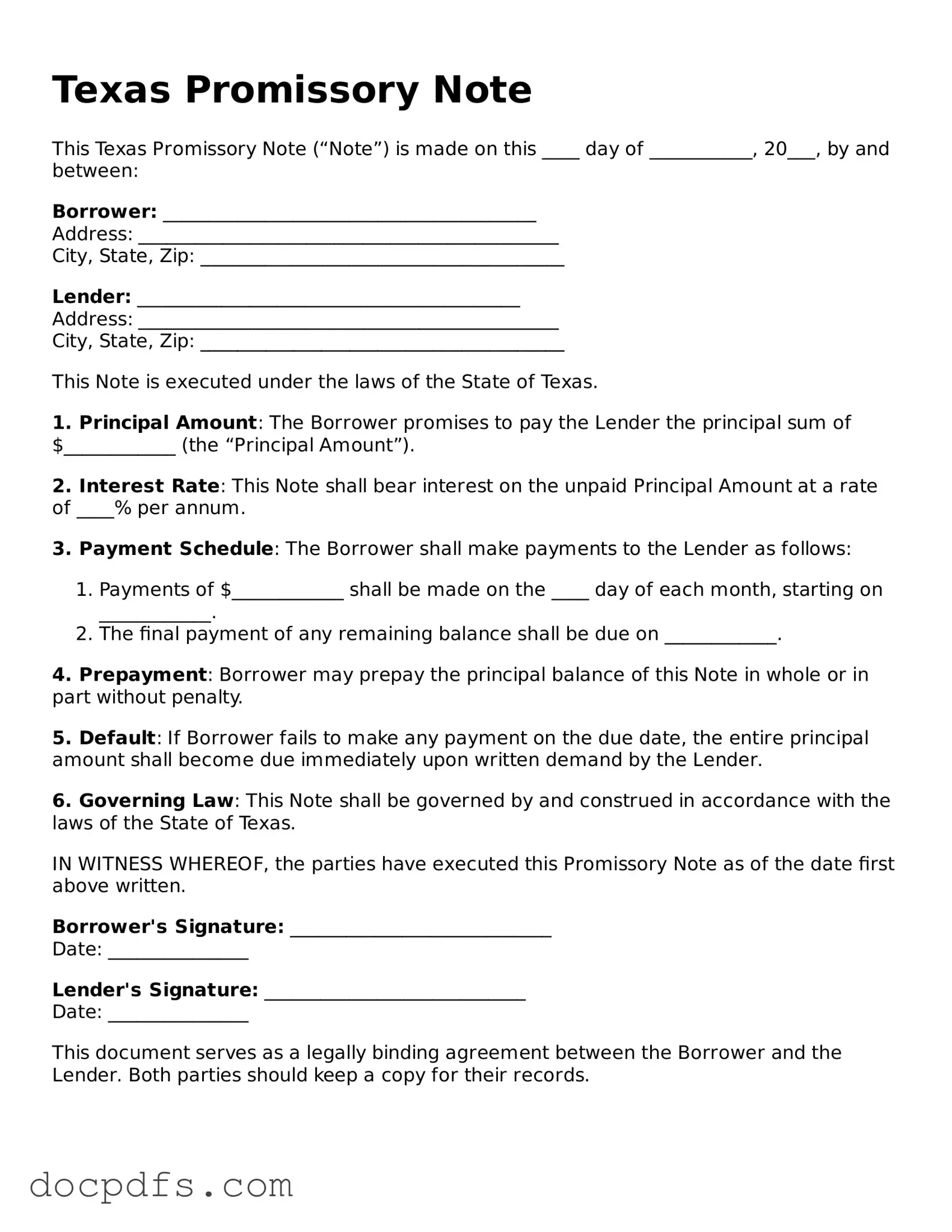

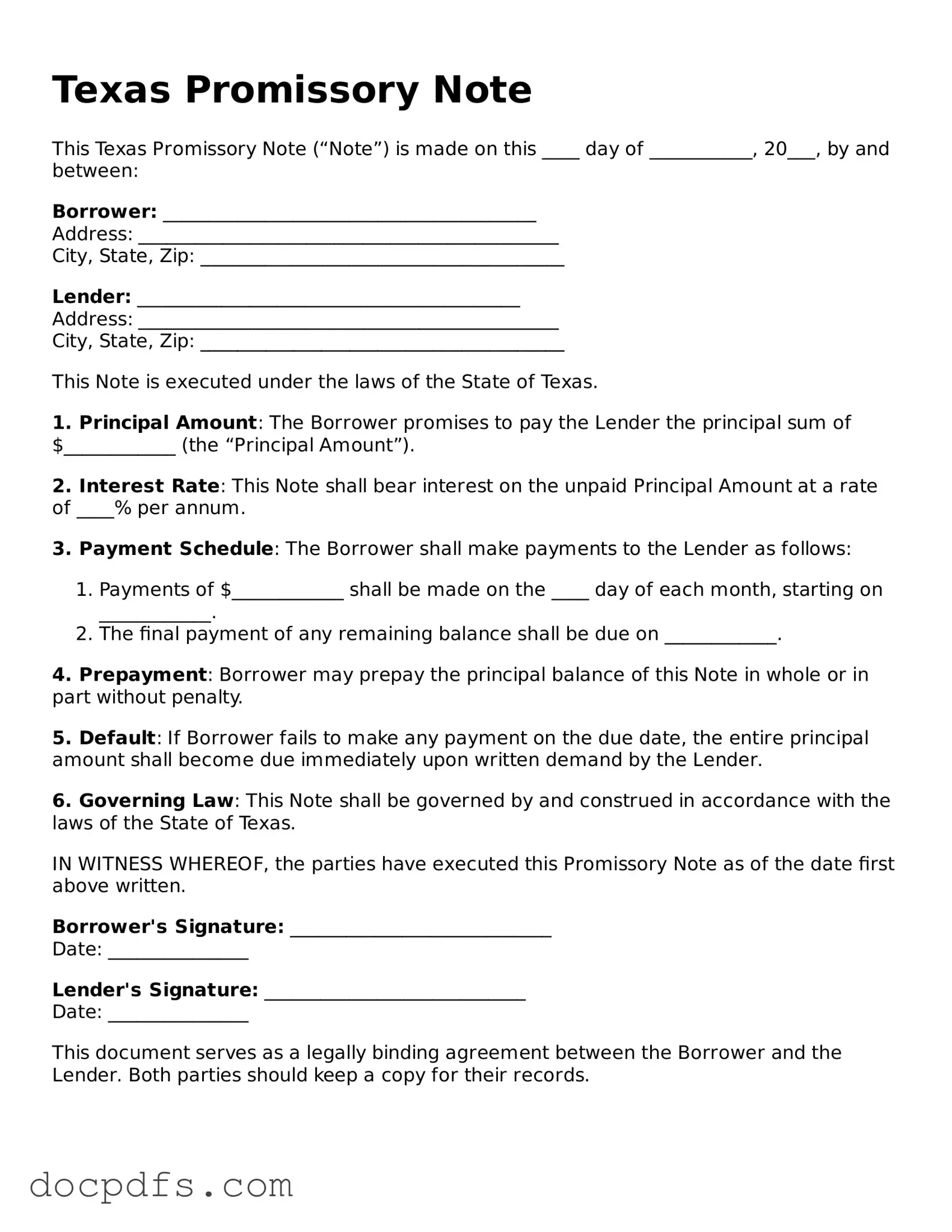

Free Texas Promissory Note Form

A Texas Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This form serves as a critical tool for personal and business transactions, ensuring that both parties understand their rights and obligations. By clearly detailing the repayment schedule, interest rates, and other conditions, it helps prevent misunderstandings and disputes in the future.

Open Promissory Note Editor Now

Free Texas Promissory Note Form

Open Promissory Note Editor Now

Open Promissory Note Editor Now

or

⇓ Promissory Note

Finish this form the fast way

Complete Promissory Note online with a smooth editing experience.