What is a Promissory Note for a Car?

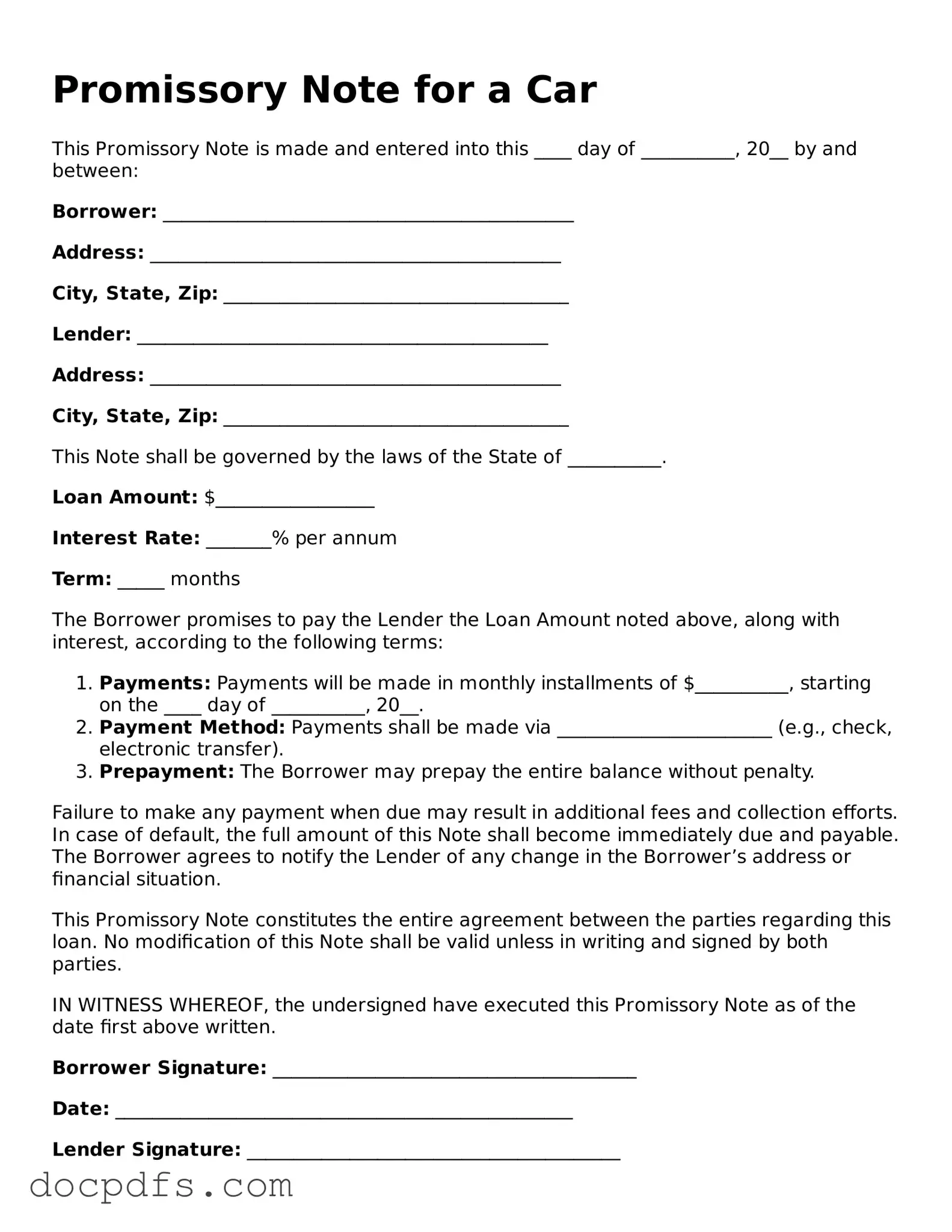

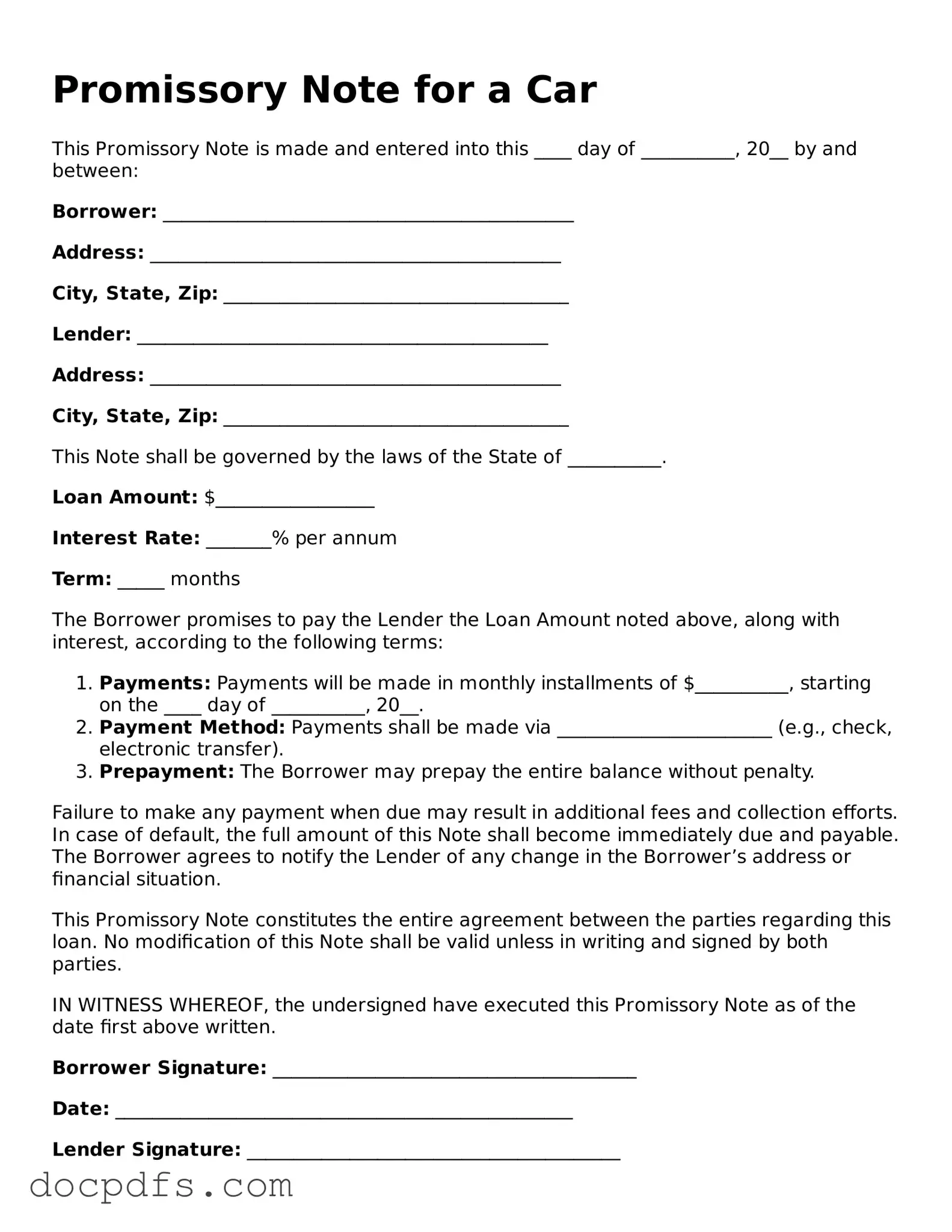

A Promissory Note for a Car is a legal document in which one party (the borrower) agrees to pay a specific amount of money to another party (the lender) under agreed-upon terms. This document outlines the details of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved, which in this case is the vehicle being financed.

Why do I need a Promissory Note for a Car?

A Promissory Note serves several important purposes:

-

Legal Protection:

It provides legal evidence of the loan agreement, protecting both the lender's and borrower's interests.

-

Clear Terms:

It clearly outlines the repayment terms, which helps prevent misunderstandings or disputes in the future.

-

Enforceability:

If the borrower fails to repay the loan, the lender can use the note to take legal action to recover the owed amount.

When drafting a Promissory Note for a Car, it is essential to include the following information:

-

The names and addresses of both the borrower and the lender.

-

The amount of money being borrowed.

-

The interest rate, if applicable.

-

The repayment schedule, including due dates and payment amounts.

-

A description of the vehicle being financed, including make, model, and VIN.

-

Any consequences for late payments or defaulting on the loan.

How is a Promissory Note different from a loan agreement?

While both documents serve to outline the terms of a loan, they differ in complexity and detail. A Promissory Note is typically simpler and focuses primarily on the borrower's promise to repay the loan. In contrast, a loan agreement is more comprehensive, often including additional terms such as covenants, representations, and warranties. A loan agreement may also cover broader aspects of the lending relationship beyond just the repayment of the loan.

Can I modify a Promissory Note after it has been signed?

Yes, modifications can be made to a Promissory Note, but both parties must agree to the changes. It is important to document any amendments in writing and have both parties sign the revised note. This ensures that the modifications are legally binding and enforceable.

What happens if I default on the Promissory Note?

If a borrower defaults on the Promissory Note, the lender has several options. Typically, the lender can:

-

Contact the borrower to discuss the missed payments and explore possible solutions.

-

Charge late fees as specified in the note.

-

Initiate legal proceedings to recover the amount owed, which may include repossessing the vehicle if it was used as collateral.

It is always best to communicate with the lender as soon as difficulties arise to avoid escalation.