What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the person transferring the property has clear title. It simply conveys whatever interest the grantor has in the property, if any.

When should I use a Quitclaim Deed?

Quitclaim Deeds are commonly used in specific situations, such as:

-

Transferring property between family members.

-

Clearing up title issues or disputes.

-

Transferring property in a divorce settlement.

-

Adding or removing someone from the title.

It’s important to consider your situation carefully before using this type of deed.

What are the risks of using a Quitclaim Deed?

Since a Quitclaim Deed does not provide any warranties or guarantees about the property title, there are some risks involved. The new owner may inherit any existing liens or claims against the property. If the grantor does not actually own the property, the recipient may end up with nothing.

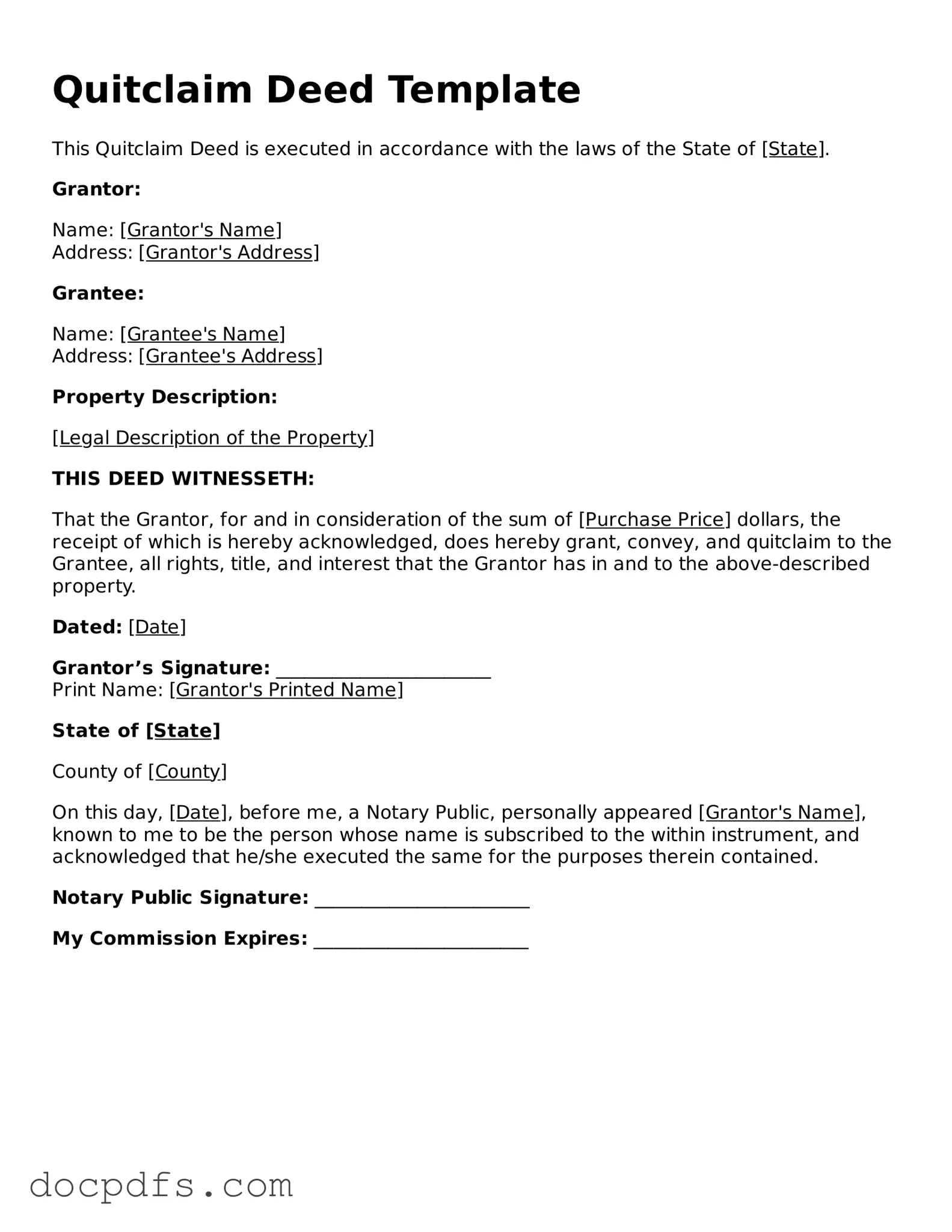

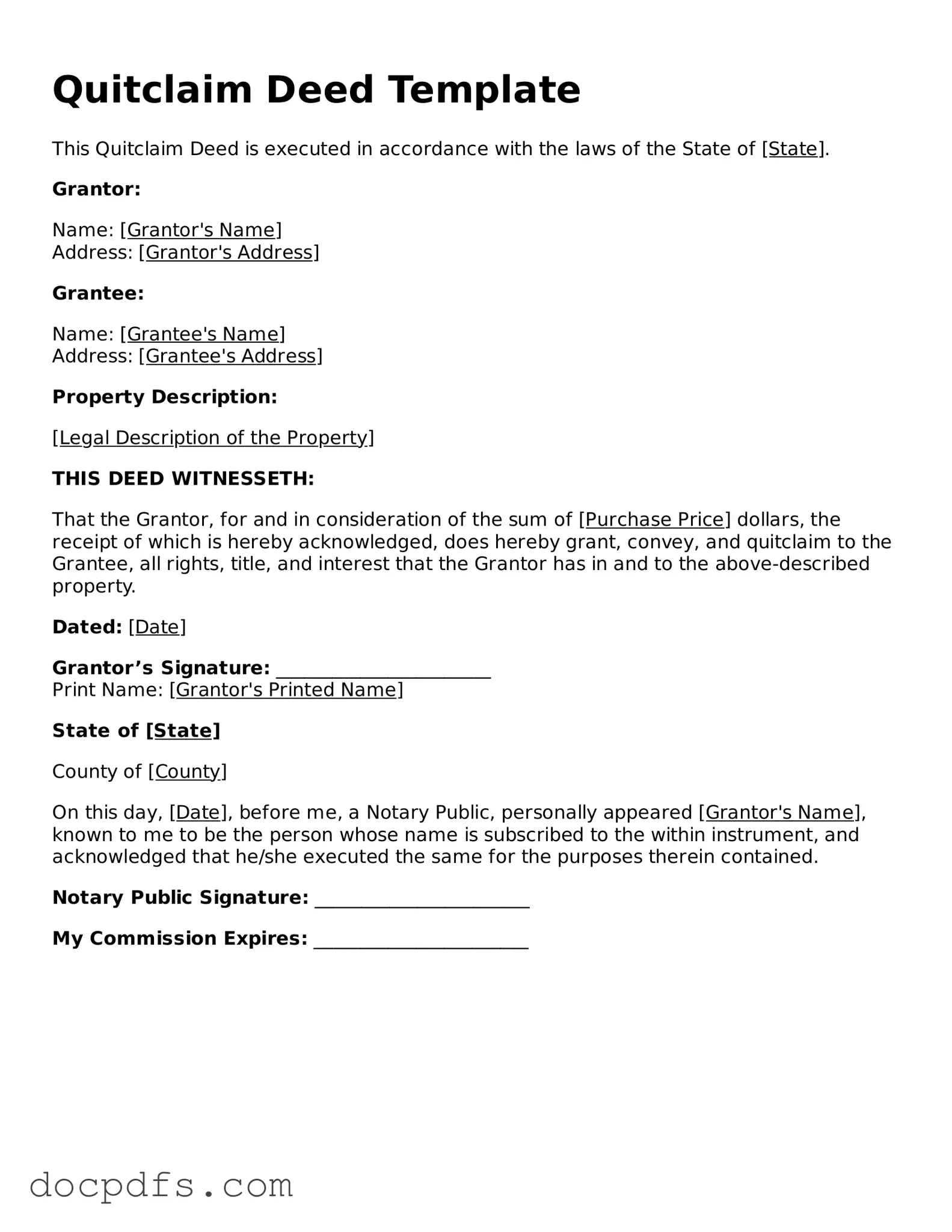

How do I complete a Quitclaim Deed?

Completing a Quitclaim Deed involves several steps:

-

Obtain a Quitclaim Deed form from a reliable source.

-

Fill in the required information, including the names of the grantor and grantee, property description, and date.

-

Sign the deed in front of a notary public.

-

File the completed deed with the county recorder’s office where the property is located.

Make sure to keep a copy for your records.

Do I need a lawyer to create a Quitclaim Deed?

While it is not legally required to have a lawyer, consulting one can be beneficial. A lawyer can help ensure that the deed is completed correctly and that all legal requirements are met. This can prevent potential issues in the future.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed and a Warranty Deed are not the same. A Warranty Deed provides guarantees about the title and protects the buyer from claims against the property. In contrast, a Quitclaim Deed offers no such protections. It’s important to understand these differences before deciding which type of deed to use.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and recorded, it generally cannot be revoked. The transfer of property is final. However, if there was fraud or coercion involved in the signing, it may be possible to challenge the deed in court. Always seek legal advice if you believe there are grounds for revocation.