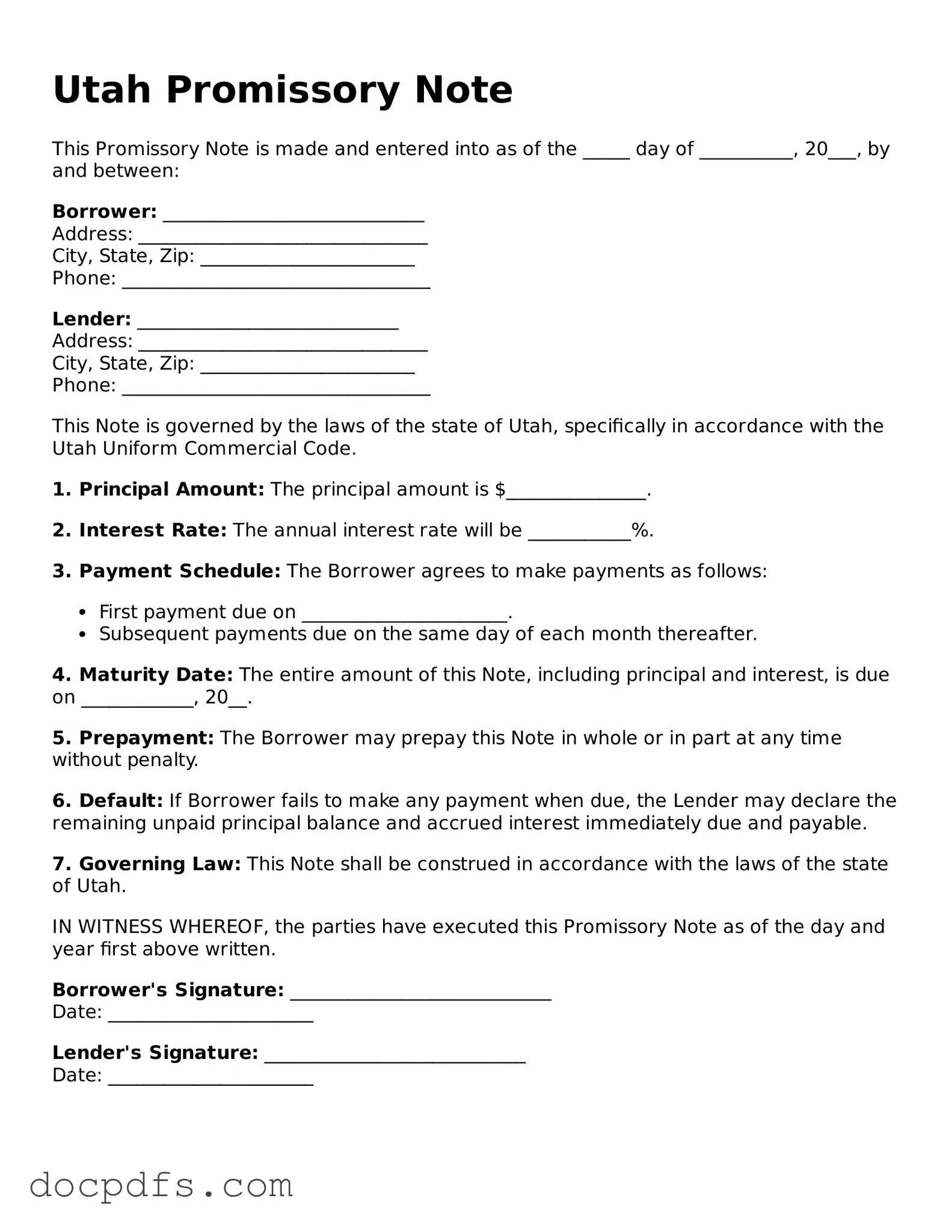

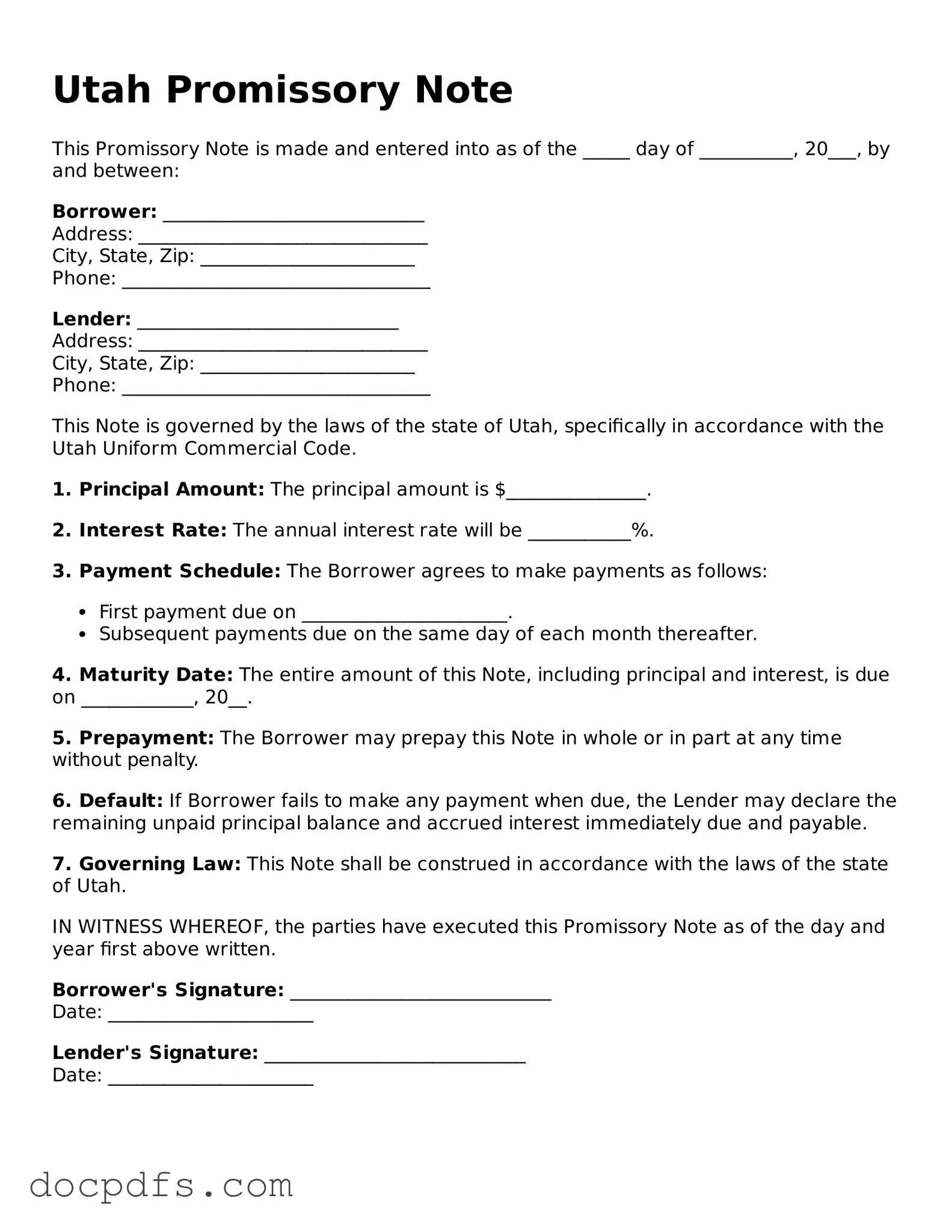

Free Utah Promissory Note Form

A Utah Promissory Note is a legal document in which one party promises to pay a specified amount of money to another party under agreed-upon terms. This form serves as a written record of the debt and outlines the repayment schedule, interest rate, and any consequences for defaulting on the loan. Understanding the nuances of this document can help both borrowers and lenders navigate their financial agreements more effectively.

Open Promissory Note Editor Now

Free Utah Promissory Note Form

Open Promissory Note Editor Now

Open Promissory Note Editor Now

or

⇓ Promissory Note

Finish this form the fast way

Complete Promissory Note online with a smooth editing experience.