What is a Texas Affidavit of Death?

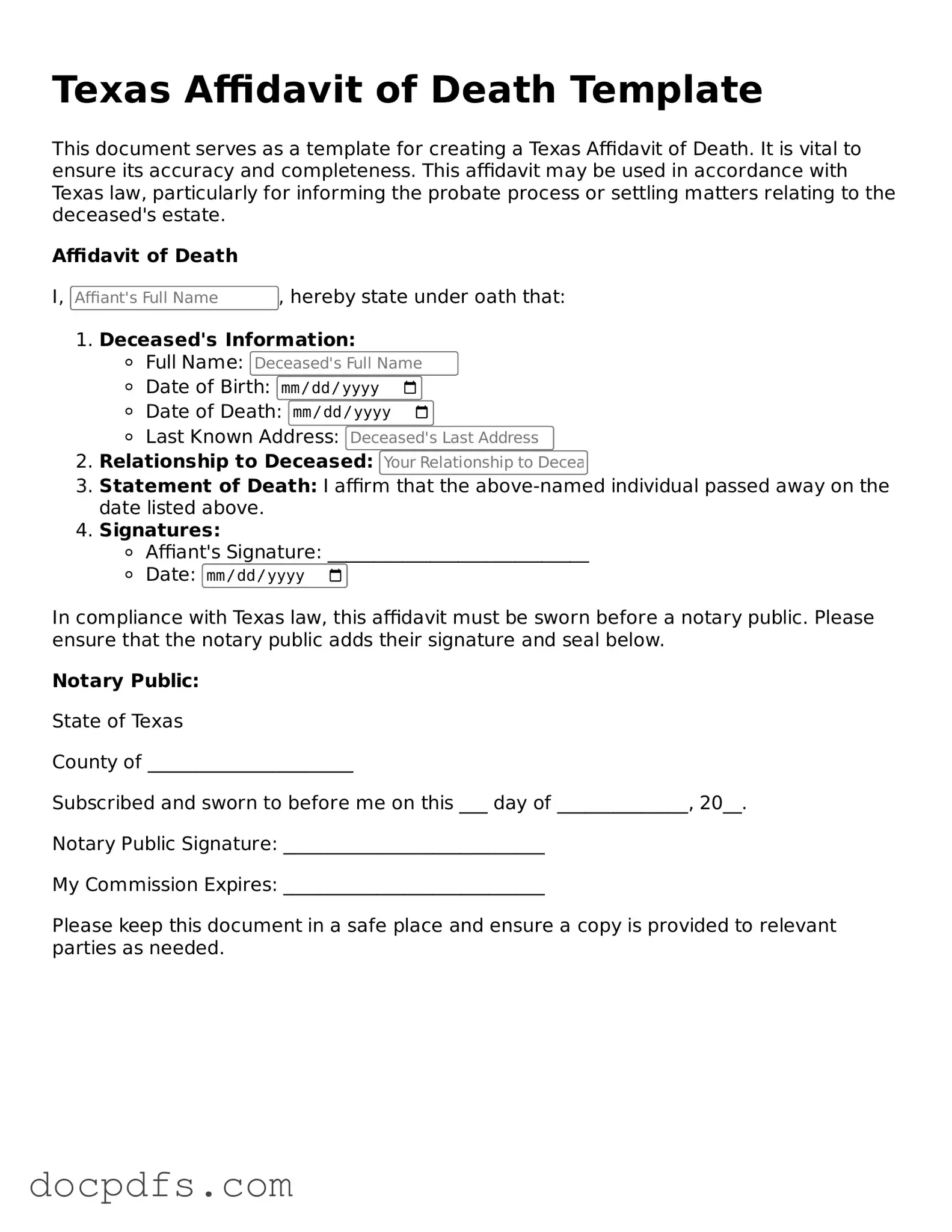

A Texas Affidavit of Death is a legal document used to officially declare that an individual has passed away. This form is often used to help settle the deceased's estate, transfer property, or clarify the status of a person's affairs after their death. By signing this affidavit, the affiant confirms the death and provides necessary details that may be required for legal or administrative purposes.

Who can complete the Affidavit of Death?

The Affidavit of Death can typically be completed by an individual who has personal knowledge of the deceased's passing. This could be a family member, close friend, or anyone who can affirm the facts surrounding the death. It is important that the person completing the form is credible and can provide accurate information.

The form generally requires several key pieces of information, including:

-

The full name of the deceased

-

The date of death

-

The place of death

-

The affiant's relationship to the deceased

-

Any relevant details regarding the deceased's estate or property

Providing accurate and complete information is crucial to ensure the affidavit serves its intended purpose.

Is the Affidavit of Death a public document?

Yes, once filed with the appropriate court or agency, the Affidavit of Death becomes a public record. This means that anyone can access it. However, the specific details about who can access it and how may vary based on local laws and regulations.

Do I need to have the Affidavit of Death notarized?

Yes, the Affidavit of Death must be notarized to be considered valid. This means that the person completing the affidavit must sign it in the presence of a notary public, who will then verify the identity of the signer and witness the signing of the document.

How do I file the Affidavit of Death?

The filing process typically involves submitting the completed and notarized Affidavit of Death to the appropriate county clerk or probate court. It is advisable to check with the local court for specific filing requirements, as they can vary by jurisdiction.

What happens after the Affidavit of Death is filed?

Once the Affidavit of Death is filed, it serves as a formal declaration of the individual's death. This document may be used to settle the deceased's estate, transfer property titles, or fulfill other legal obligations. The next steps will depend on the specific circumstances of the deceased’s estate and any pending legal matters.

Can the Affidavit of Death be contested?

In some cases, the Affidavit of Death can be contested, especially if there are disputes regarding the deceased's estate or if someone challenges the validity of the affidavit itself. If there are concerns about the affidavit, it may be advisable to seek legal counsel to understand the options available.

You can obtain a Texas Affidavit of Death form from various sources, including local county clerk offices, probate courts, or legal form websites. It is important to ensure that you are using the most current version of the form to comply with local regulations.