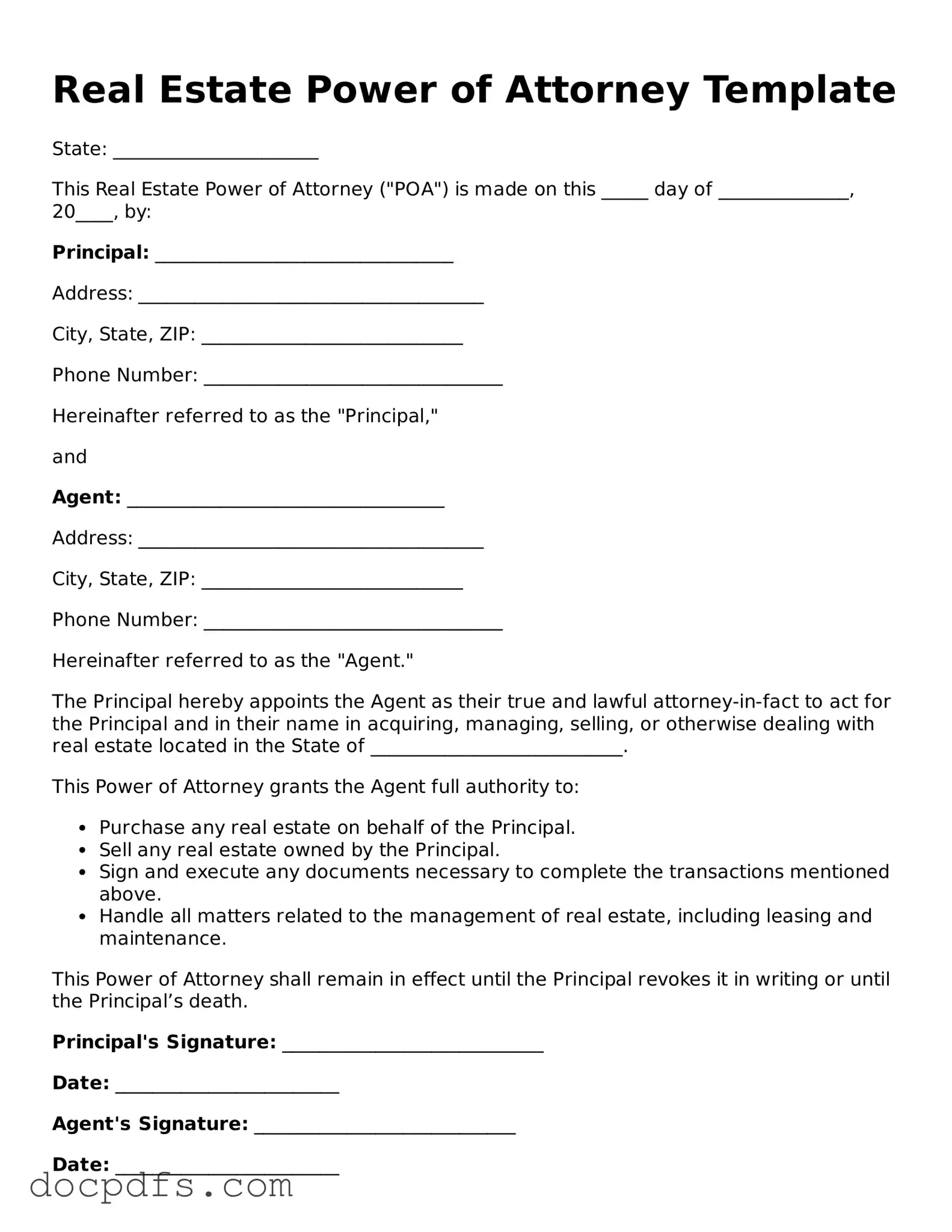

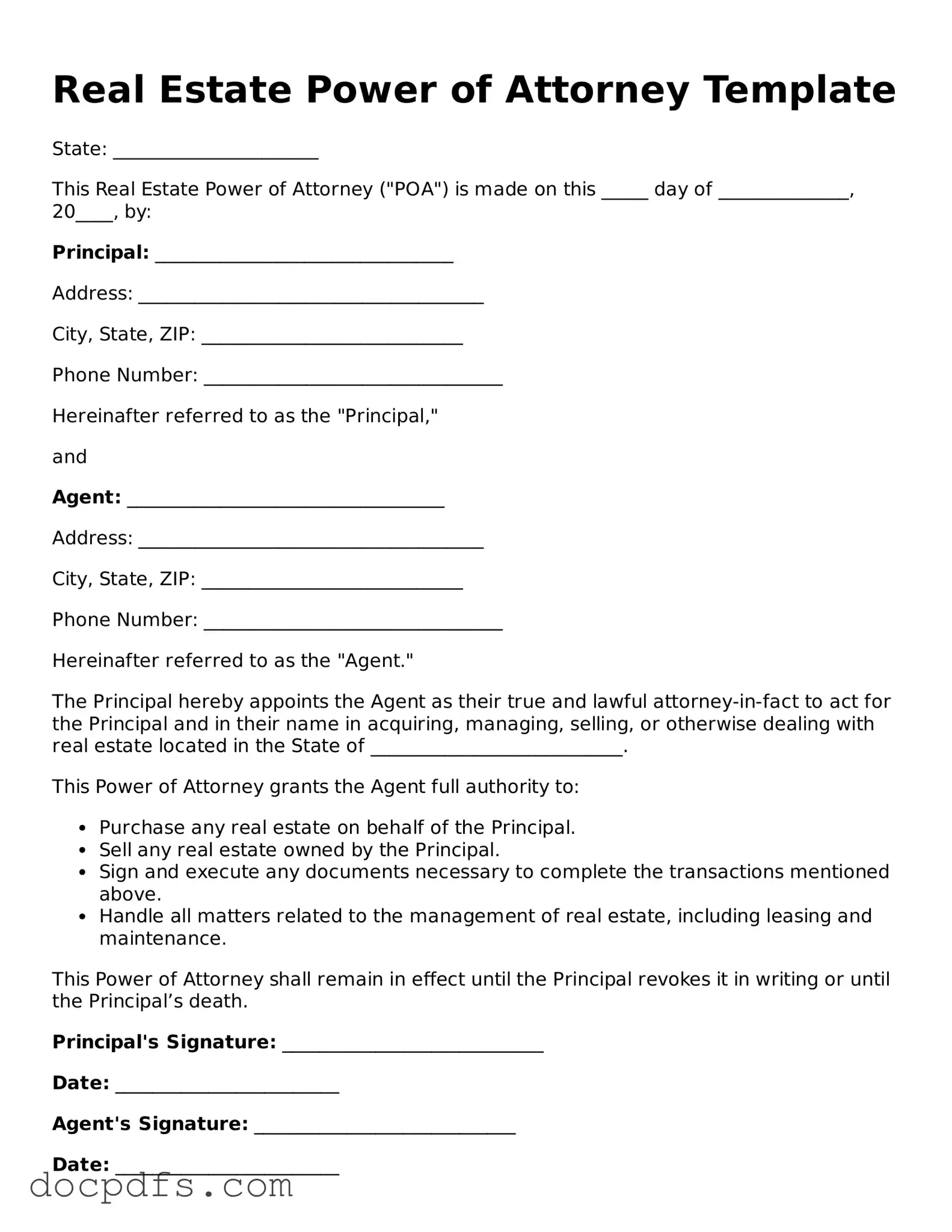

Legal Real Estate Power of Attorney Document

A Real Estate Power of Attorney form is a legal document that allows one person to authorize another to manage their real estate transactions on their behalf. This form is essential for individuals who may be unable to handle their property affairs due to various reasons, such as illness or absence. Understanding its significance can help ensure that real estate matters are handled efficiently and in accordance with the principal's wishes.

Open Real Estate Power of Attorney Editor Now

Legal Real Estate Power of Attorney Document

Open Real Estate Power of Attorney Editor Now

Open Real Estate Power of Attorney Editor Now

or

⇓ Real Estate Power of Attorney

Finish this form the fast way

Complete Real Estate Power of Attorney online with a smooth editing experience.