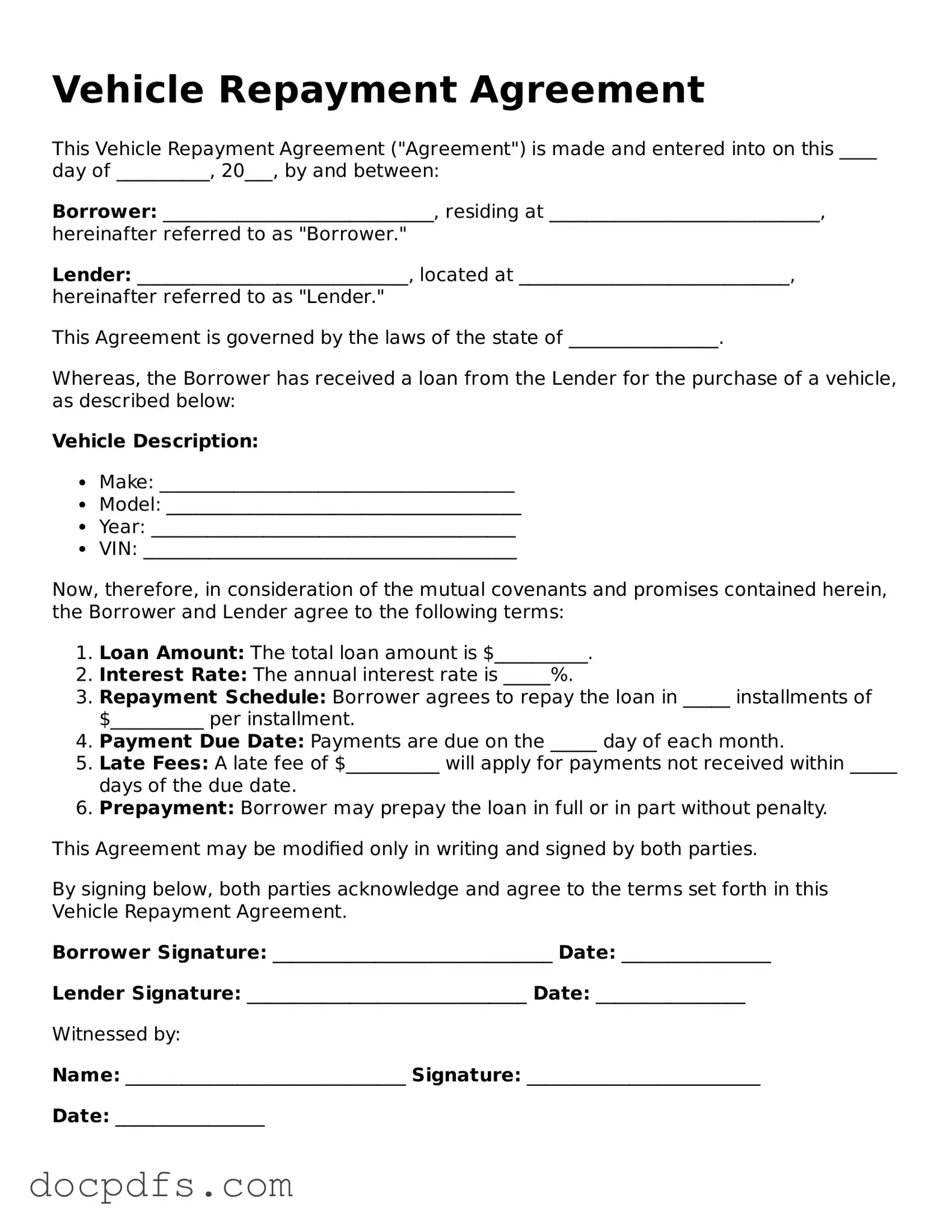

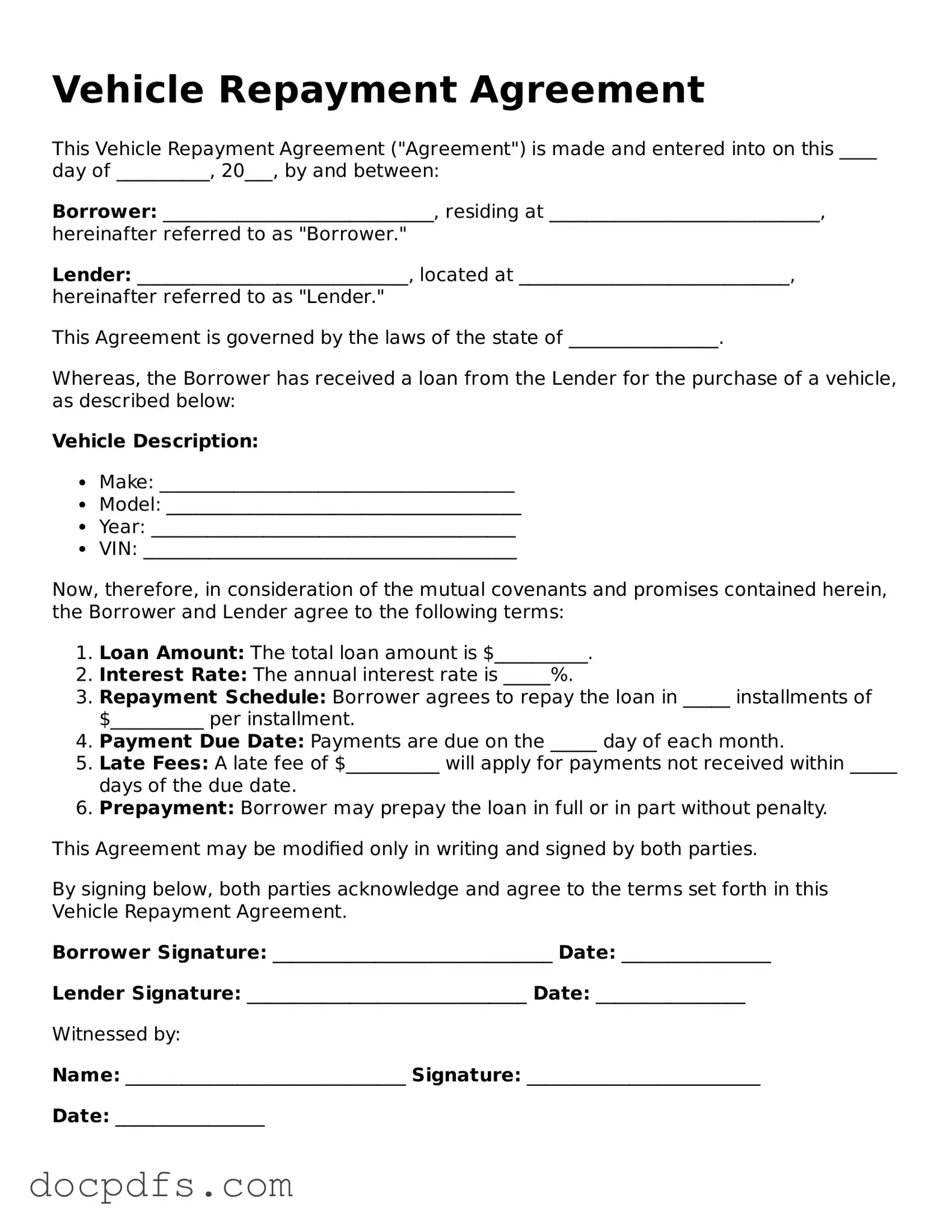

A Vehicle Repayment Agreement form is a legal document that outlines the terms under which a borrower agrees to repay a loan taken out to purchase a vehicle. This form typically includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments. It serves to protect both the lender and the borrower by clearly defining the obligations of each party.

Any individual or entity that is borrowing money to purchase a vehicle should complete a Vehicle Repayment Agreement form. This includes private buyers, businesses acquiring vehicles for commercial use, and even individuals seeking financing through a bank or credit union. It ensures that all parties are on the same page regarding the terms of the loan.

The Vehicle Repayment Agreement form generally contains the following information:

-

Borrower’s name and contact information

-

Lender’s name and contact information

-

Details about the vehicle, including make, model, year, and VIN (Vehicle Identification Number)

-

Loan amount and interest rate

-

Repayment schedule, including due dates and amounts

-

Terms regarding late payments or defaults

-

Signatures of both parties

To fill out the form, start by gathering all necessary information about the vehicle and the loan. Carefully input the details in the appropriate sections of the form. It’s crucial to double-check all entries for accuracy. Both the borrower and the lender should review the completed form before signing to ensure that everyone agrees to the terms outlined.

What happens if I miss a payment?

If a payment is missed, the terms outlined in the Vehicle Repayment Agreement will come into play. Typically, there may be late fees or penalties specified in the agreement. It’s important to communicate with the lender as soon as possible if a payment cannot be made on time. Many lenders are willing to work with borrowers to find a solution, such as extending the payment deadline or adjusting the repayment plan.

Can the terms of the Vehicle Repayment Agreement be modified?

Yes, the terms of the Vehicle Repayment Agreement can be modified, but both parties must agree to any changes. It’s advisable to document any amendments in writing and have both parties sign the updated agreement. This helps to avoid misunderstandings in the future and ensures that everyone is aware of the new terms.

Vehicle Repayment Agreement forms can often be obtained from various sources, including:

-

Financial institutions, such as banks and credit unions

-

Online legal document services

-

Local government offices that handle vehicle registrations

-

Legal professionals who can provide customized agreements

It’s important to choose a form that complies with your state’s laws and regulations to ensure that it is legally binding.