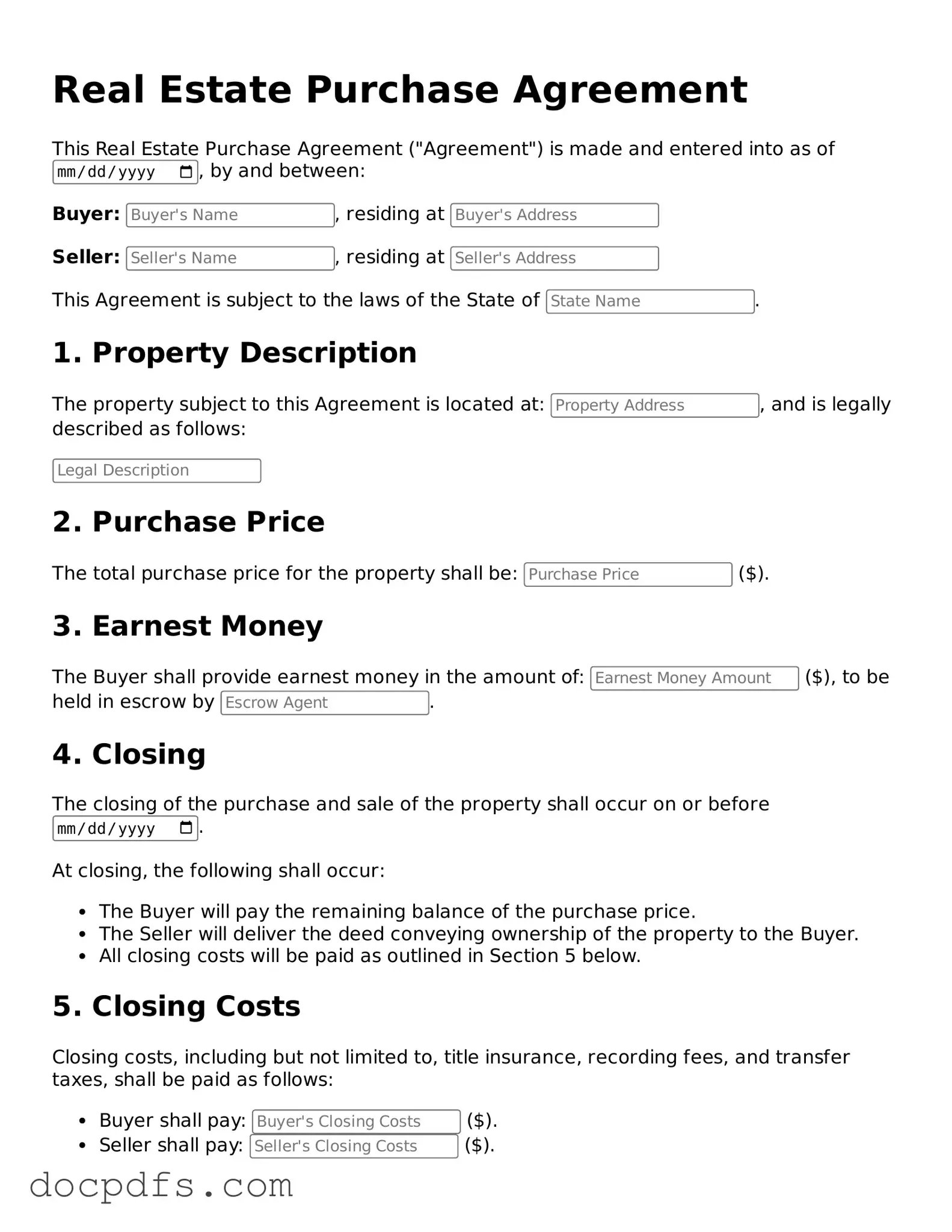

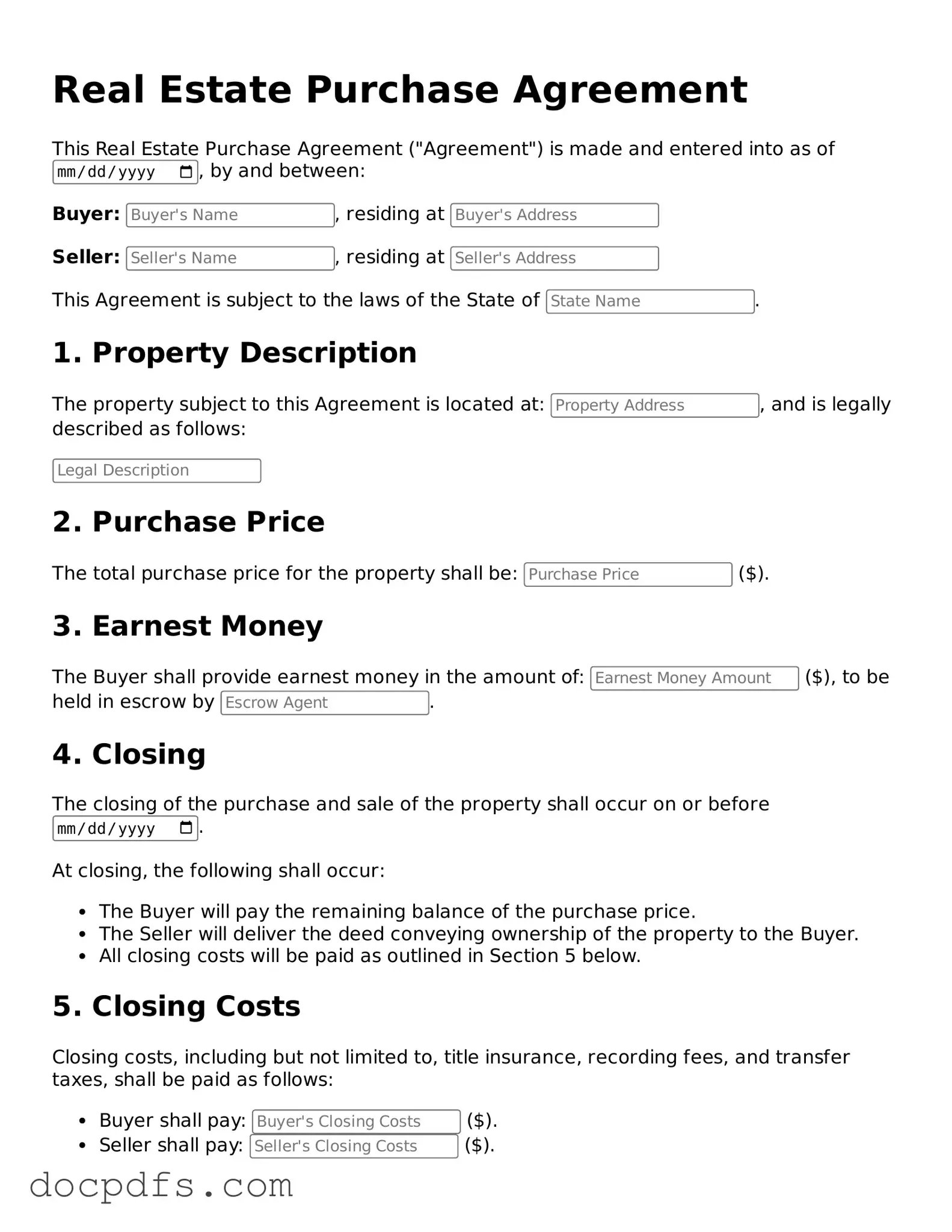

What is a Real Estate Purchase Agreement?

A Real Estate Purchase Agreement is a legally binding document between a buyer and a seller. It outlines the terms and conditions under which the buyer agrees to purchase a property. This agreement includes details such as the purchase price, closing date, and any contingencies that must be met before the sale is finalized.

What are the key components of this agreement?

The key components typically include:

-

Parties Involved:

Names and addresses of the buyer and seller.

-

Property Description:

A detailed description of the property being sold, including its address and legal description.

-

Purchase Price:

The agreed-upon price for the property.

-

Earnest Money:

A deposit made by the buyer to show commitment to the purchase.

-

Contingencies:

Conditions that must be met for the sale to proceed, such as financing or home inspections.

-

Closing Date:

The date when the property will officially change hands.

Why is it important to have a Real Estate Purchase Agreement?

This agreement is crucial because it protects both the buyer and the seller. It clearly outlines the expectations of each party and provides a framework for resolving any disputes that may arise. Without this document, misunderstandings can occur, leading to potential legal issues.

Can the agreement be modified after it is signed?

Yes, the Real Estate Purchase Agreement can be modified after it is signed, but both parties must agree to any changes. It is essential to document any modifications in writing and have both parties sign the revised agreement to ensure clarity and legal enforceability.

What happens if one party breaches the agreement?

If one party fails to meet the terms of the agreement, it is considered a breach. The non-breaching party may have several options, including:

-

Seeking damages for any losses incurred.

-

Requesting specific performance, which means asking the court to enforce the agreement.

-

Negotiating a settlement with the breaching party.

Is it necessary to hire a lawyer when creating this agreement?

While it is not legally required to hire a lawyer, it is often advisable. A lawyer can help ensure that the agreement complies with state laws and adequately protects your interests. They can also assist in understanding any complex terms or conditions that may arise.

What is the role of earnest money in the agreement?

Earnest money serves as a good faith deposit from the buyer to show their seriousness about purchasing the property. It is typically held in an escrow account until the closing date. If the sale goes through, the earnest money is applied to the purchase price. If the buyer backs out without a valid reason, the seller may keep the earnest money as compensation.

How long is a Real Estate Purchase Agreement valid?

The validity of a Real Estate Purchase Agreement can vary based on the terms set within the document. Generally, it remains in effect until the closing date or until any contingencies are resolved. If the agreement does not specify a time frame, it may be considered valid until one party withdraws or breaches the agreement.