What is a Pennsylvania Promissory Note?

A Pennsylvania Promissory Note is a legal document in which one party, known as the borrower, agrees to pay a specified amount of money to another party, the lender, under agreed-upon terms. This document outlines the loan amount, interest rate, repayment schedule, and any penalties for late payments. It serves as a formal acknowledgment of the debt and provides protection for both parties involved.

Who should use a Promissory Note in Pennsylvania?

Individuals or businesses that lend money or extend credit to another party should consider using a Promissory Note. This document is especially important in situations where a personal loan is made, or when a business transaction involves credit. It helps clarify the terms of the loan and protects the lender's rights in case of default.

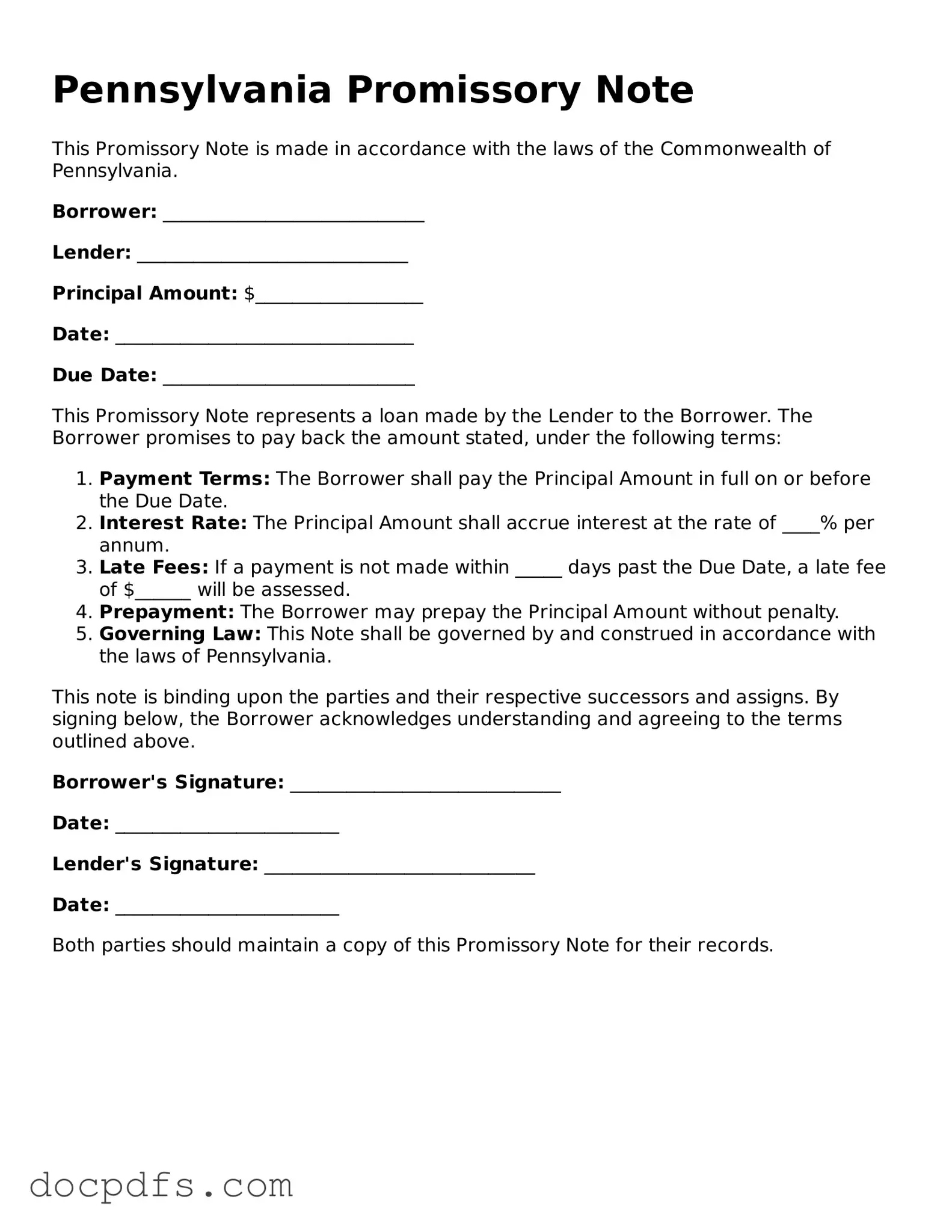

What key elements should be included in a Pennsylvania Promissory Note?

A well-drafted Promissory Note should include the following key elements:

-

Names of the parties:

Clearly identify the borrower and lender.

-

Loan amount:

Specify the exact amount being borrowed.

-

Interest rate:

State the interest rate, if applicable.

-

Repayment schedule:

Outline when payments are due and the total duration of the loan.

-

Late payment penalties:

Include any fees or penalties for late payments.

-

Signatures:

Both parties must sign the document to make it legally binding.

Is a Promissory Note legally binding in Pennsylvania?

Yes, a Promissory Note is legally binding in Pennsylvania as long as it meets the necessary legal requirements. This includes having clear terms, being signed by both parties, and being executed voluntarily. In the event of a dispute, the note can be enforced in court, making it crucial for both parties to understand the terms before signing.

Can a Promissory Note be modified after it has been signed?

Yes, a Promissory Note can be modified after it has been signed, but this typically requires mutual agreement from both parties. Any changes should be documented in writing and signed by both the borrower and the lender to ensure clarity and enforceability. It’s advisable to consult with a legal professional when making modifications to avoid potential disputes.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, meaning they fail to make payments as agreed, the lender has several options. The lender can pursue collection efforts, which may include contacting the borrower for payment or hiring a collection agency. Additionally, the lender may choose to take legal action to recover the owed amount. Having a Promissory Note provides the lender with a solid legal foundation to enforce their rights in such situations.

You can obtain a Pennsylvania Promissory Note form from various sources, including legal stationery stores, online legal form providers, or through legal professionals. Ensure that the form you choose complies with Pennsylvania laws and includes all necessary terms to protect your interests.