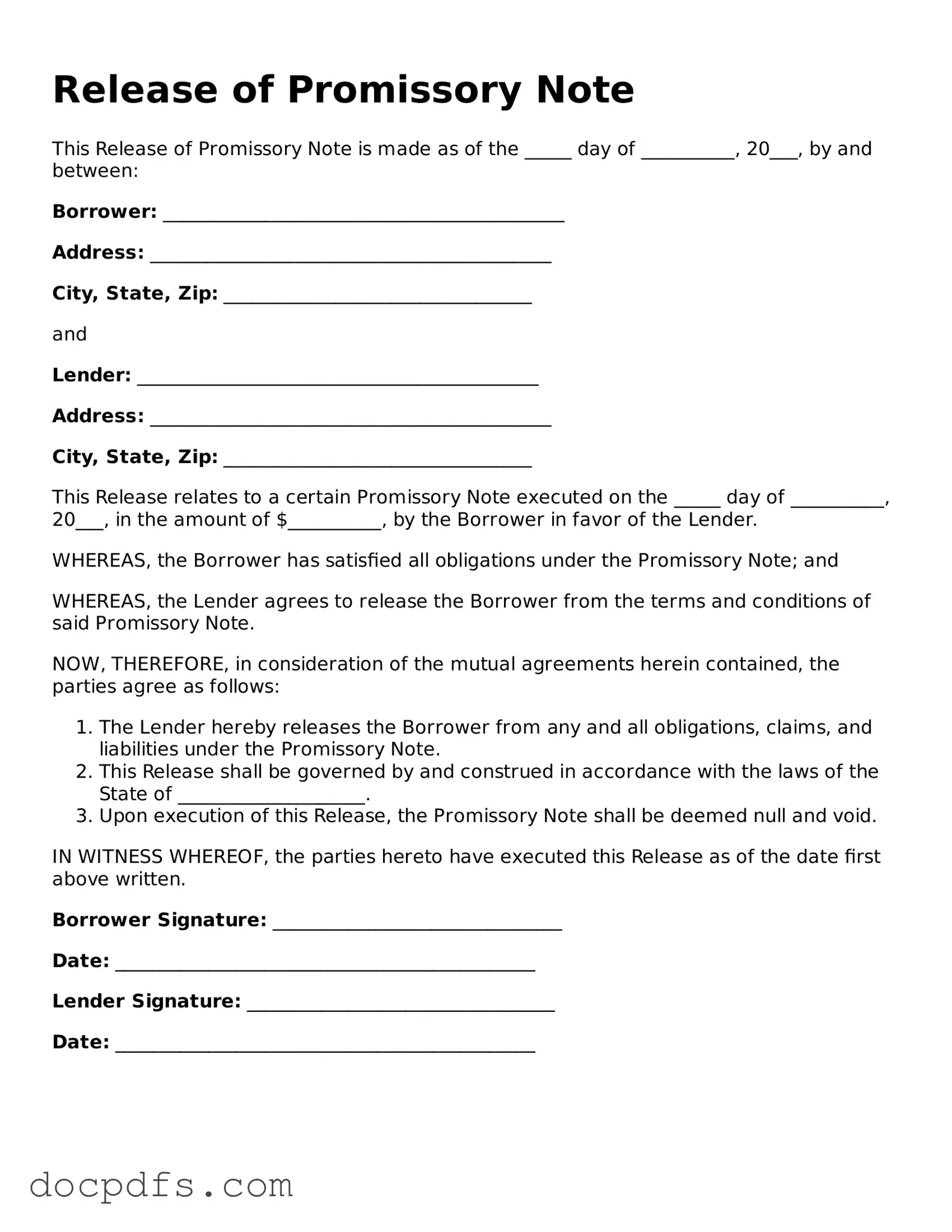

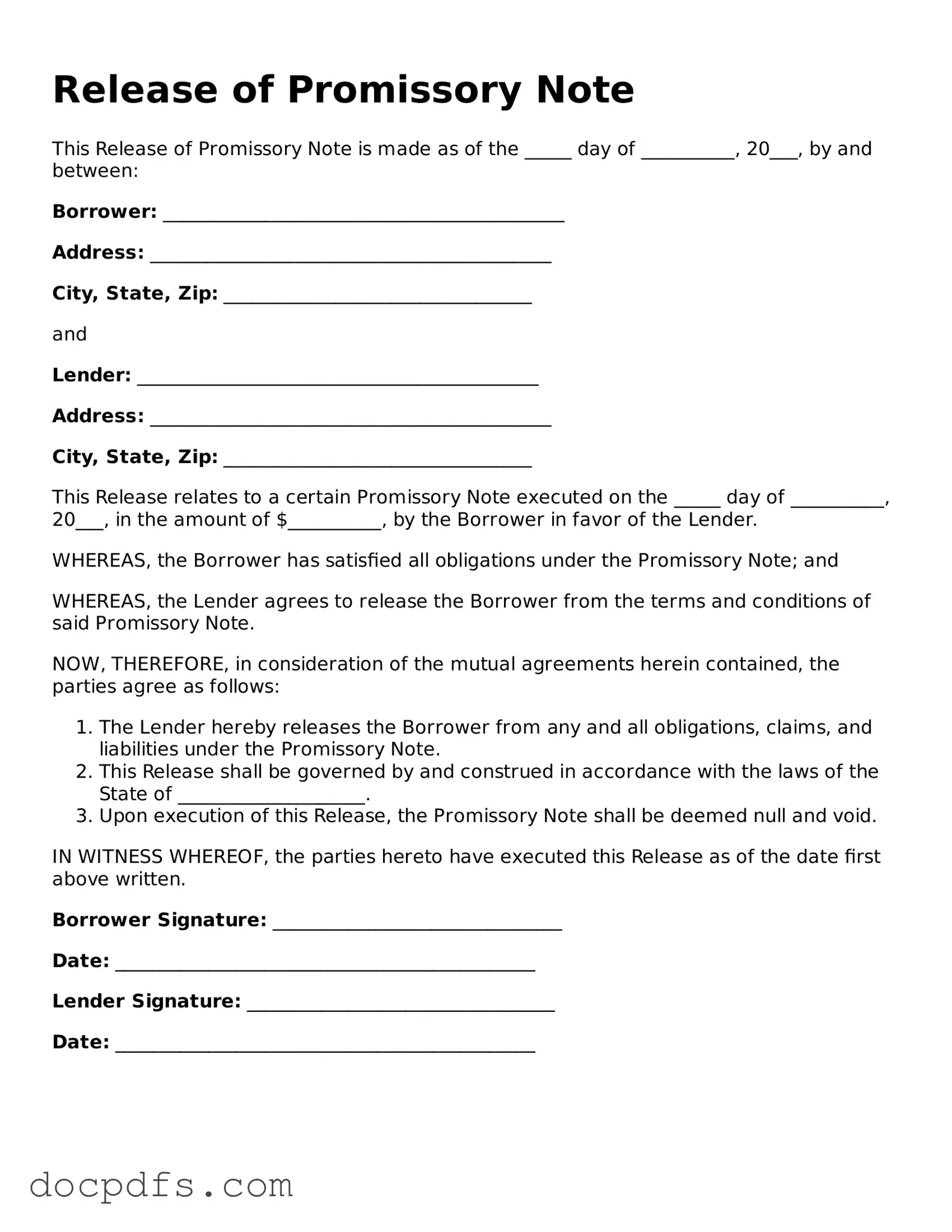

Legal Release of Promissory Note Document

A Release of Promissory Note form is a legal document that signifies the cancellation of a promissory note. This form is important for both lenders and borrowers, as it formally releases the borrower from their obligation to repay the loan. Understanding how to properly execute this form can provide peace of mind for all parties involved.

Open Release of Promissory Note Editor Now

Legal Release of Promissory Note Document

Open Release of Promissory Note Editor Now

Open Release of Promissory Note Editor Now

or

⇓ Release of Promissory Note

Finish this form the fast way

Complete Release of Promissory Note online with a smooth editing experience.