What is a Power of Attorney in Pennsylvania?

A Power of Attorney (POA) is a legal document that allows one person to act on behalf of another in legal and financial matters. In Pennsylvania, this document grants authority to an agent, also known as an attorney-in-fact, to make decisions for the principal, who is the person granting the authority. This can include managing finances, handling real estate transactions, and making healthcare decisions, depending on the type of POA created.

What types of Power of Attorney are available in Pennsylvania?

Pennsylvania recognizes several types of Power of Attorney:

-

General Power of Attorney:

Grants broad authority to the agent to act on behalf of the principal.

-

Limited Power of Attorney:

Restricts the agent's authority to specific tasks or time periods.

-

Durable Power of Attorney:

Remains in effect even if the principal becomes incapacitated.

-

Healthcare Power of Attorney:

Specifically allows the agent to make medical decisions for the principal if they are unable to do so.

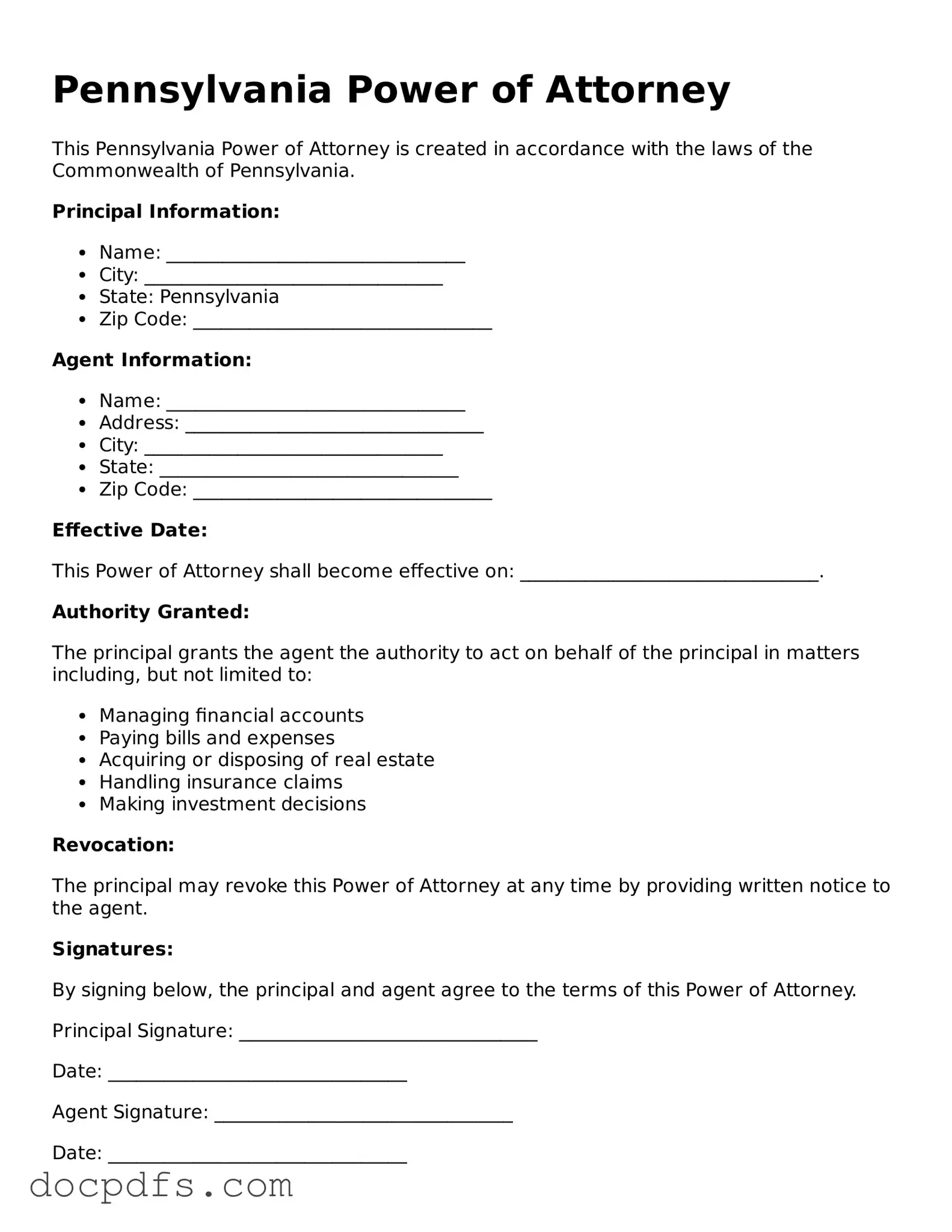

How do I create a Power of Attorney in Pennsylvania?

To create a Power of Attorney in Pennsylvania, follow these steps:

-

Choose a trusted individual to act as your agent.

-

Decide what powers you want to grant your agent.

-

Complete the Pennsylvania Power of Attorney form, which can be found online or through legal resources.

-

Sign the document in the presence of a notary public and two witnesses.

It’s important to ensure that the document meets all legal requirements to be valid.

Do I need a lawyer to create a Power of Attorney?

While it is not required to have a lawyer to create a Power of Attorney in Pennsylvania, consulting with one can be beneficial. A lawyer can help ensure that the document meets all legal requirements and that your wishes are clearly expressed. This can prevent potential disputes or misunderstandings in the future.

Can I revoke a Power of Attorney in Pennsylvania?

Yes, you can revoke a Power of Attorney in Pennsylvania at any time, as long as you are mentally competent. To do so, you should create a written revocation document and notify your agent and any institutions or individuals that were relying on the original POA. It’s a good practice to also destroy any copies of the original document to avoid confusion.

What happens if I become incapacitated and have a Power of Attorney?

If you become incapacitated and have a Durable Power of Attorney, your agent can step in and make decisions on your behalf. This includes managing your finances and making healthcare decisions, depending on the powers granted in the document. If you do not have a Durable Power of Attorney, your family may need to seek a court-appointed guardian to make decisions for you.

Can I use a Power of Attorney for healthcare decisions?

Yes, you can use a Power of Attorney specifically for healthcare decisions in Pennsylvania. This type of POA allows your agent to make medical decisions on your behalf if you are unable to do so. It is important to clearly outline your wishes regarding medical treatment in this document to guide your agent in making decisions that align with your values.

Is a Power of Attorney valid in other states?

A Power of Attorney created in Pennsylvania may be valid in other states, but this can depend on the laws of those states. It is advisable to check the specific requirements of the state where the POA will be used. If you plan to move or travel frequently, consider creating a new POA that complies with the laws of your new state.