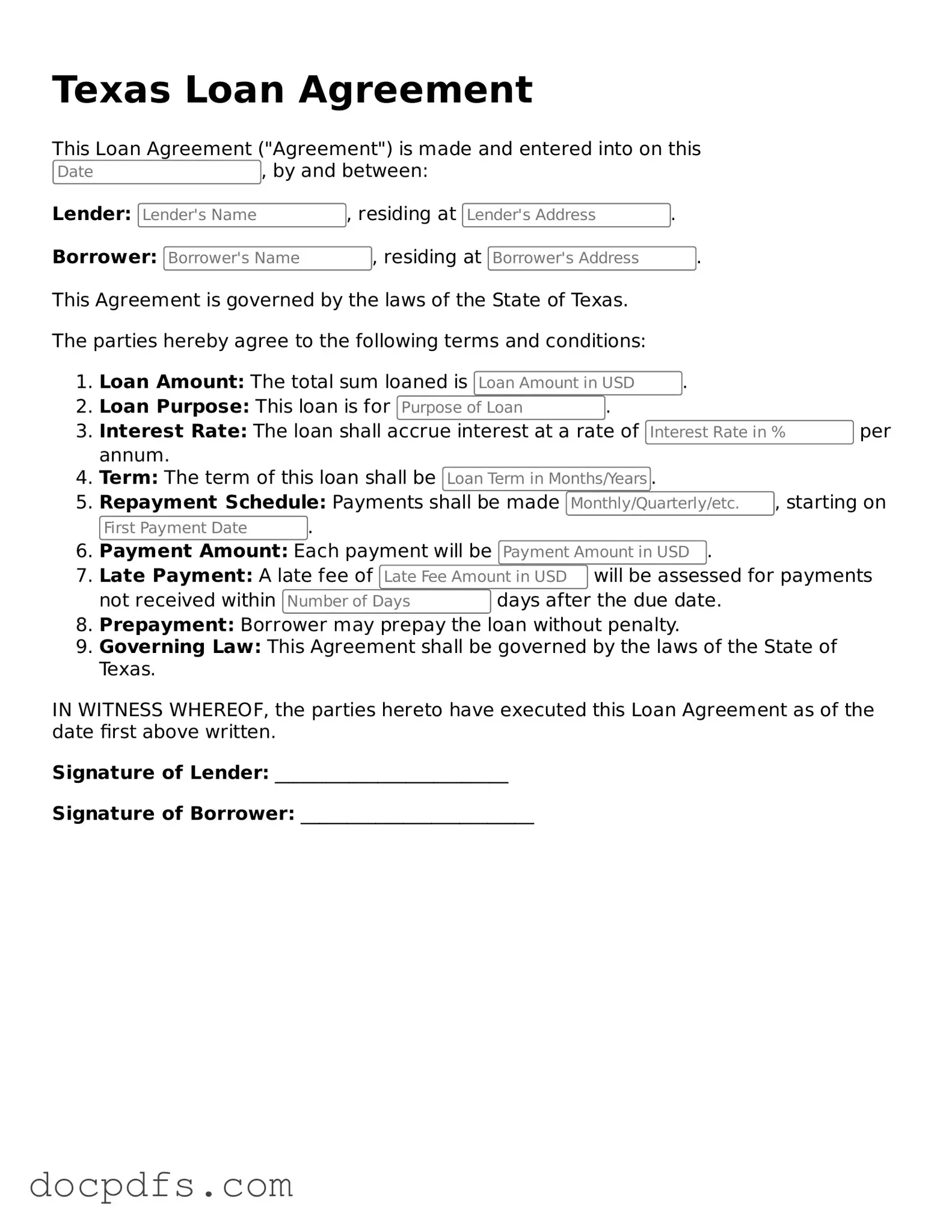

A Texas Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in the state of Texas. This form specifies the amount of money being borrowed, the interest rate, repayment schedule, and any collateral involved. It serves to protect both parties by clearly defining their rights and responsibilities.

This form is suitable for individuals or businesses that are entering into a loan arrangement. Whether you are lending money to a friend, family member, or a business entity, having a written agreement can help prevent misunderstandings and disputes. It is especially important in larger transactions or when the terms are complex.

What key elements are included in a Texas Loan Agreement?

A comprehensive Texas Loan Agreement typically includes:

-

The names and contact information of both the lender and borrower.

-

The loan amount and interest rate.

-

The repayment schedule, including due dates and payment methods.

-

Any collateral securing the loan.

-

Default and late payment provisions.

-

Governing law clause, specifying Texas law.

Is it necessary to have a lawyer review the Texas Loan Agreement?

While it is not legally required to have a lawyer review your Texas Loan Agreement, doing so can provide valuable peace of mind. A legal professional can ensure that the agreement complies with Texas laws and adequately protects your interests. This is particularly advisable for larger loans or complex terms.

Can a Texas Loan Agreement be modified after it is signed?

Yes, a Texas Loan Agreement can be modified after it is signed, but both parties must agree to the changes. It is best practice to document any modifications in writing and have both parties sign the updated agreement. This helps maintain clarity and prevents future disputes.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has several options. These may include charging late fees, demanding immediate repayment of the entire loan, or taking possession of any collateral specified in the agreement. The specific remedies available will depend on the terms outlined in the Loan Agreement and Texas law.

Are there any specific laws governing Texas Loan Agreements?

Yes, Texas has specific laws that govern loan agreements, including regulations on interest rates, disclosure requirements, and consumer protections. Familiarizing yourself with these laws can help ensure that your agreement is valid and enforceable. It is wise to consult legal resources or a professional for guidance.

Texas Loan Agreement forms can be obtained from various sources. Many legal websites offer templates that you can customize to fit your needs. Additionally, local law libraries or legal aid organizations may provide free resources. Always ensure that the form you use is up-to-date and compliant with Texas laws.