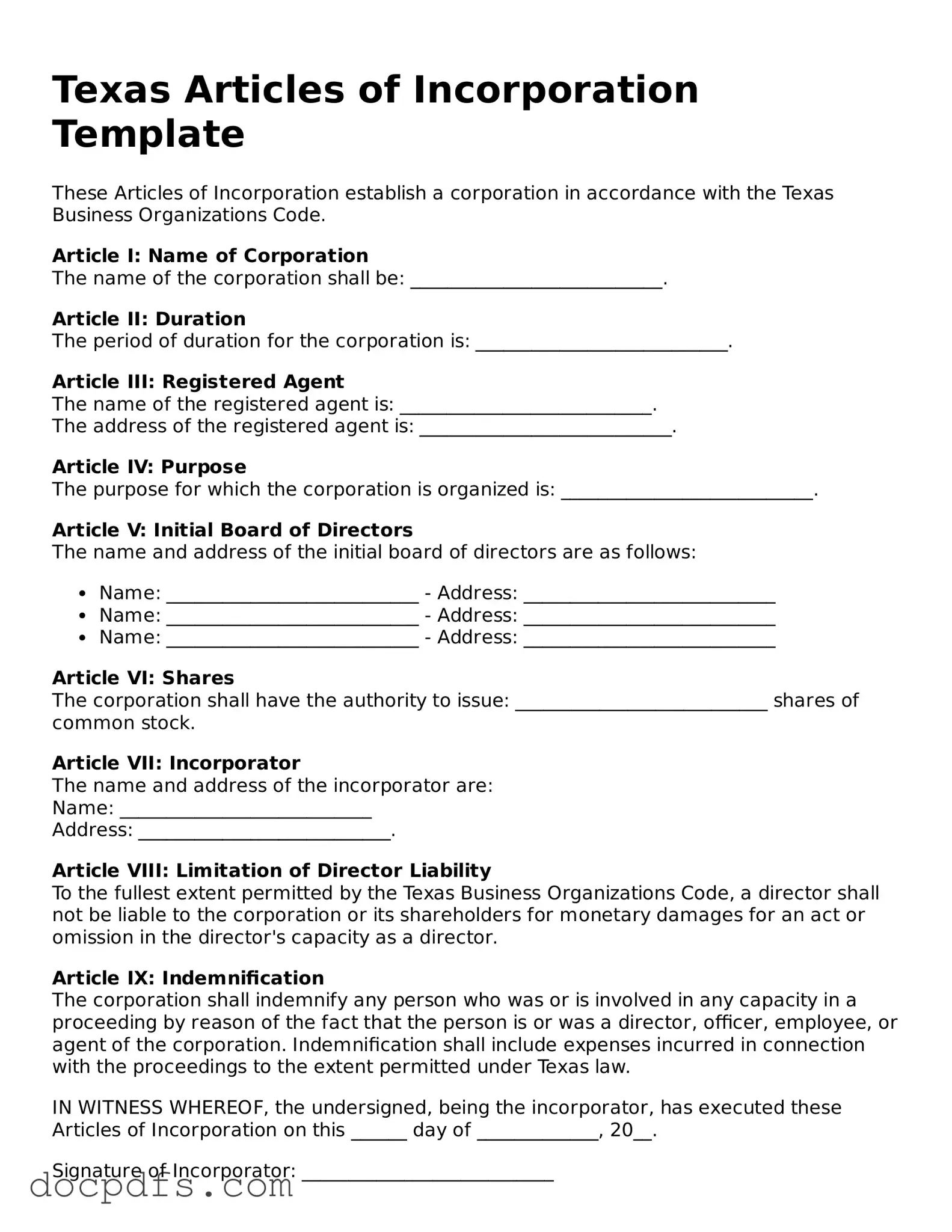

What are the Texas Articles of Incorporation?

The Texas Articles of Incorporation is a legal document that establishes a corporation in the state of Texas. It outlines essential information about the corporation, such as its name, purpose, and structure. Filing this document with the Texas Secretary of State is the first step in forming a corporation.

What information is required to complete the Articles of Incorporation?

To complete the Articles of Incorporation, you will typically need to provide the following information:

-

The name of the corporation

-

The duration of the corporation (usually perpetual)

-

The purpose of the corporation

-

The registered agent's name and address

-

The number of shares the corporation is authorized to issue

-

The names and addresses of the initial directors

How do I file the Articles of Incorporation?

You can file the Articles of Incorporation online through the Texas Secretary of State's website or by mailing a paper form. If you choose to file online, you will need to create an account. For paper filings, you can download the form, fill it out, and send it to the appropriate address along with the filing fee.

What is the filing fee for the Articles of Incorporation in Texas?

The filing fee for the Articles of Incorporation varies based on the type of corporation you are forming. As of the latest information, the fee is generally around $300 for a for-profit corporation. Non-profit corporations may have a reduced fee. Always check the Texas Secretary of State's website for the most current fee schedule.

Can I amend the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation after filing. To do this, you will need to file a Certificate of Amendment with the Texas Secretary of State. This document will require you to specify the changes you wish to make and may also involve a filing fee.

What happens if I don’t file the Articles of Incorporation?

If you don’t file the Articles of Incorporation, your business will not be legally recognized as a corporation in Texas. This means you won't have the liability protections that a corporation provides, and you may face legal issues when trying to operate your business.

Do I need a lawyer to file the Articles of Incorporation?

While it's not legally required to have a lawyer, consulting one can be beneficial. A lawyer can help ensure that all information is accurate and compliant with Texas law. If you're unfamiliar with the process, seeking legal advice may save you time and potential issues down the road.

How long does it take to process the Articles of Incorporation?

The processing time for the Articles of Incorporation can vary. Typically, online filings are processed faster, often within a few business days. Paper filings may take longer, sometimes up to several weeks. For urgent needs, expedited processing options may be available for an additional fee.

What should I do after my Articles of Incorporation are approved?

Once your Articles of Incorporation are approved, you should take several important steps:

-

Obtain an Employer Identification Number (EIN) from the IRS.

-

Set up a corporate bank account.

-

Develop corporate bylaws to govern your corporation.

-

Hold an initial meeting with the board of directors.

-

Comply with any local business licenses or permits required.