania Department of State's website and follow the instructions for electronic filing. If you prefer to file by mail, print the form, complete it, and send it to the appropriate address along with the filing fee.

Is there a filing fee for the Articles of Incorporation?

Yes, there is a filing fee associated with submitting the Articles of Incorporation. As of October 2023, the fee is typically around $125, but it is advisable to check the Pennsylvania Department of State's website for the most current fee information. Additional fees may apply for expedited processing or other services.

How long does it take for the Articles of Incorporation to be processed?

Processing times can vary. Generally, it takes about 7 to 10 business days for the Pennsylvania Department of State to process the Articles of Incorporation. If you choose expedited service, you may receive approval in as little as 2 to 3 business days.

Can I amend the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation after they have been filed. If changes are needed, such as altering the corporation's name or purpose, you must file an amendment form with the Pennsylvania Department of State. There is usually a fee associated with this amendment process.

What happens after my Articles of Incorporation are approved?

Once your Articles of Incorporation are approved, your corporation is officially formed. You will receive a certificate of incorporation, which serves as proof of your corporation's existence. From this point, you can open a bank account, apply for permits, and conduct business under your corporate name.

Do I need to create bylaws for my corporation?

While not required to file with the state, creating bylaws is highly recommended. Bylaws outline the internal rules and procedures for your corporation, including how meetings will be conducted and how decisions will be made. Having clear bylaws can help prevent disputes and ensure smooth operations.

What is the difference between Articles of Incorporation and a business license?

The Articles of Incorporation establish your corporation as a legal entity, while a business license is a permit that allows you to operate your business legally within a specific jurisdiction. Both are important, but they serve different purposes. You will need to file the Articles of Incorporation first before applying for any necessary business licenses.