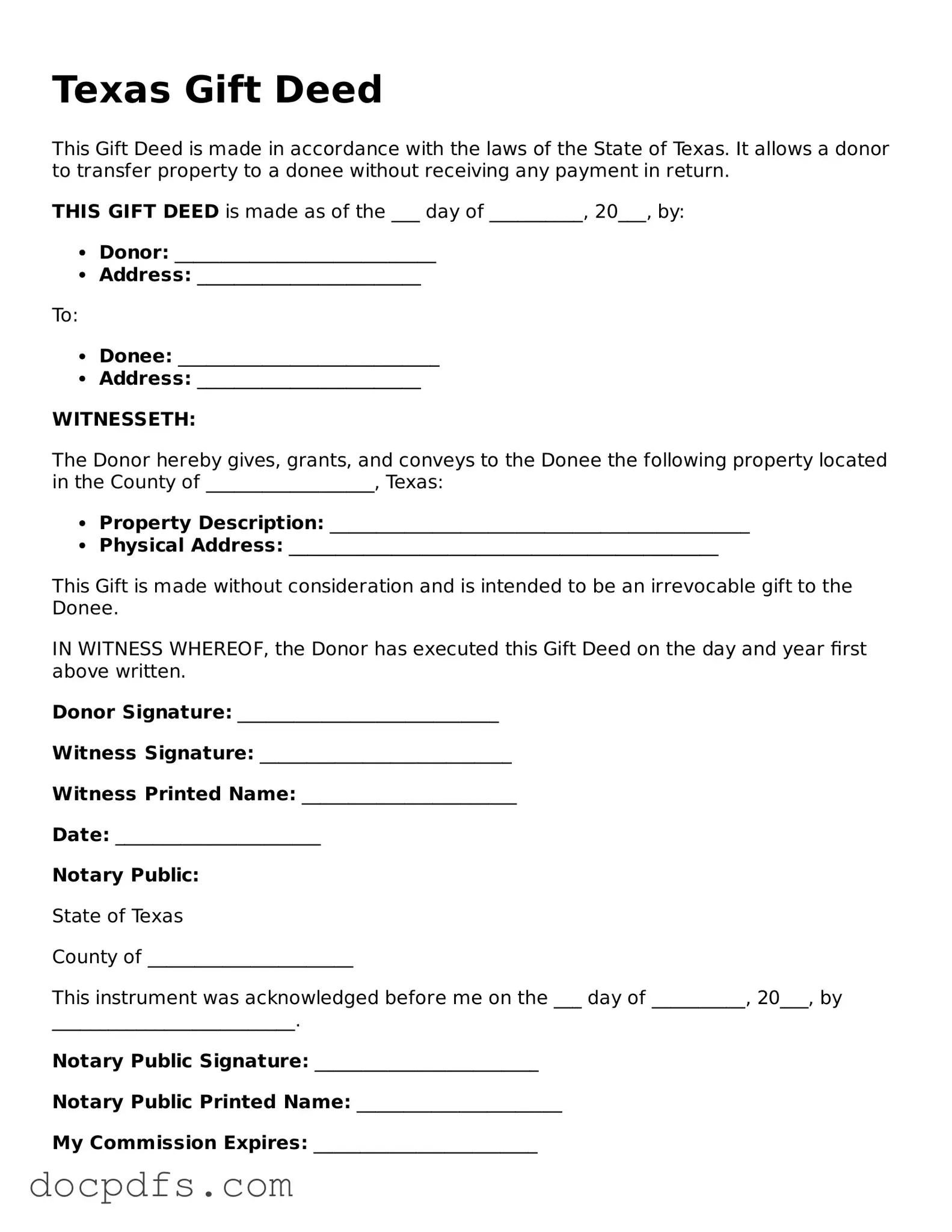

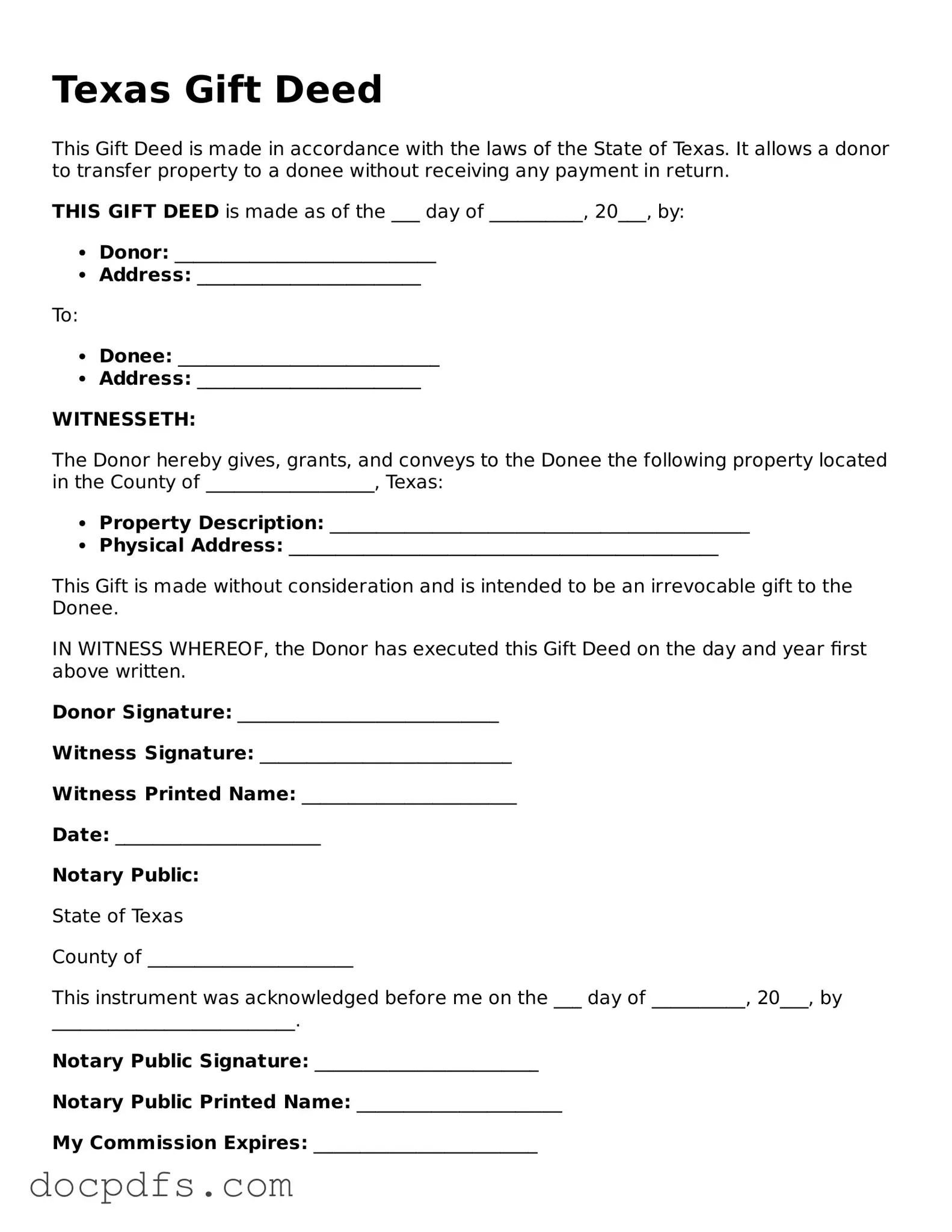

Free Texas Gift Deed Form

A Texas Gift Deed form is a legal document used to transfer ownership of property from one person to another without any exchange of money. This form is particularly useful for individuals who wish to give real estate as a gift to family members or friends. By completing this document, the donor can ensure that the transfer is recognized under Texas law, making the process straightforward and legally binding.

Open Gift Deed Editor Now

Free Texas Gift Deed Form

Open Gift Deed Editor Now

Open Gift Deed Editor Now

or

⇓ Gift Deed

Finish this form the fast way

Complete Gift Deed online with a smooth editing experience.