What are the Articles of Incorporation in Utah?

The Articles of Incorporation is a legal document that establishes a corporation in Utah. This form outlines essential information about the corporation, including its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this document with the Utah Division of Corporations is a crucial step in forming a corporation and provides the entity with legal recognition.

Who needs to file Articles of Incorporation?

Any individual or group looking to create a corporation in Utah must file Articles of Incorporation. This applies to various types of corporations, including for-profit businesses, non-profit organizations, and professional corporations. If you intend to operate as a corporation, filing this document is mandatory to gain the benefits and protections that come with corporate status.

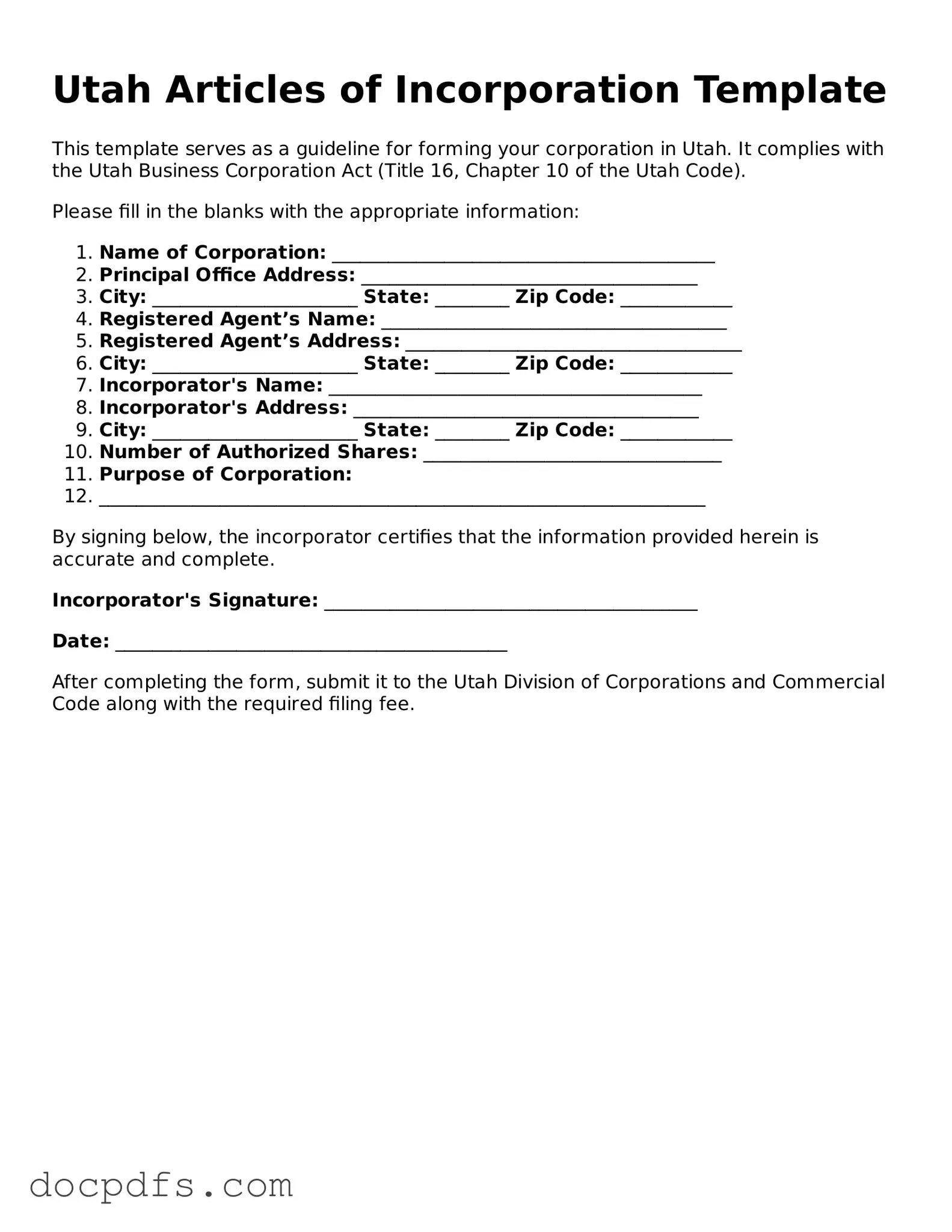

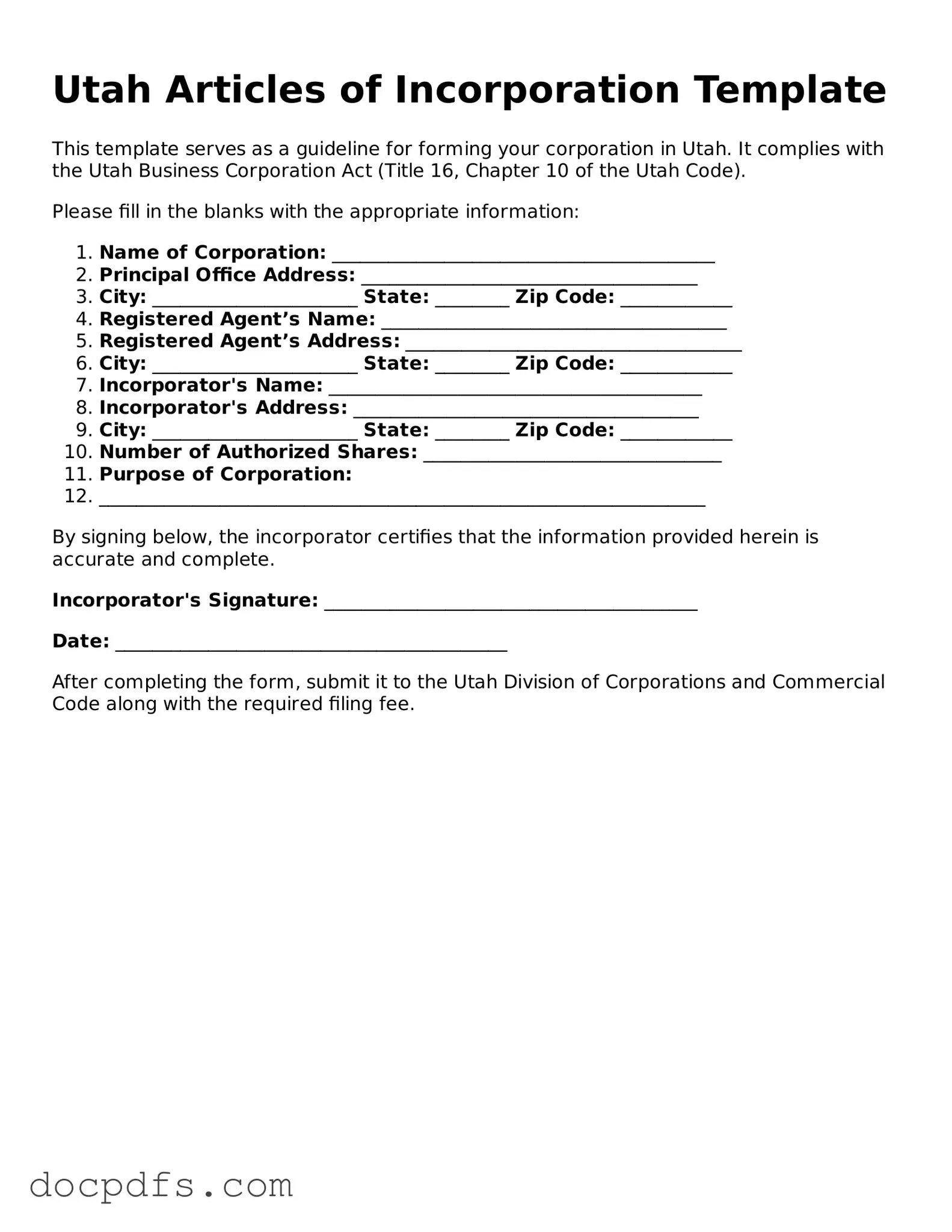

What information is required in the Articles of Incorporation?

The Articles of Incorporation must include specific information, such as:

-

The name of the corporation, which must be unique and not misleading.

-

The purpose of the corporation, explaining what the business will do.

-

The name and address of the registered agent, who will receive legal documents on behalf of the corporation.

-

The number of shares the corporation is authorized to issue.

-

The names and addresses of the incorporators, who are responsible for filing the document.

Providing accurate and complete information is essential for a smooth incorporation process.

How do I file the Articles of Incorporation in Utah?

To file the Articles of Incorporation in Utah, you can complete the form online or submit a paper version. The online filing is often faster and more convenient. Here are the steps to follow:

-

Visit the Utah Division of Corporations website.

-

Access the Articles of Incorporation form.

-

Fill out the required information accurately.

-

Submit the form along with the required filing fee, which varies depending on the type of corporation.

Once submitted, the Division of Corporations will review the application and, if approved, will issue a Certificate of Incorporation.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Utah varies based on the type of corporation being formed. As of October 2023, the fee for a for-profit corporation is typically around $70, while non-profit corporations may have a different fee structure. It's essential to check the latest fee schedule on the Utah Division of Corporations website, as fees can change over time.

How long does it take to process the Articles of Incorporation?

The processing time for Articles of Incorporation in Utah can vary. Generally, online submissions are processed more quickly, often within a few business days. Paper submissions may take longer, potentially up to two weeks or more, depending on the volume of applications being handled. For expedited processing, additional fees may apply. Always check the current processing times on the Division of Corporations' website for the most accurate information.