What is a Lady Bird Deed in Texas?

A Lady Bird Deed, also known as an enhanced life estate deed, allows a property owner to transfer real estate to a beneficiary while retaining the right to use and control the property during their lifetime. Upon the owner's death, the property automatically transfers to the designated beneficiary without going through probate. This type of deed is named after Lady Bird Johnson, who used it in her estate planning.

What are the benefits of using a Lady Bird Deed?

There are several advantages to using a Lady Bird Deed:

-

Avoids Probate:

The property transfers directly to the beneficiary upon the owner's death, bypassing the lengthy probate process.

-

Retains Control:

The property owner can continue to live in and manage the property during their lifetime.

-

Tax Benefits:

The property may receive a step-up in basis for tax purposes, potentially reducing capital gains taxes for the beneficiary.

-

Flexibility:

The owner can change the beneficiary or revoke the deed at any time before their death.

Who can be named as a beneficiary in a Lady Bird Deed?

Any individual or entity can be named as a beneficiary in a Lady Bird Deed. Common choices include family members, friends, or even charitable organizations. It is essential to choose a trusted person or entity, as they will receive the property upon the owner's death.

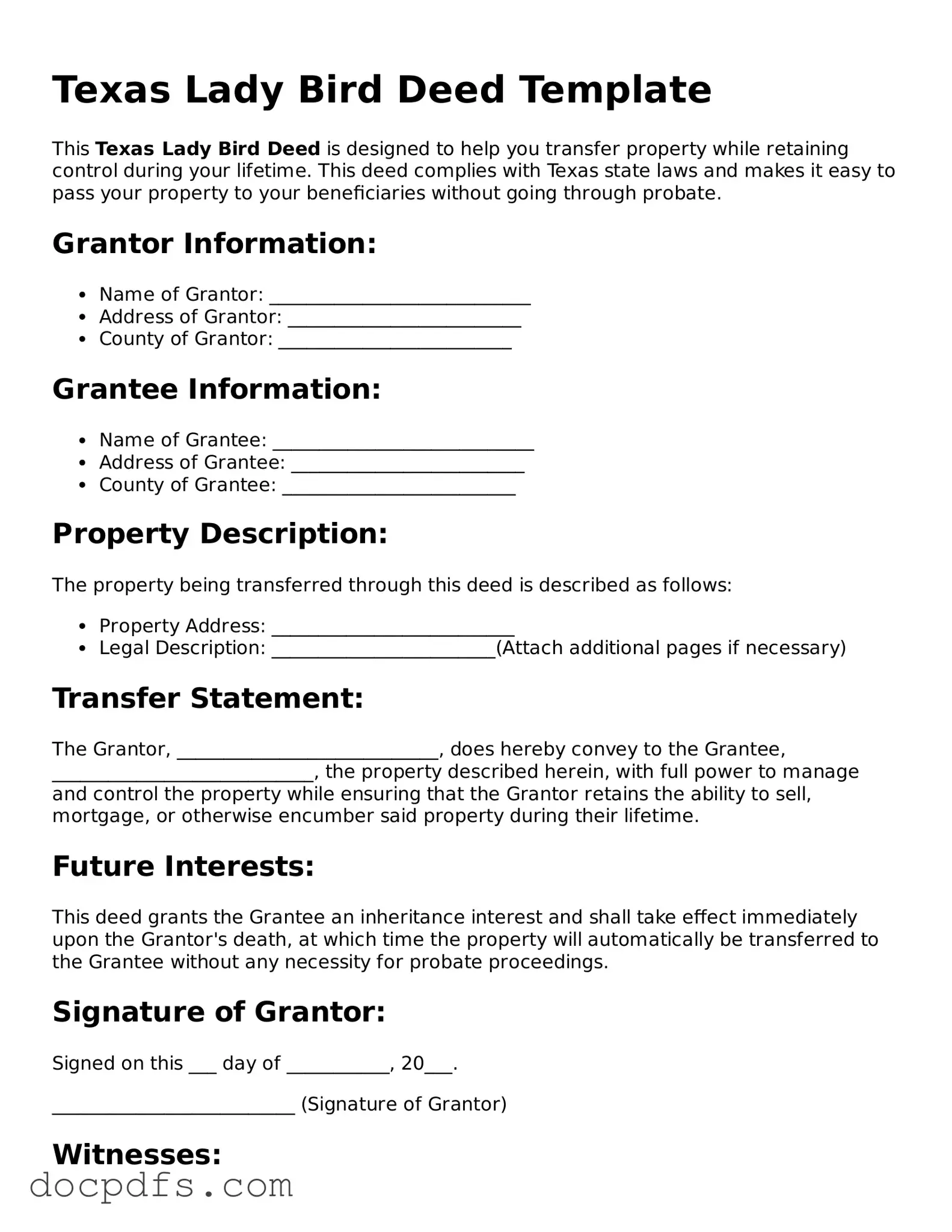

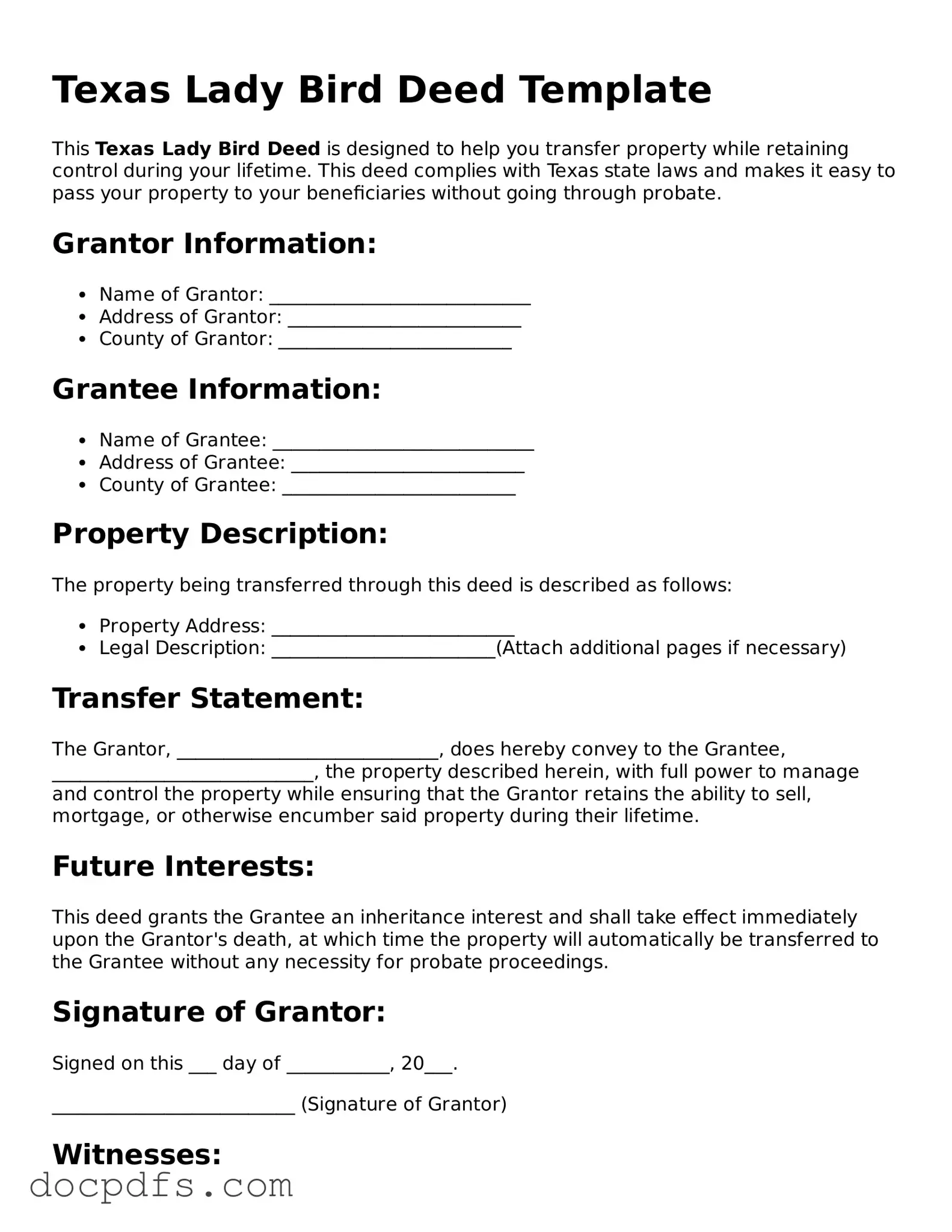

How do I create a Lady Bird Deed?

To create a Lady Bird Deed in Texas, follow these steps:

-

Obtain a template or form for the Lady Bird Deed.

-

Fill out the form with the necessary information, including the property description and the beneficiary's details.

-

Sign the deed in front of a notary public.

-

Record the signed deed with the county clerk's office where the property is located.

It is advisable to consult with a legal professional to ensure that the deed is completed correctly and meets all legal requirements.

Can a Lady Bird Deed be revoked?

Yes, a Lady Bird Deed can be revoked at any time before the property owner's death. The owner can execute a new deed that revokes the previous one or simply create a new Lady Bird Deed with different terms. It is important to properly record the revocation to ensure that it is legally recognized.

Is a Lady Bird Deed the right choice for everyone?

A Lady Bird Deed can be an effective estate planning tool for many individuals, but it may not be suitable for everyone. Factors to consider include the complexity of the estate, family dynamics, and specific financial situations. Consulting with an estate planning attorney can help determine if a Lady Bird Deed aligns with your overall estate planning goals.