What is a Texas Motor Vehicle Bill of Sale?

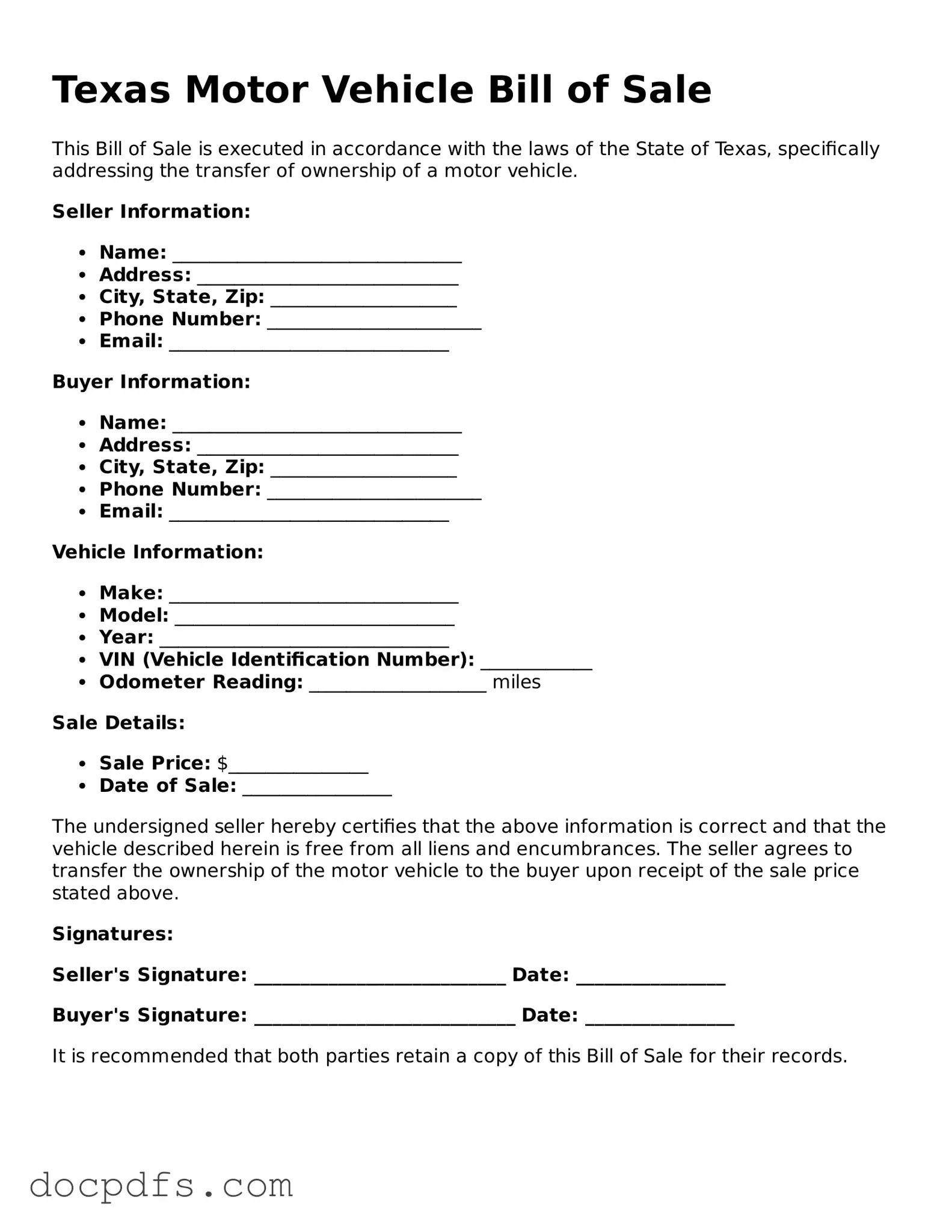

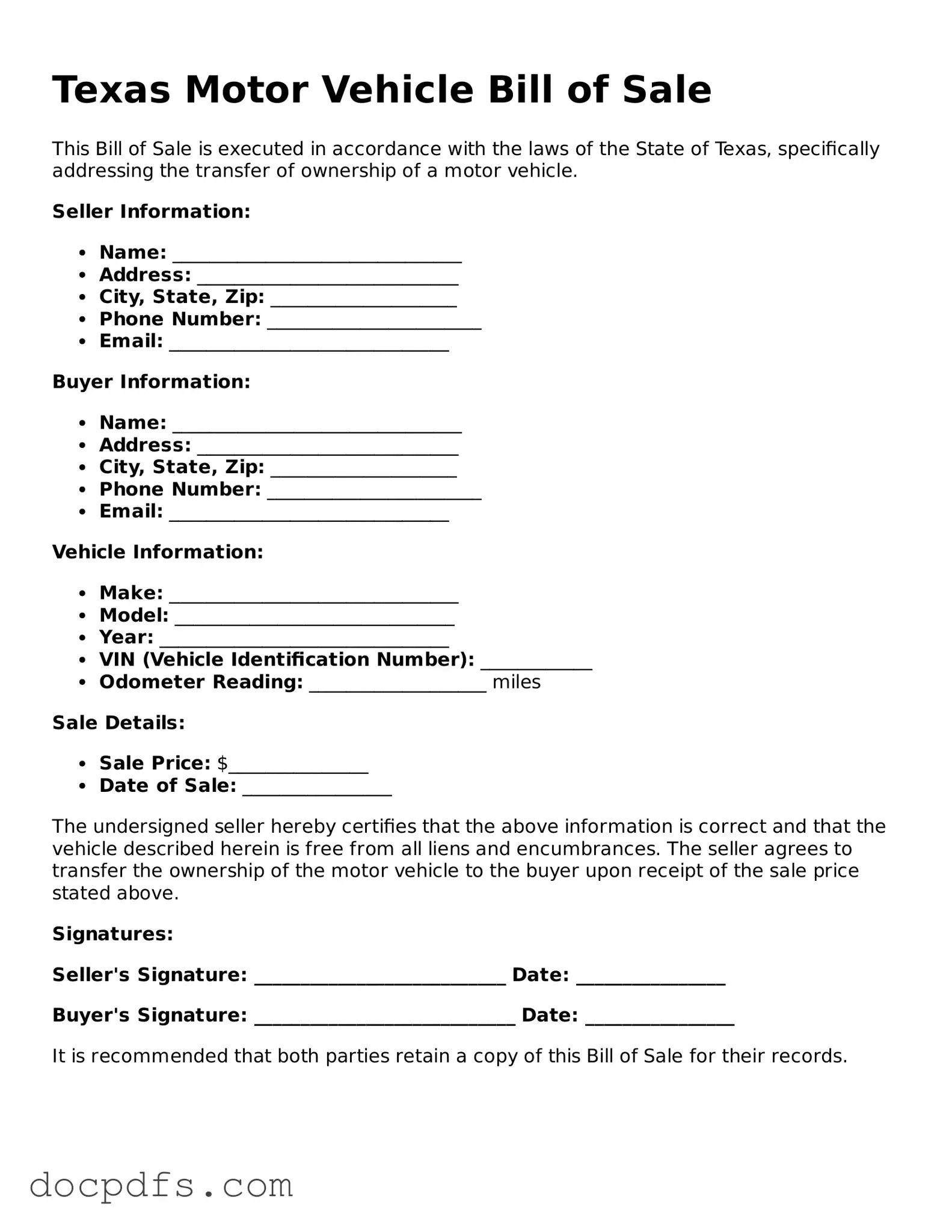

A Texas Motor Vehicle Bill of Sale is a legal document that records the sale of a vehicle in Texas. It serves as proof of the transaction between the seller and the buyer. This document is essential for transferring ownership and can be required for registration and titling purposes.

Why do I need a Bill of Sale?

A Bill of Sale is important for several reasons:

-

It provides a record of the transaction for both parties.

-

It helps protect the seller from future claims related to the vehicle.

-

It may be required by the Texas Department of Motor Vehicles (DMV) for registration.

-

It establishes the sale price for tax purposes.

The Bill of Sale should include the following details:

-

Names and addresses of both the seller and the buyer.

-

Vehicle identification number (VIN).

-

Make, model, and year of the vehicle.

-

Odometer reading at the time of sale.

-

Sale price of the vehicle.

-

Date of the transaction.

-

Signatures of both parties.

Is a Bill of Sale required in Texas?

While a Bill of Sale is not legally required in Texas, it is highly recommended. Without it, disputes may arise regarding the sale, and the buyer may face challenges when registering the vehicle. Having a Bill of Sale provides clarity and protection for both parties.

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale. However, it is important to ensure that it includes all necessary information and complies with Texas regulations. Many templates are available online, or you can consult with a legal professional to draft a document tailored to your needs.

Do I need to notarize the Bill of Sale?

Notarization is not required for a Bill of Sale in Texas. However, having it notarized can add an extra layer of authenticity and may be beneficial if any disputes arise in the future.

How do I obtain a copy of the Bill of Sale after the transaction?

After the transaction, both the buyer and seller should keep a copy of the Bill of Sale for their records. If you lose your copy, you can create a new one, but both parties must agree to the details outlined in the new document.

What should I do if the vehicle has a lien?

If the vehicle has a lien, it is essential to address it before completing the sale. The seller should pay off the lien and obtain a lien release from the lender. This release should be included with the Bill of Sale to ensure the buyer receives clear title to the vehicle.

Can I use a Bill of Sale for a vehicle purchased from a dealer?

When purchasing from a dealer, you typically do not need a separate Bill of Sale. The dealer will provide documentation that includes the necessary information for the transaction. However, it's wise to keep all paperwork related to the purchase for your records.

What if I need to sell a vehicle without a title?

Selling a vehicle without a title can be complicated. In Texas, the seller must apply for a duplicate title before selling the vehicle. A Bill of Sale can still be used, but it is crucial to resolve the title issue to ensure a smooth transfer of ownership.