What is a prenuptial agreement in Utah?

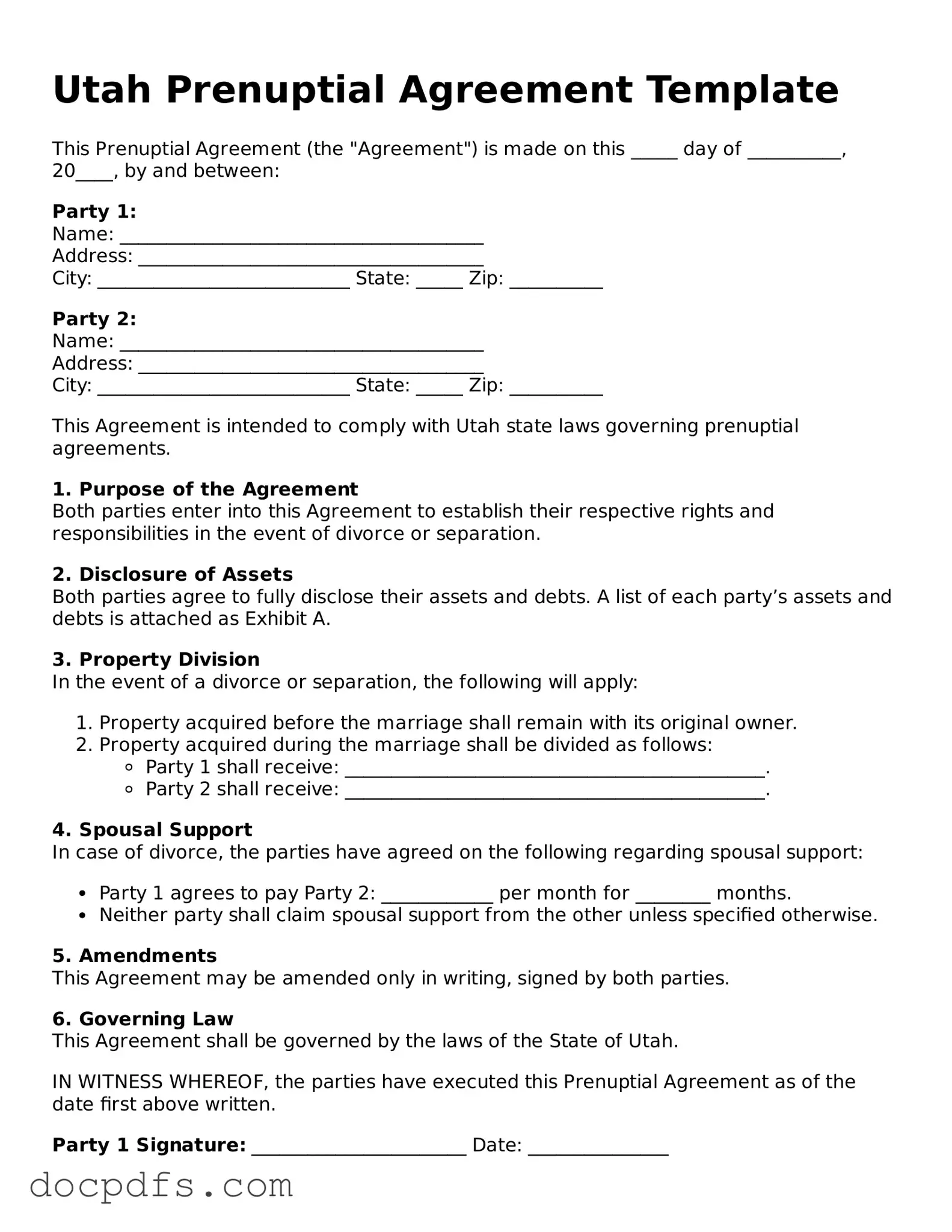

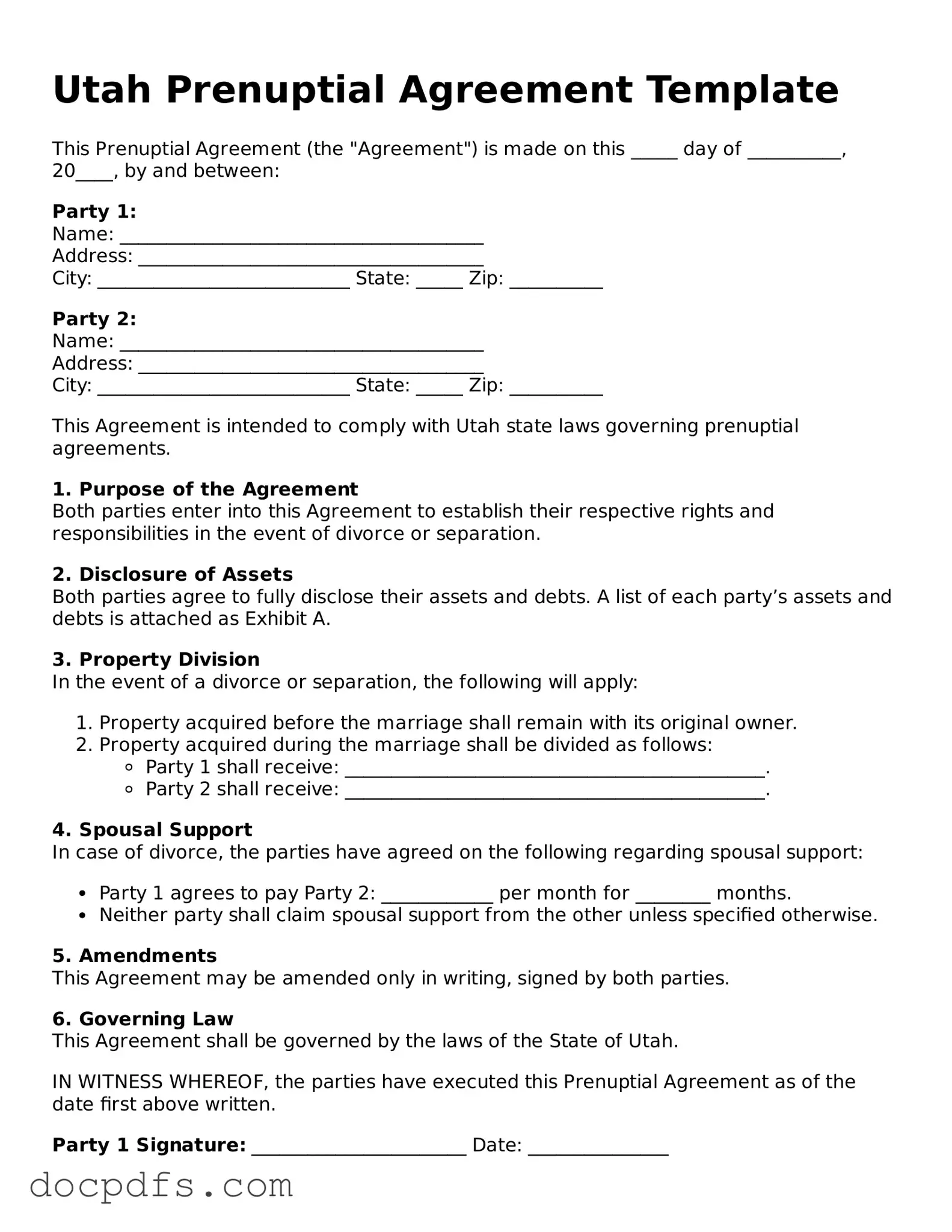

A prenuptial agreement, often referred to as a prenup, is a legal document that couples create before getting married. This agreement outlines the division of assets, debts, and other financial matters in the event of divorce or separation. In Utah, prenuptial agreements can also address spousal support and other personal matters, ensuring both parties have a clear understanding of their rights and responsibilities.

Why should I consider a prenuptial agreement?

There are several reasons to consider a prenuptial agreement:

-

Asset Protection:

A prenup can help protect individual assets acquired before the marriage.

-

Debt Management:

It can clarify how debts will be handled, preventing one spouse from being responsible for the other's debts.

-

Clarity:

A prenup provides clear guidelines on financial matters, which can reduce conflict in the future.

-

Custom Terms:

Couples can include specific terms that reflect their unique situation, such as how to handle business interests or inheritances.

How do I create a prenuptial agreement in Utah?

Creating a prenuptial agreement involves several steps:

-

Both parties should discuss their financial situations and what they want the agreement to cover.

-

Consulting with separate attorneys is advisable to ensure that both parties understand their rights and obligations.

-

Draft the agreement, including all necessary terms and conditions.

-

Both parties must sign the agreement, ideally well in advance of the wedding date to avoid claims of coercion.

Are prenuptial agreements enforceable in Utah?

Yes, prenuptial agreements are generally enforceable in Utah, provided they meet certain criteria. The agreement must be in writing and signed by both parties. Additionally, it should be fair and not unconscionable at the time of enforcement. Courts will also look for full disclosure of assets and debts at the time the agreement was created.

Can a prenuptial agreement be changed after marriage?

Yes, a prenuptial agreement can be modified or revoked after marriage. Both parties must agree to the changes in writing. It is essential to follow the same formalities as the original agreement to ensure that the modifications are enforceable.

What happens if we don’t have a prenuptial agreement?

If a couple does not have a prenuptial agreement and later divorces, Utah's divorce laws will determine the division of assets and debts. This can lead to outcomes that may not align with either party's wishes. Without a prenup, courts will typically divide marital property equitably, but this does not always mean equally.

How can I ensure my prenuptial agreement is valid?

To ensure the validity of a prenuptial agreement in Utah, consider the following tips:

-

Seek independent legal advice for both parties.

-

Ensure full and honest disclosure of assets and debts.

-

Draft the agreement well in advance of the wedding.

-

Make sure the terms are fair and reasonable.