What is a Transfer-on-Death Deed in Texas?

A Transfer-on-Death Deed (TODD) in Texas allows property owners to transfer real estate to beneficiaries without going through probate. This deed becomes effective upon the death of the property owner. It is a straightforward way to ensure that your property passes directly to your chosen beneficiaries, simplifying the transfer process and potentially saving time and money.

Who can create a Transfer-on-Death Deed?

Any individual who owns real estate in Texas can create a Transfer-on-Death Deed. This includes single owners, co-owners, or individuals who hold property in a trust. However, the property must be solely owned by the individual creating the deed, as joint ownership can complicate the transfer process.

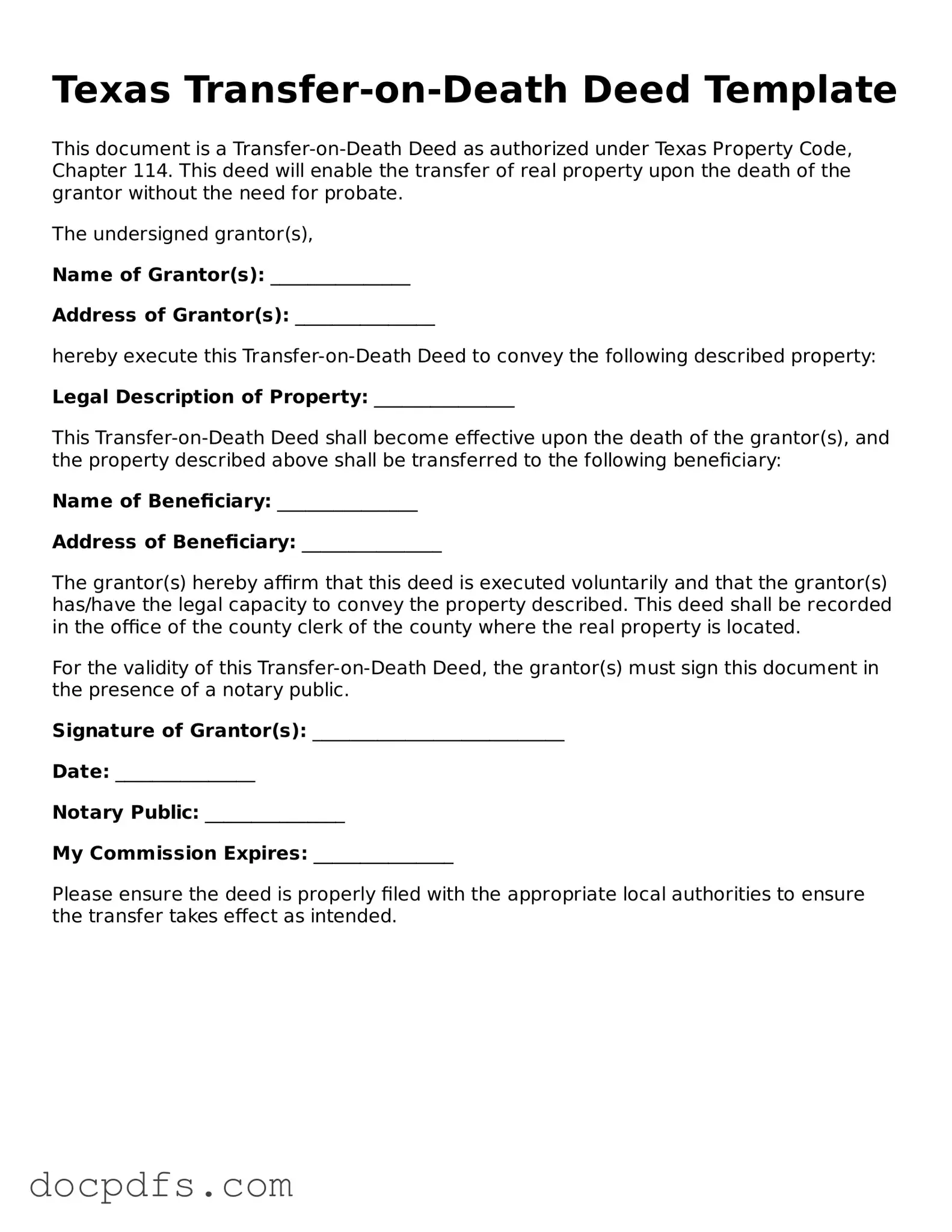

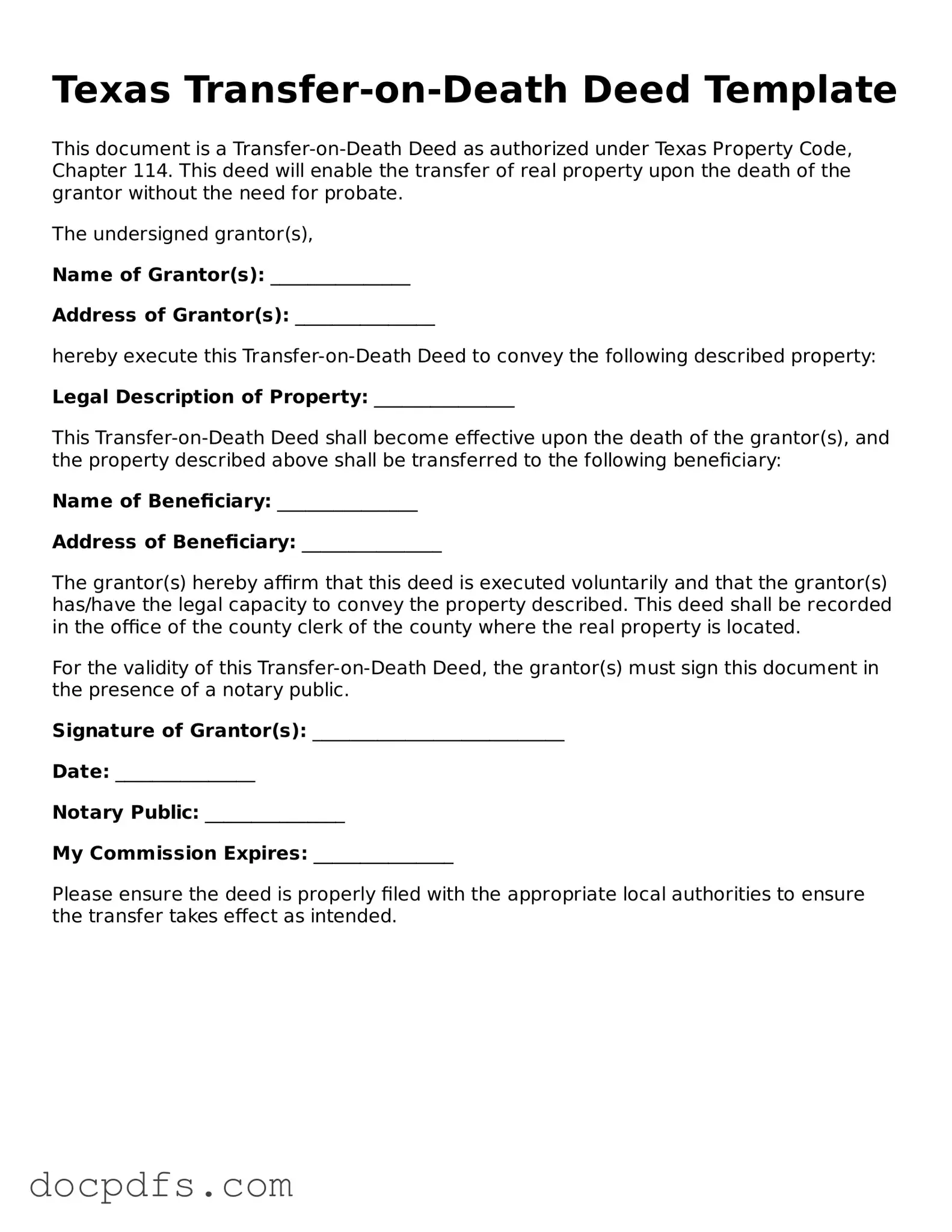

How do I fill out a Transfer-on-Death Deed?

To fill out a Transfer-on-Death Deed, follow these steps:

-

Identify the property: Clearly describe the real estate you wish to transfer.

-

List the beneficiaries: Include the full names and addresses of the individuals or entities receiving the property.

-

Sign the deed: The property owner must sign the deed in front of a notary public.

-

Record the deed: File the completed deed with the county clerk's office where the property is located.

Ensure that all information is accurate to avoid any issues in the future.

Are there any restrictions on who can be a beneficiary?

Generally, beneficiaries can be individuals or entities such as trusts or organizations. However, there are some restrictions. For instance, you cannot name a minor as a beneficiary directly. Instead, consider establishing a trust for the minor's benefit. Additionally, if you name multiple beneficiaries, be aware that the property will be divided among them unless specified otherwise in the deed.

Can I revoke or change a Transfer-on-Death Deed?

Yes, you can revoke or change a Transfer-on-Death Deed at any time before your death. To do this, you must create a new deed that explicitly revokes the previous one or file a formal revocation with the county clerk. It’s important to ensure that the new deed is properly executed and recorded to avoid any confusion regarding your intentions.

What happens if I don’t have a Transfer-on-Death Deed?

If you do not have a Transfer-on-Death Deed, your property will typically go through the probate process upon your death. This can be time-consuming and costly for your heirs. Without a TODD, the distribution of your property will follow state laws regarding intestate succession, which may not align with your wishes. Therefore, creating a Transfer-on-Death Deed can provide peace of mind and clarity for your loved ones.