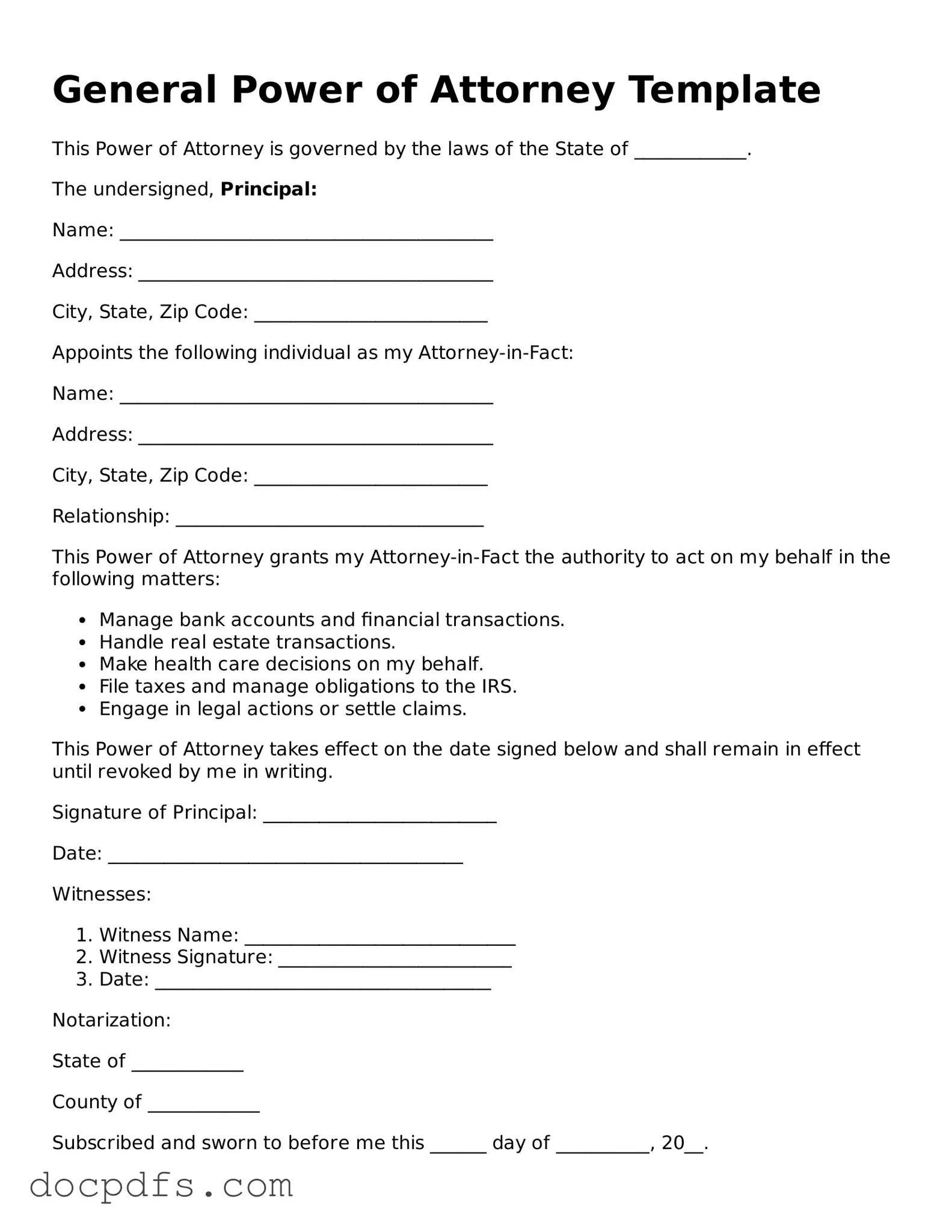

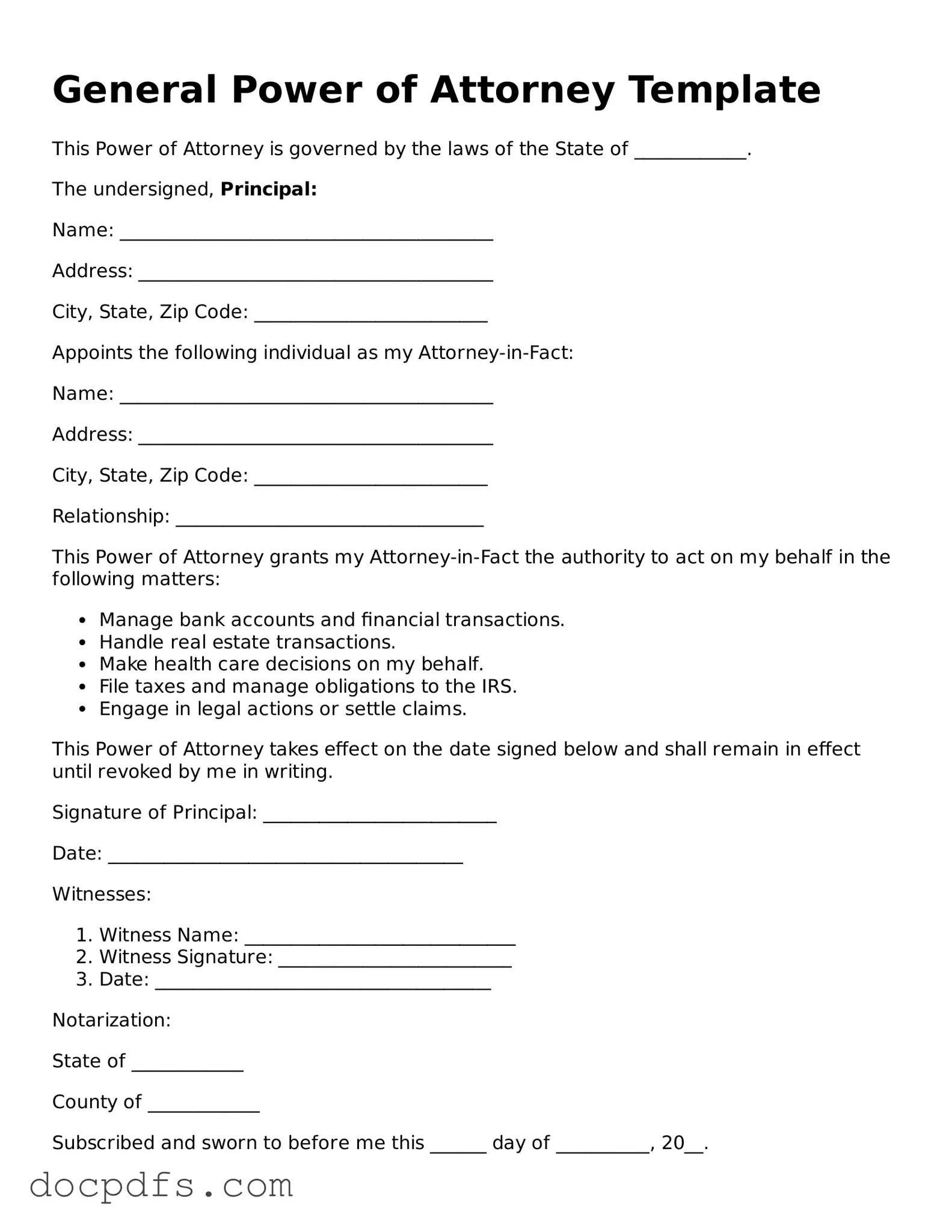

Legal Power of Attorney Document

A Power of Attorney form is a legal document that allows one person to act on behalf of another in legal or financial matters. This form grants authority to an agent, enabling them to make decisions and take actions in the best interest of the principal. Understanding the implications and uses of a Power of Attorney is essential for effective personal and financial planning.

Open Power of Attorney Editor Now

Legal Power of Attorney Document

Open Power of Attorney Editor Now

Open Power of Attorney Editor Now

or

⇓ Power of Attorney

Finish this form the fast way

Complete Power of Attorney online with a smooth editing experience.