What is a Transfer-on-Death Deed?

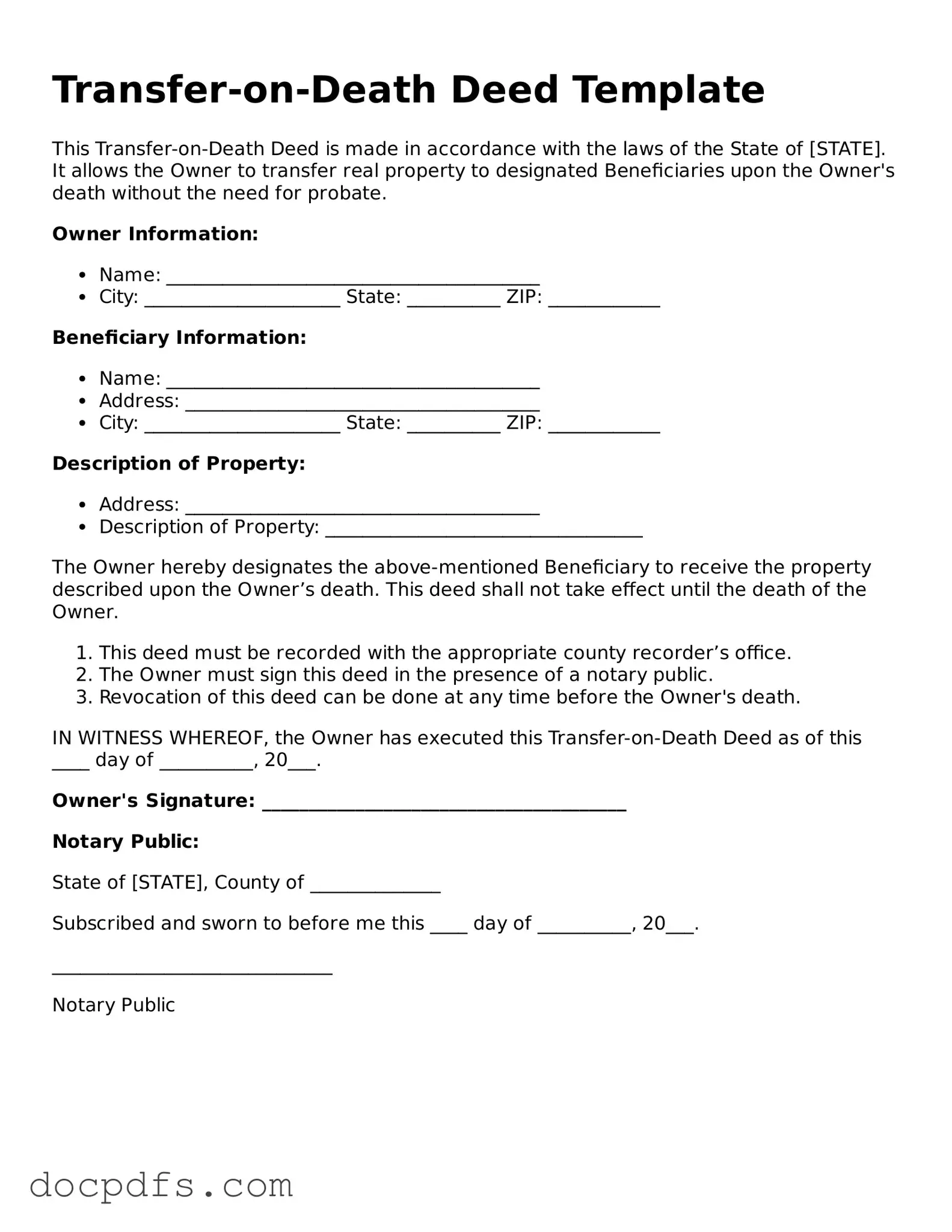

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows an individual to transfer real estate to a designated beneficiary upon their death. This type of deed bypasses the probate process, making it a straightforward way to ensure that property is passed on to loved ones without the delays and costs associated with probate.

How does a Transfer-on-Death Deed work?

When the owner of the property dies, the designated beneficiary automatically receives ownership of the property. The deed must be properly executed and recorded with the county recorder's office while the owner is still alive. Once recorded, the TOD Deed takes effect upon the owner’s death.

What are the benefits of using a Transfer-on-Death Deed?

There are several benefits to using a Transfer-on-Death Deed, including:

-

Bypassing probate: The property transfers directly to the beneficiary without going through probate.

-

Retaining control: The property owner retains full control over the property during their lifetime.

-

Flexibility: The owner can revoke or change the deed at any time before their death.

-

Cost-effective: It can save money on legal fees and reduce the time involved in transferring property.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time while you are alive. To do this, you must create a new deed that clearly states your intentions or file a revocation form with the county recorder’s office. It’s important to follow the proper procedures to ensure the changes are legally recognized.

Who can be named as a beneficiary in a Transfer-on-Death Deed?

Generally, you can name anyone as a beneficiary in a Transfer-on-Death Deed. This can include family members, friends, or even organizations. However, it’s advisable to ensure that the beneficiary is someone who will accept the property and is capable of managing it.

Are there any limitations on using a Transfer-on-Death Deed?

Yes, there are some limitations. A Transfer-on-Death Deed can only be used for real estate, not personal property or financial accounts. Additionally, some states may have specific rules regarding the use of TOD Deeds, so it’s essential to check local laws.

What happens if the beneficiary dies before the property owner?

If the beneficiary named in the Transfer-on-Death Deed dies before the property owner, the property will not automatically transfer to that beneficiary’s heirs. Instead, the property will become part of the owner's estate. The owner can choose to name a new beneficiary or make other arrangements for the property.

Do I need a lawyer to create a Transfer-on-Death Deed?

While it’s not legally required to have a lawyer to create a Transfer-on-Death Deed, consulting with one can be beneficial. A lawyer can help ensure that the deed is correctly drafted and meets all legal requirements, reducing the chance of complications in the future.