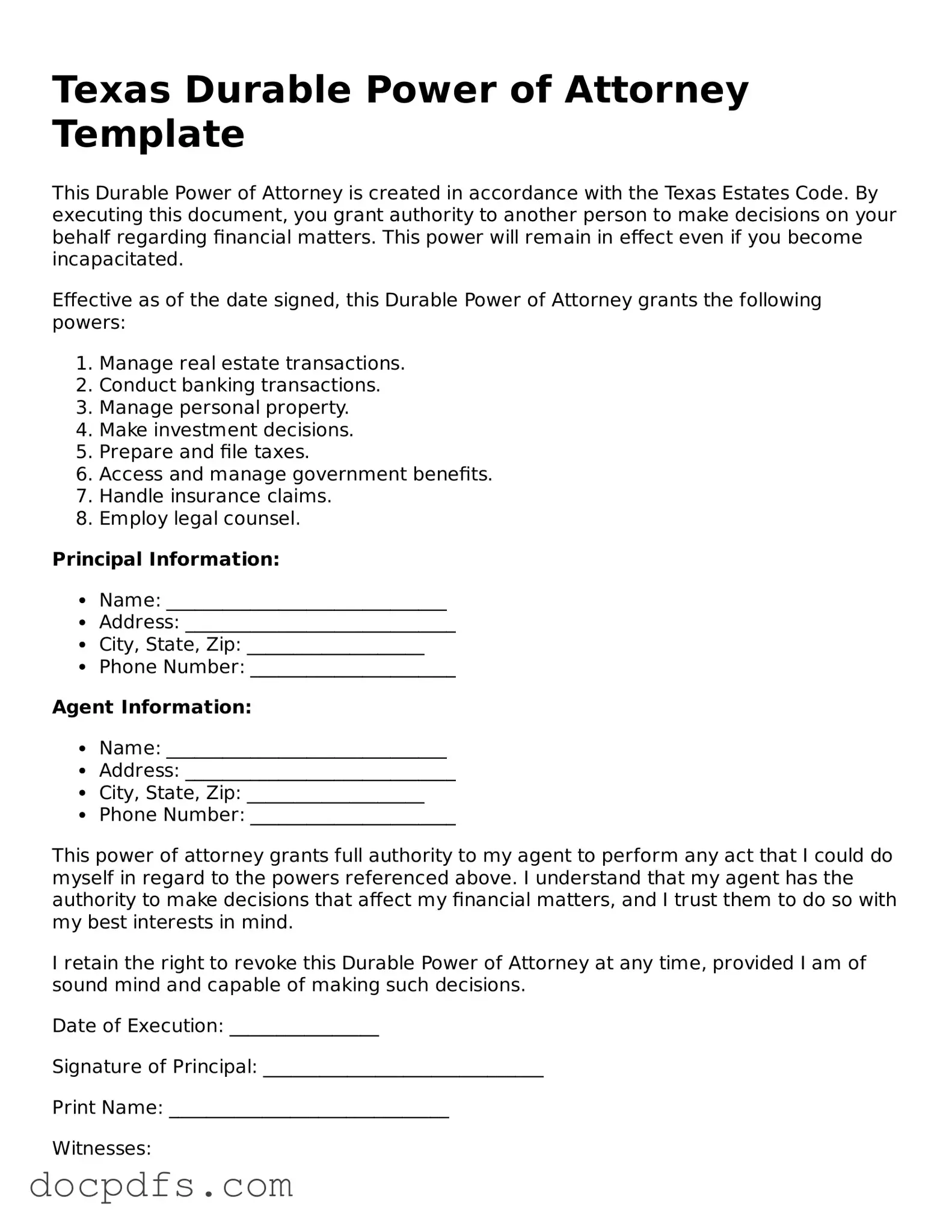

What is a Texas Durable Power of Attorney?

A Texas Durable Power of Attorney is a legal document that allows an individual (the principal) to designate another person (the agent) to make decisions on their behalf regarding financial matters. This document remains effective even if the principal becomes incapacitated.

Why is a Durable Power of Attorney important?

This document is important because it provides a clear plan for managing financial affairs in the event of incapacity. It ensures that someone the principal trusts can handle their financial responsibilities, such as paying bills, managing investments, and making legal decisions.

Who can be appointed as an agent?

Any competent adult can be appointed as an agent. This includes family members, friends, or professionals. It is crucial to choose someone trustworthy, as they will have significant control over the principal's financial matters.

What powers can be granted to the agent?

The principal can grant a wide range of powers to the agent, including:

-

Managing bank accounts

-

Buying or selling property

-

Handling investments

-

Paying bills

-

Filing taxes

Specific powers can be tailored to meet the principal's needs and preferences.

Does a Durable Power of Attorney need to be notarized?

Yes, in Texas, a Durable Power of Attorney must be signed by the principal in the presence of a notary public to be legally valid. Additionally, it is advisable to have witnesses present during the signing process, although this is not a requirement.

Can the principal revoke a Durable Power of Attorney?

Yes, the principal can revoke a Durable Power of Attorney at any time, as long as they are still mentally competent. To revoke, the principal should provide written notice to the agent and any relevant third parties. It is also advisable to destroy any copies of the original document.

What happens if the principal becomes incapacitated?

Once the principal becomes incapacitated, the Durable Power of Attorney remains in effect. The agent can then step in to manage the principal's financial affairs without the need for court intervention, ensuring that the principal's wishes are respected.

Is a Durable Power of Attorney the same as a Medical Power of Attorney?

No, a Durable Power of Attorney deals specifically with financial matters, while a Medical Power of Attorney grants someone the authority to make healthcare decisions on behalf of the principal. Both documents serve different purposes and may be necessary for comprehensive planning.

Individuals can obtain a Texas Durable Power of Attorney form from various sources, including legal websites, attorneys, or local government offices. It is important to ensure that the form complies with Texas state laws and meets the specific needs of the principal.