What is a Texas Real Estate Purchase Agreement?

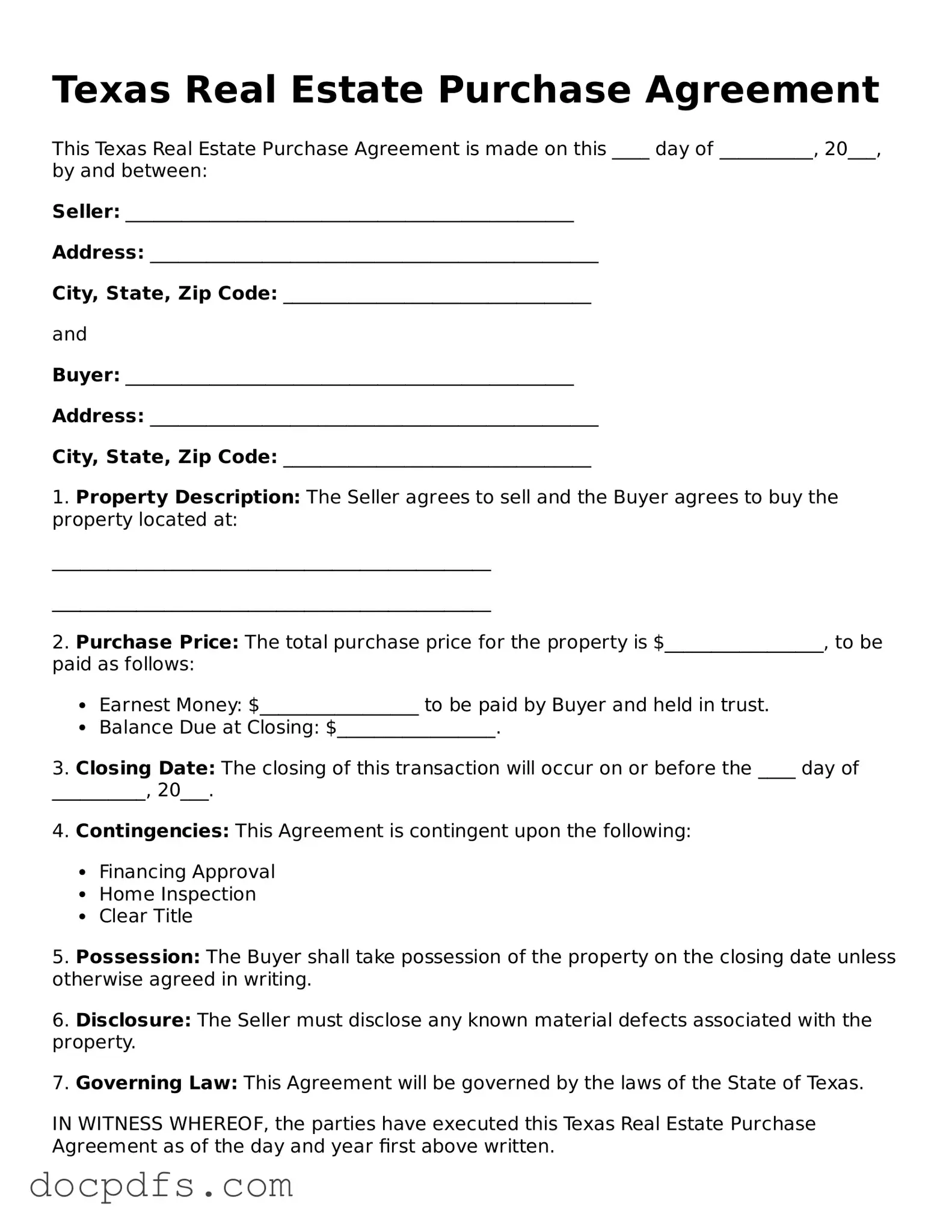

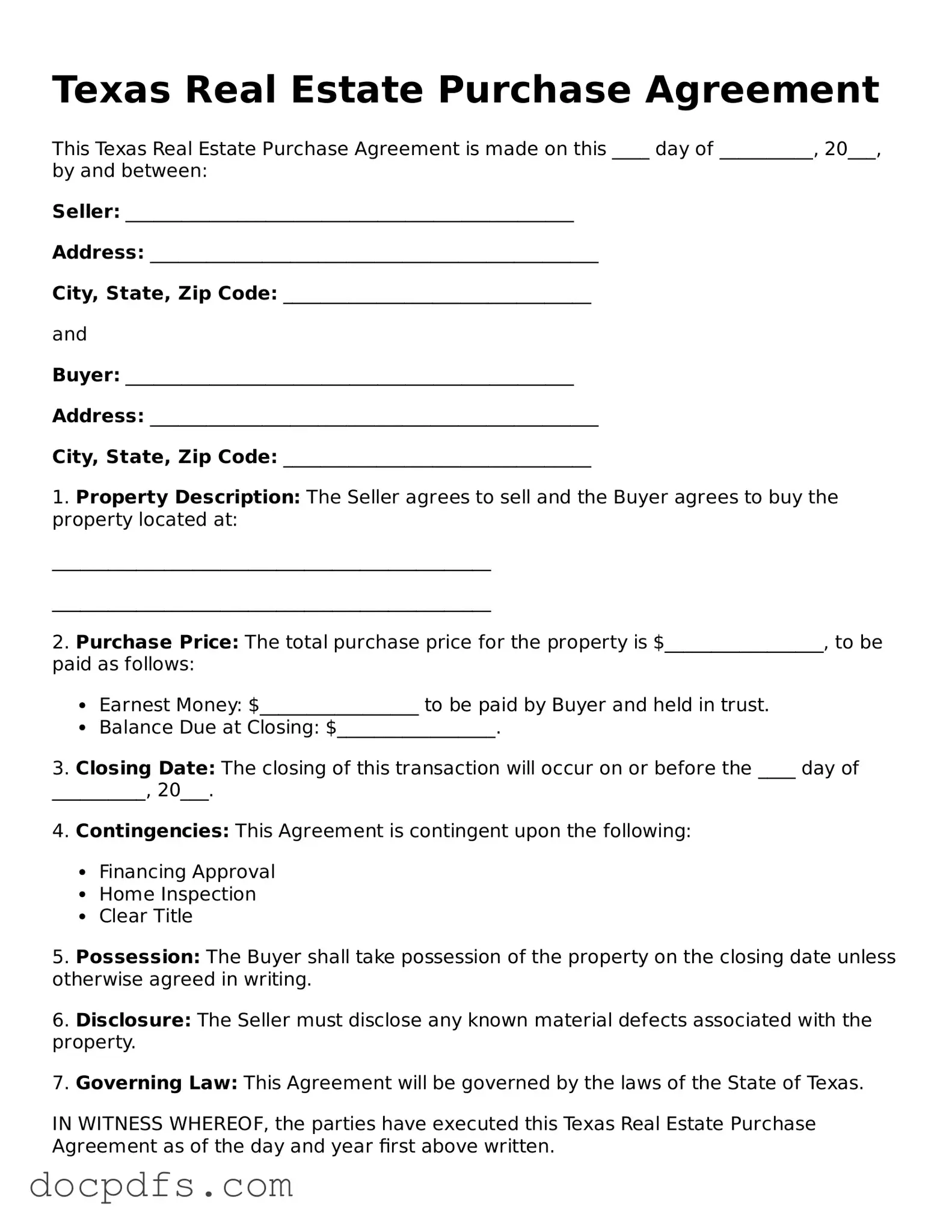

The Texas Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase real estate from a seller. This agreement includes essential details such as the purchase price, financing arrangements, and contingencies that must be satisfied before the sale can be completed.

Who typically uses the Texas Real Estate Purchase Agreement?

This agreement is commonly used by individuals and entities involved in the sale or purchase of residential or commercial properties in Texas. Buyers, sellers, real estate agents, and attorneys may all utilize this document to facilitate a real estate transaction.

What key components are included in the agreement?

The Texas Real Estate Purchase Agreement generally includes the following components:

-

Parties Involved:

Identification of the buyer and seller.

-

Property Description:

A detailed description of the property being sold.

-

Purchase Price:

The agreed-upon price for the property.

-

Earnest Money:

The amount of money the buyer will deposit to demonstrate commitment.

-

Contingencies:

Conditions that must be met for the sale to proceed, such as financing or inspections.

-

Closing Date:

The date on which the sale will be finalized.

Can the Texas Real Estate Purchase Agreement be modified?

Yes, the Texas Real Estate Purchase Agreement can be modified if both the buyer and seller agree to the changes. Any amendments should be documented in writing and signed by both parties to ensure clarity and enforceability.

What happens if a party breaches the agreement?

