What is a Promissory Note?

A Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a certain time or on demand. It outlines the terms of the loan, including interest rates and payment schedules.

Who uses a Promissory Note?

Individuals and businesses often use Promissory Notes. They are commonly utilized in personal loans, business financing, and real estate transactions. Both lenders and borrowers benefit from the clarity and structure that a Promissory Note provides.

What are the key components of a Promissory Note?

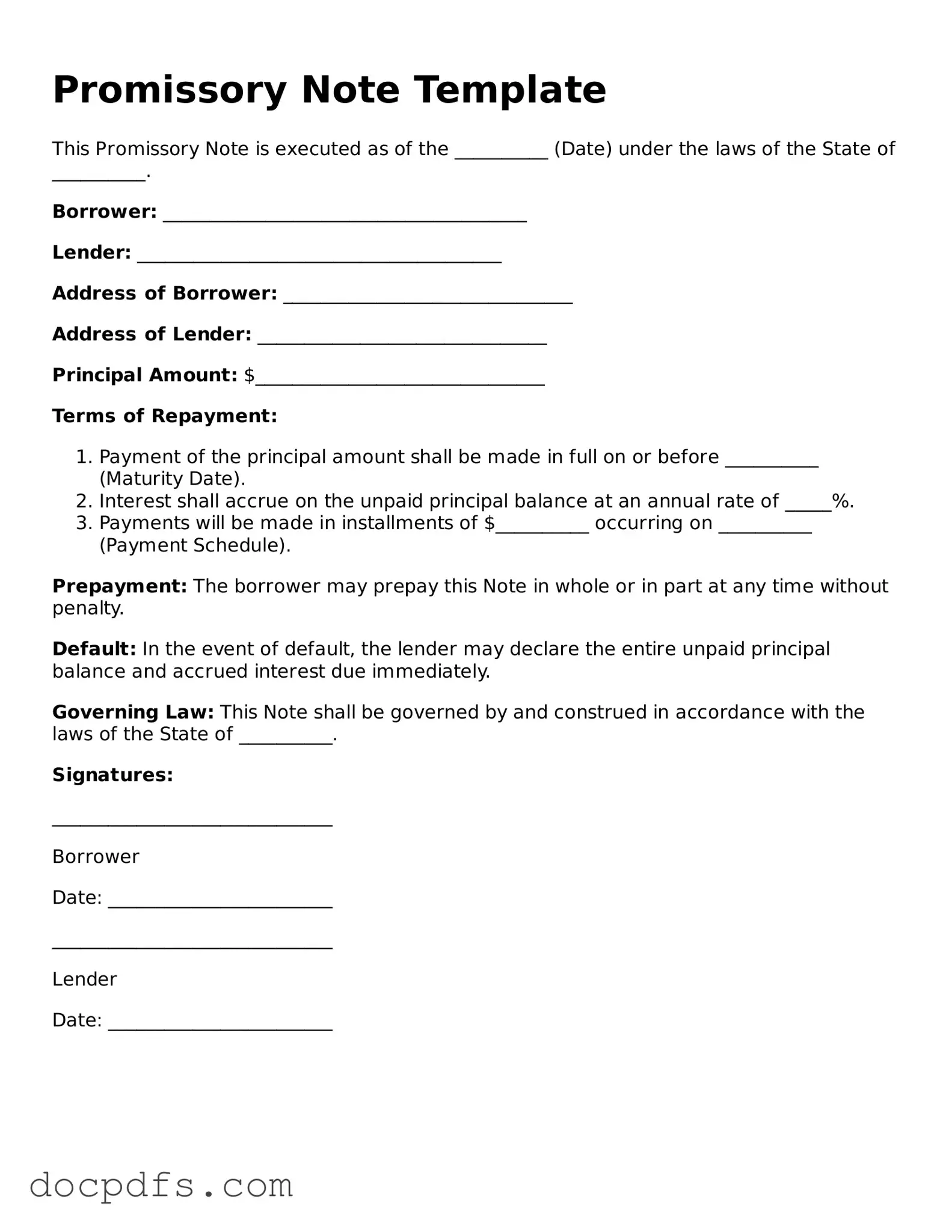

A typical Promissory Note includes the following elements:

-

The principal amount borrowed

-

The interest rate applied

-

The payment schedule

-

The maturity date

-

Any collateral securing the loan

-

Signatures of both parties

How is a Promissory Note different from a loan agreement?

While both documents serve to outline the terms of a loan, a Promissory Note is generally simpler and focuses solely on the promise to pay. A loan agreement, on the other hand, may include additional terms, conditions, and responsibilities for both parties involved.

Is a Promissory Note legally binding?

Yes, a properly executed Promissory Note is legally binding. It creates an obligation for the borrower to repay the loan according to the agreed-upon terms. However, enforceability may depend on local laws and the clarity of the document.

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified if both parties agree to the changes. It’s important to document any modifications in writing to avoid misunderstandings in the future.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender may take legal action to recover the owed amount. This could involve filing a lawsuit or pursuing collection efforts. Having a clear Promissory Note can help facilitate this process.

Do I need a lawyer to create a Promissory Note?

While it's not required to have a lawyer draft a Promissory Note, consulting one can be beneficial, especially for larger loans or complex agreements. A legal expert can ensure that the document meets all necessary legal standards.

Where can I find a template for a Promissory Note?

Templates for Promissory Notes are widely available online. Many legal websites offer free or paid templates that you can customize to fit your specific needs. Always ensure that the template complies with your state’s laws.