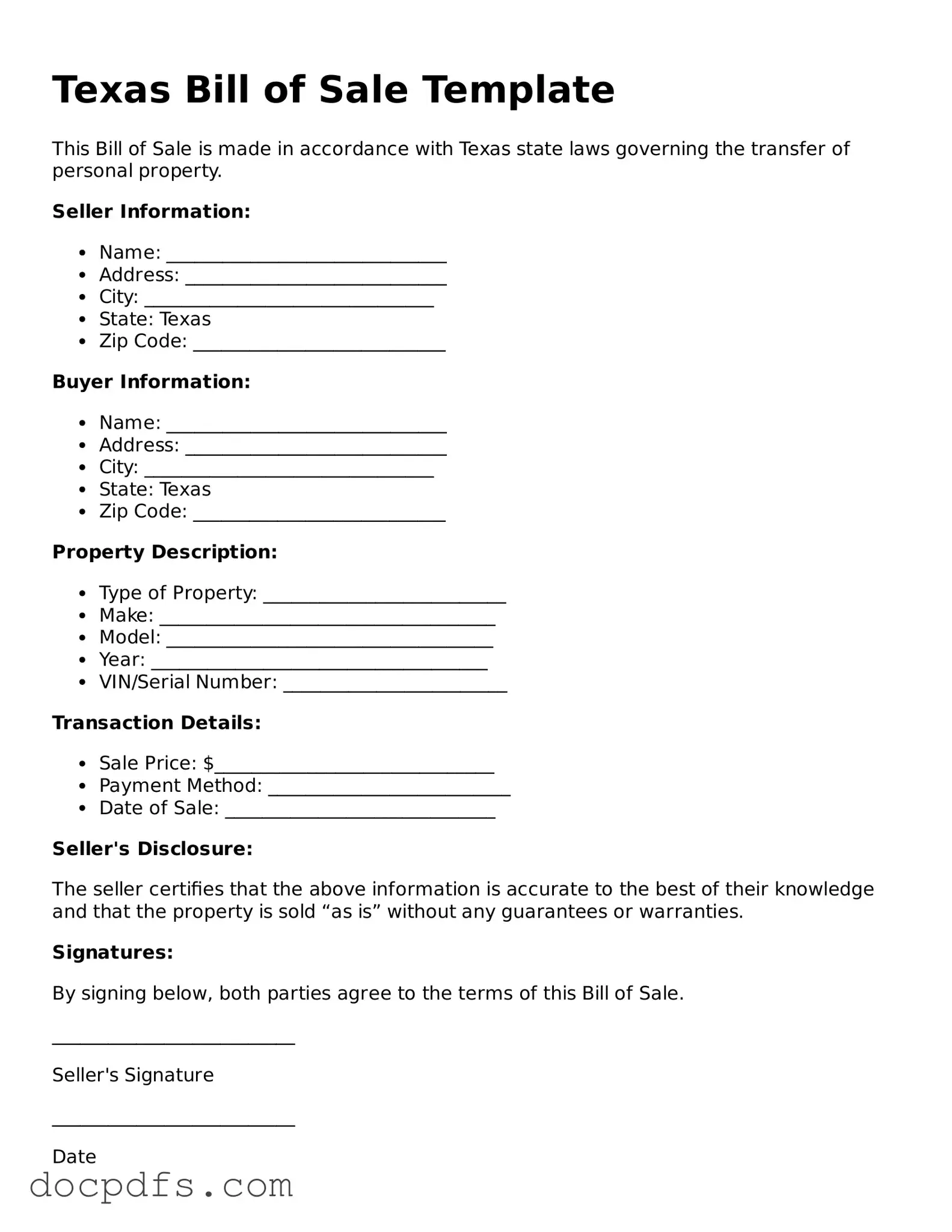

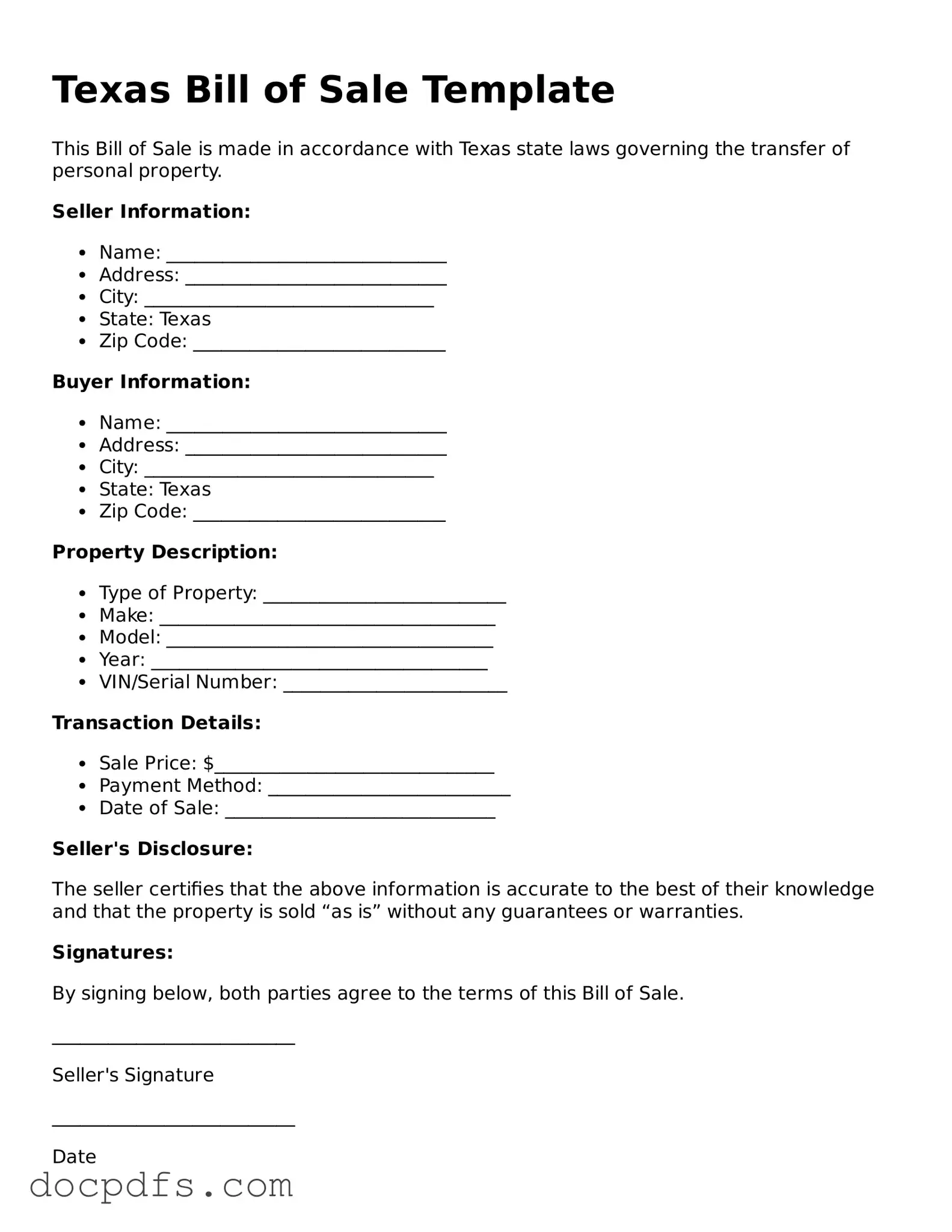

Free Texas Bill of Sale Form

A Texas Bill of Sale form is a legal document that serves as proof of the transfer of ownership of personal property from one party to another. This form is essential for ensuring that both the buyer and seller have a clear record of the transaction. By documenting the sale, it helps protect the rights of both parties involved.

Open Bill of Sale Editor Now

Free Texas Bill of Sale Form

Open Bill of Sale Editor Now

Open Bill of Sale Editor Now

or

⇓ Bill of Sale

Finish this form the fast way

Complete Bill of Sale online with a smooth editing experience.