Free Pennsylvania Transfer-on-Death Deed Form

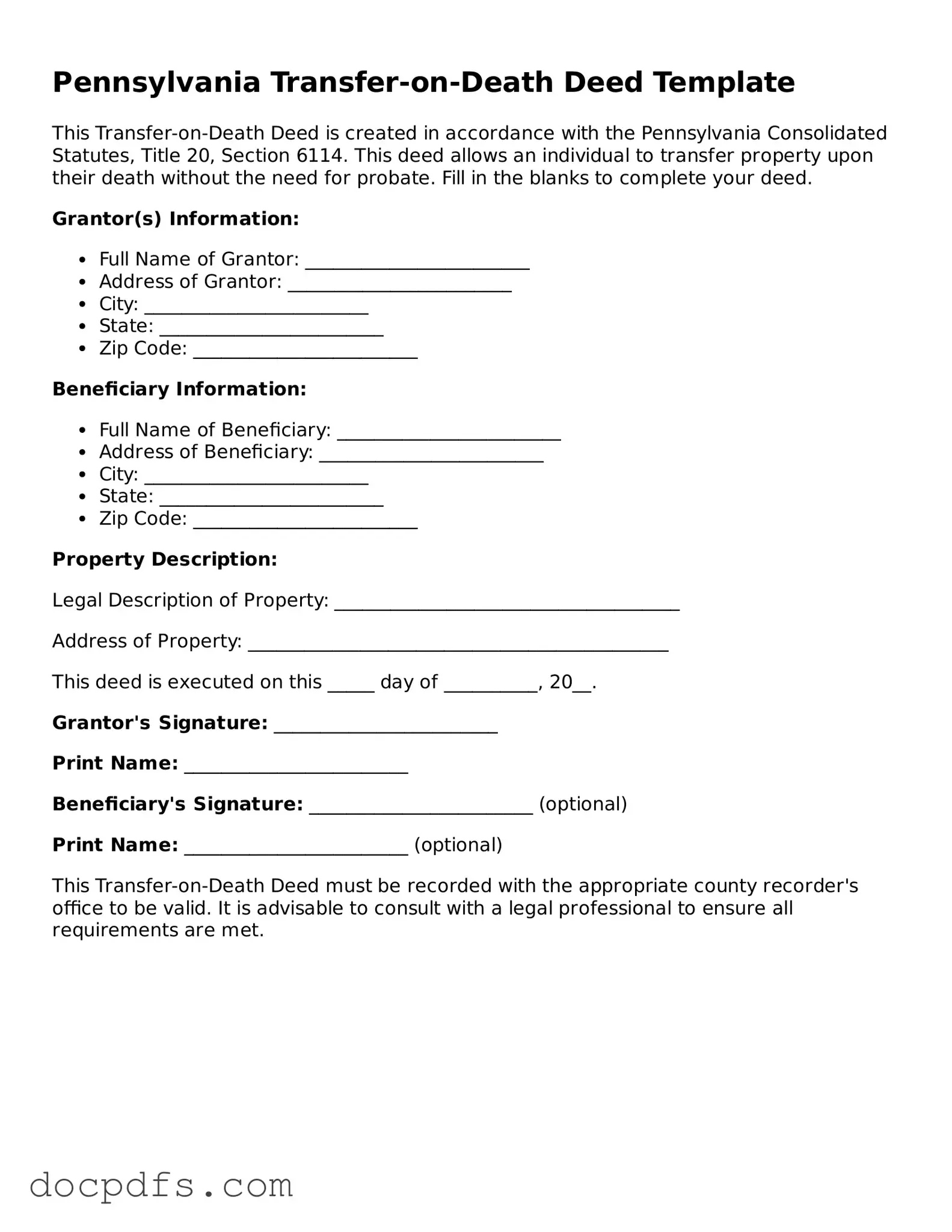

The Pennsylvania Transfer-on-Death Deed form is a legal document that allows property owners to transfer their real estate to beneficiaries upon their death, avoiding probate. This form provides a straightforward way to ensure that your property passes directly to your chosen heirs. Understanding its use and requirements is essential for effective estate planning in Pennsylvania.

Open Transfer-on-Death Deed Editor Now

Free Pennsylvania Transfer-on-Death Deed Form

Open Transfer-on-Death Deed Editor Now

Open Transfer-on-Death Deed Editor Now

or

⇓ Transfer-on-Death Deed

Finish this form the fast way

Complete Transfer-on-Death Deed online with a smooth editing experience.