If either party fails to fulfill their obligations under the Texas Real Estate Purchase Agreement, it may be considered a breach of contract. The non-breaching party may have several options, including seeking damages or specific performance, which requires the breaching party to fulfill their contractual obligations.

Is it necessary to have a real estate agent when using this agreement?

While it is not mandatory to have a real estate agent when using the Texas Real Estate Purchase Agreement, having professional assistance can be beneficial. Agents can provide valuable insights, help negotiate terms, and ensure that the agreement complies with Texas laws.

What is earnest money, and why is it important?

Earnest money is a deposit made by the buyer to demonstrate their seriousness about purchasing the property. This amount is typically held in an escrow account and is applied to the purchase price at closing. Earnest money is important because it protects the seller by showing that the buyer is committed to the transaction.

How does the closing process work after the agreement is signed?

Once the Texas Real Estate Purchase Agreement is signed, the closing process begins. This process typically involves the following steps:

-

Conducting necessary inspections and obtaining financing.

-

Finalizing title searches and ensuring there are no liens on the property.

-

Preparing closing documents, including the deed and settlement statement.

-

Conducting the closing meeting where all parties sign documents and funds are exchanged.

Texas Real Estate Purchase Agreement forms can be obtained from various sources, including real estate agents, legal document preparation services, and online legal resources. It is important to ensure that the form is current and complies with Texas law.