What is a prenuptial agreement?

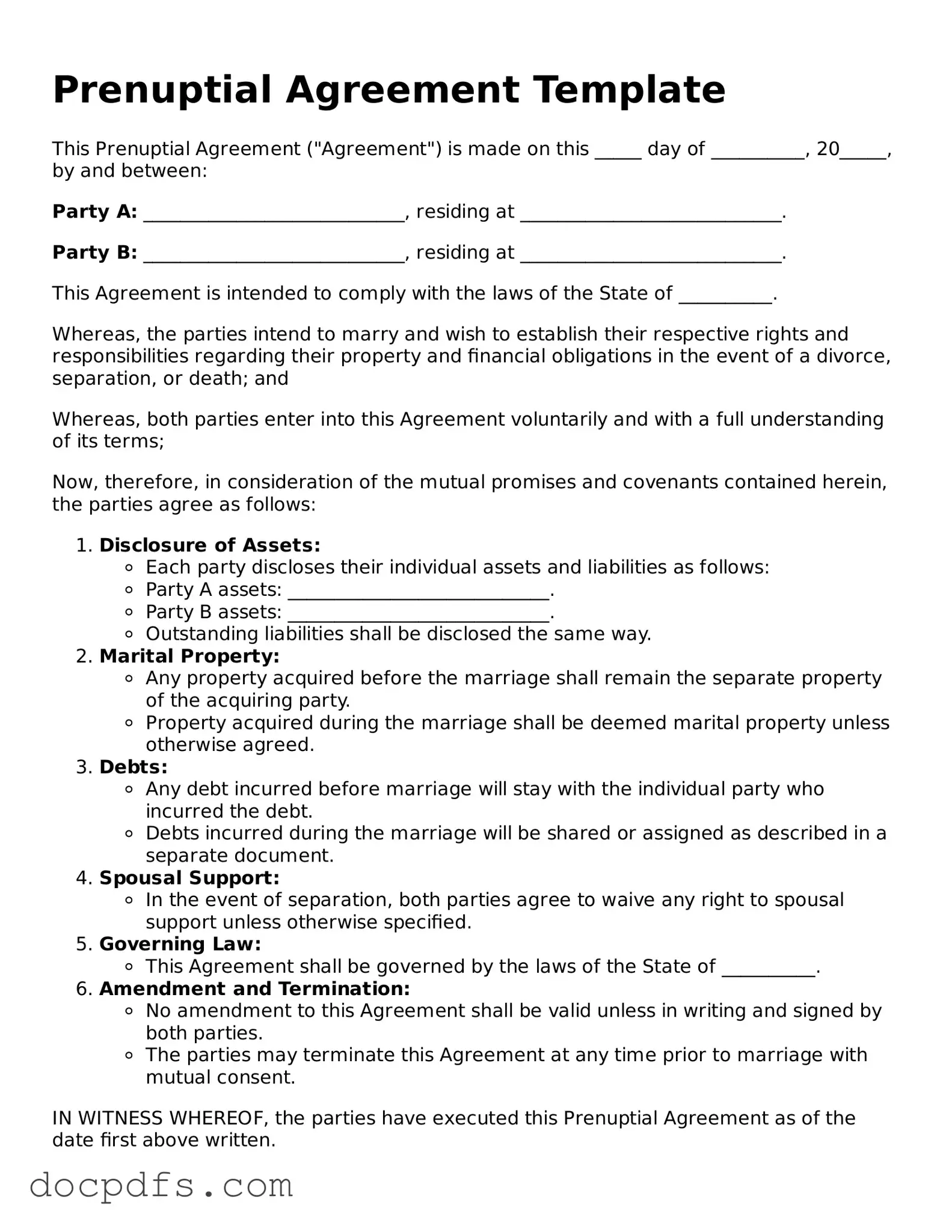

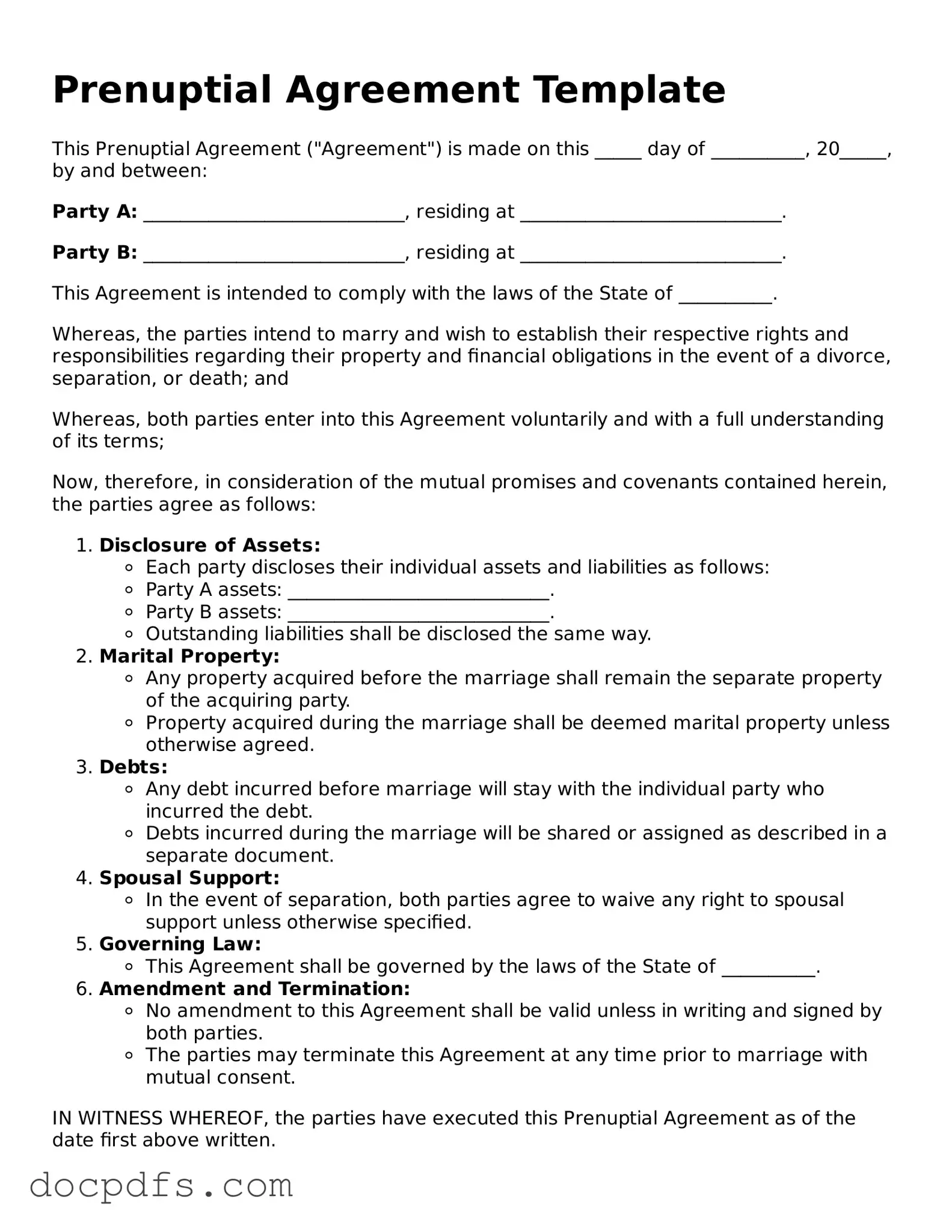

A prenuptial agreement, often called a prenup, is a legal document created by two individuals before they get married. It outlines how assets and debts will be divided in the event of a divorce or separation. This agreement can also address issues such as spousal support and property rights.

Why should couples consider a prenuptial agreement?

Couples may consider a prenuptial agreement for several reasons:

-

To protect individual assets acquired before marriage.

-

To clarify financial responsibilities during the marriage.

-

To avoid lengthy and costly disputes in case of divorce.

-

To ensure fair treatment of children from previous relationships.

When should a prenuptial agreement be created?

A prenuptial agreement should ideally be created well before the wedding date. This allows both parties ample time to discuss and negotiate the terms without the pressure of an impending marriage. It is recommended to start the process at least a few months before the wedding.

What should be included in a prenuptial agreement?

A comprehensive prenuptial agreement may include:

-

Identification of separate and marital property.

-

Debt responsibilities.

-

Spousal support provisions.

-

How assets will be divided in case of divorce.

-

Provisions for inheritance and estate planning.

Is a prenuptial agreement legally binding?

Yes, a prenuptial agreement can be legally binding if it meets certain requirements. Both parties must voluntarily agree to the terms, fully disclose their financial situations, and have the opportunity to consult with independent legal counsel. Additionally, the agreement must be fair and not unconscionable at the time it is enforced.

