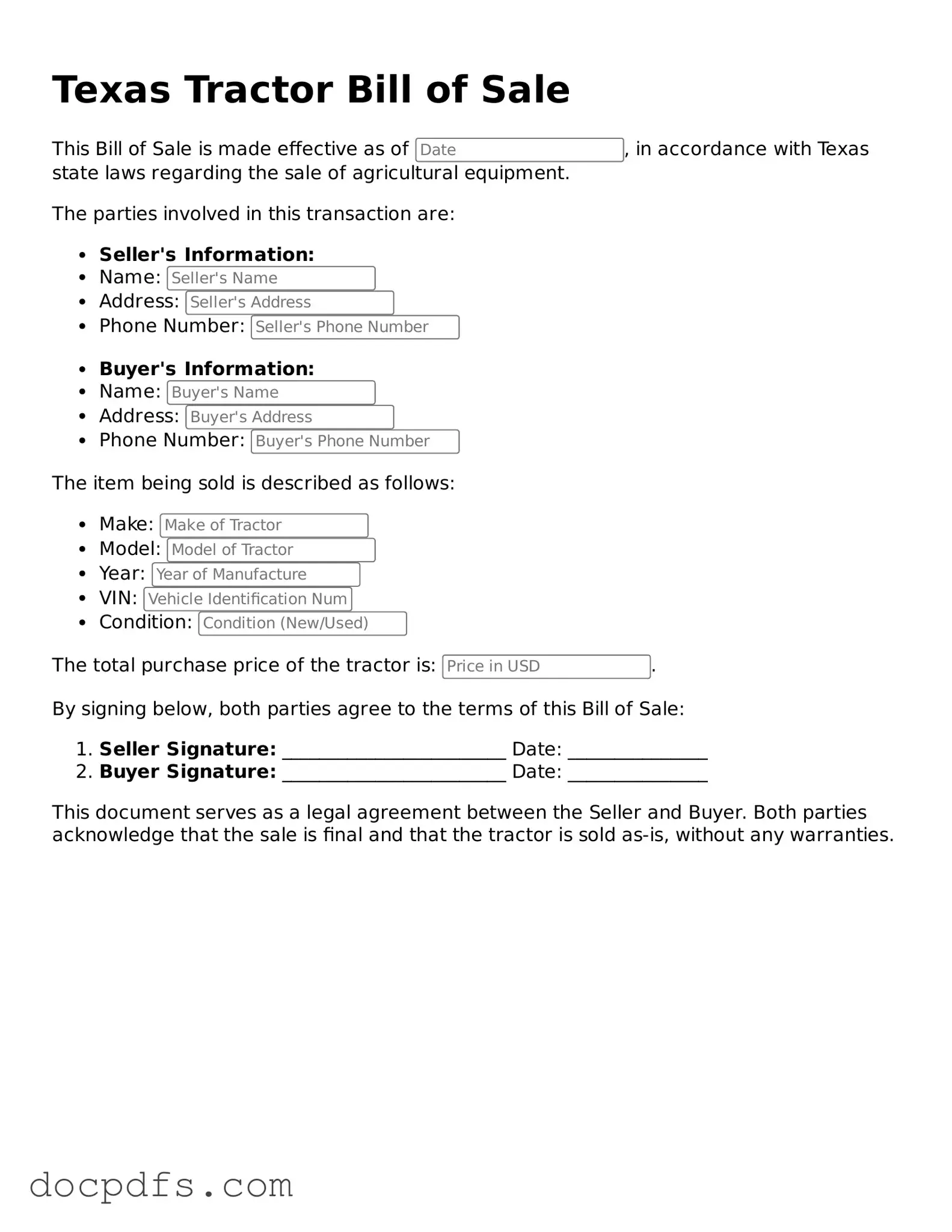

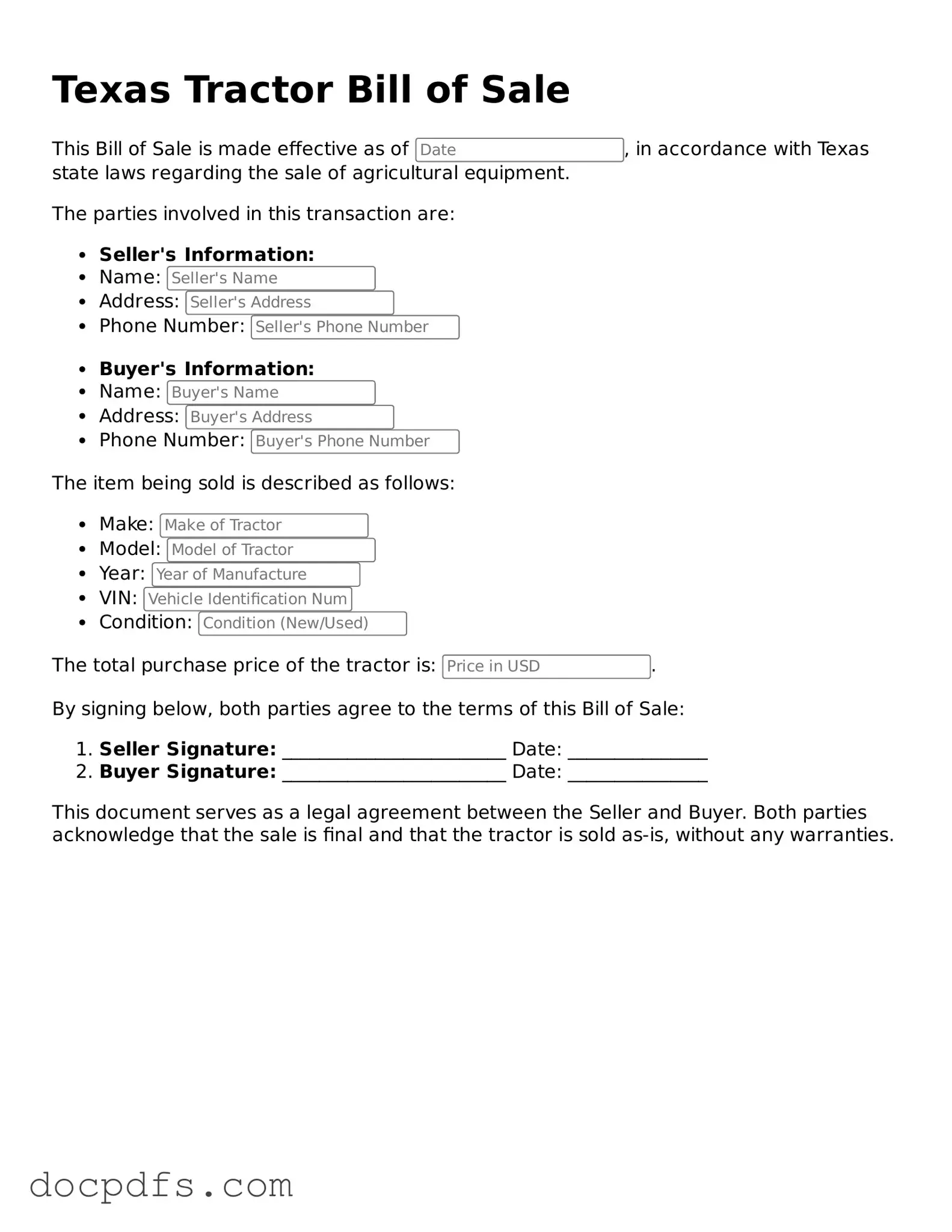

Free Texas Tractor Bill of Sale Form

The Texas Tractor Bill of Sale form is a legal document used to record the sale of a tractor in the state of Texas. This form serves as proof of ownership transfer between the seller and the buyer, ensuring that both parties have a clear understanding of the transaction details. Completing this form accurately is essential for a smooth transfer of ownership and to avoid potential disputes in the future.

Open Tractor Bill of Sale Editor Now

Free Texas Tractor Bill of Sale Form

Open Tractor Bill of Sale Editor Now

Open Tractor Bill of Sale Editor Now

or

⇓ Tractor Bill of Sale

Finish this form the fast way

Complete Tractor Bill of Sale online with a smooth editing experience.