The Utah Tractor Bill of Sale form is a legal document used to record the sale and transfer of ownership of a tractor in the state of Utah. This form captures essential details about the transaction, including the buyer's and seller's information, the tractor's specifications, and the sale price. It's a vital tool for both parties to ensure that the transaction is documented and that ownership is officially transferred.

Why is a Bill of Sale important?

A Bill of Sale serves several purposes. First, it provides proof of the transaction, which can be essential for future reference. Second, it protects both the buyer and seller by documenting the terms of the sale. In case of disputes, this document can serve as a legal record. Finally, having a Bill of Sale can simplify the process of registering the tractor with the state and obtaining necessary licenses or permits.

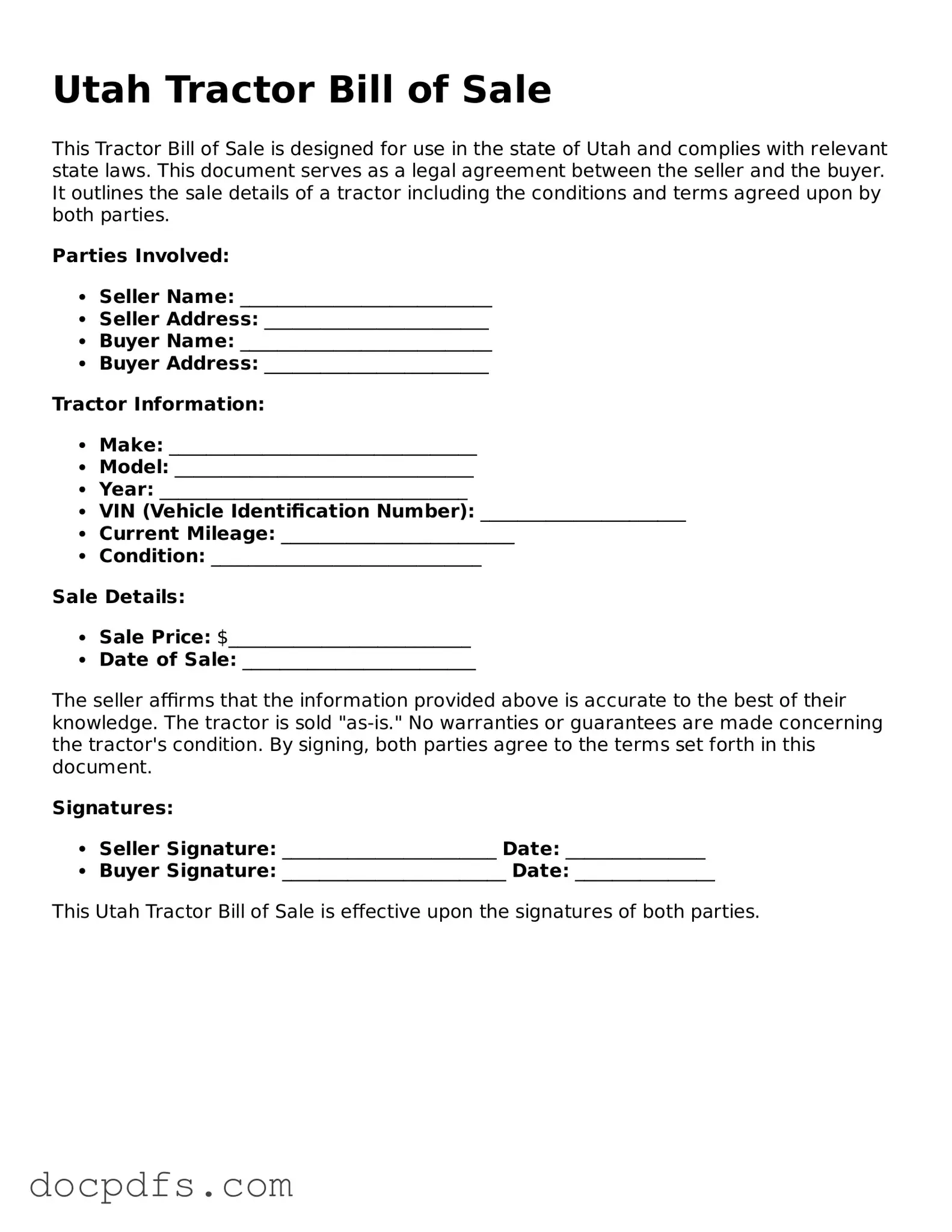

The Utah Tractor Bill of Sale form typically requires the following information:

-

Seller's name and contact information

-

Buyer's name and contact information

-

Tractor's make, model, year, and Vehicle Identification Number (VIN)

-

Sale price

-

Date of sale

Including all this information ensures clarity and helps prevent misunderstandings between the parties involved.

Do I need to have the Bill of Sale notarized?

In Utah, notarization is not a strict requirement for a Bill of Sale to be valid. However, having the document notarized can add an extra layer of security and legitimacy to the transaction. It may also be beneficial if you ever need to prove the authenticity of the document in the future.

While a generic Bill of Sale form can be used, it is advisable to use a specific form tailored for tractor sales in Utah. This ensures that all necessary details relevant to the transaction are included and complies with state regulations. Using a specific form reduces the risk of missing important information that could complicate the sale.

What if the tractor has a lien on it?

If the tractor has a lien, it is crucial to address this before completing the sale. The seller must ensure that the lien is paid off and released prior to transferring ownership. Failing to do so could lead to legal issues for both the buyer and seller. Always check for any outstanding liens before finalizing the sale.

Completing the Utah Tractor Bill of Sale form is straightforward. Start by filling in the seller's and buyer's information. Next, provide the tractor's details, including make, model, year, and VIN. Then, state the sale price and the date of the transaction. Finally, both parties should sign the document to make it official. Keeping a copy for your records is also a good idea.

Where do I submit the Bill of Sale?

The Bill of Sale does not need to be submitted to any government office in Utah. However, the buyer should keep it for their records, as it may be needed for future registration or proof of ownership. If the tractor is being registered, the buyer may need to present the Bill of Sale to the Department of Motor Vehicles (DMV) along with other required documentation.

Can I cancel the sale after the Bill of Sale is signed?

Once the Bill of Sale is signed and the transaction is completed, it is generally considered a binding agreement. Canceling the sale after this point can be complicated. If both parties agree to cancel, they should document this agreement in writing. If disputes arise, it may require legal intervention to resolve the matter.