Can a prenuptial agreement be modified after marriage?

Yes, a prenuptial agreement can be modified after marriage. Both parties must agree to the changes, and it is advisable to put any modifications in writing and have them notarized. This ensures clarity and legal validity of the revised agreement.

What happens if a couple does not have a prenuptial agreement?

If a couple does not have a prenuptial agreement, state laws will govern the division of assets and debts in the event of a divorce. This could lead to outcomes that may not align with either party’s wishes, potentially resulting in disputes and lengthy legal battles.

How can couples ensure their prenuptial agreement is enforceable?

To ensure a prenuptial agreement is enforceable, couples should:

-

Ensure full financial disclosure from both parties.

-

Consult with separate legal counsel.

-

Draft the agreement well in advance of the wedding.

-

Make sure the terms are fair and reasonable.

Can a prenuptial agreement cover child custody and support?

While a prenuptial agreement can address financial responsibilities related to children, it typically cannot dictate custody or support arrangements. Courts usually reserve the right to make these decisions based on the best interests of the child at the time of divorce.

Where can couples find a template for a prenuptial agreement?

Couples can find templates for prenuptial agreements through various sources, including legal websites, family law attorneys, and self-help legal books. However, it is recommended to have any template reviewed or customized by a qualified attorney to ensure it meets specific needs and complies with state laws.