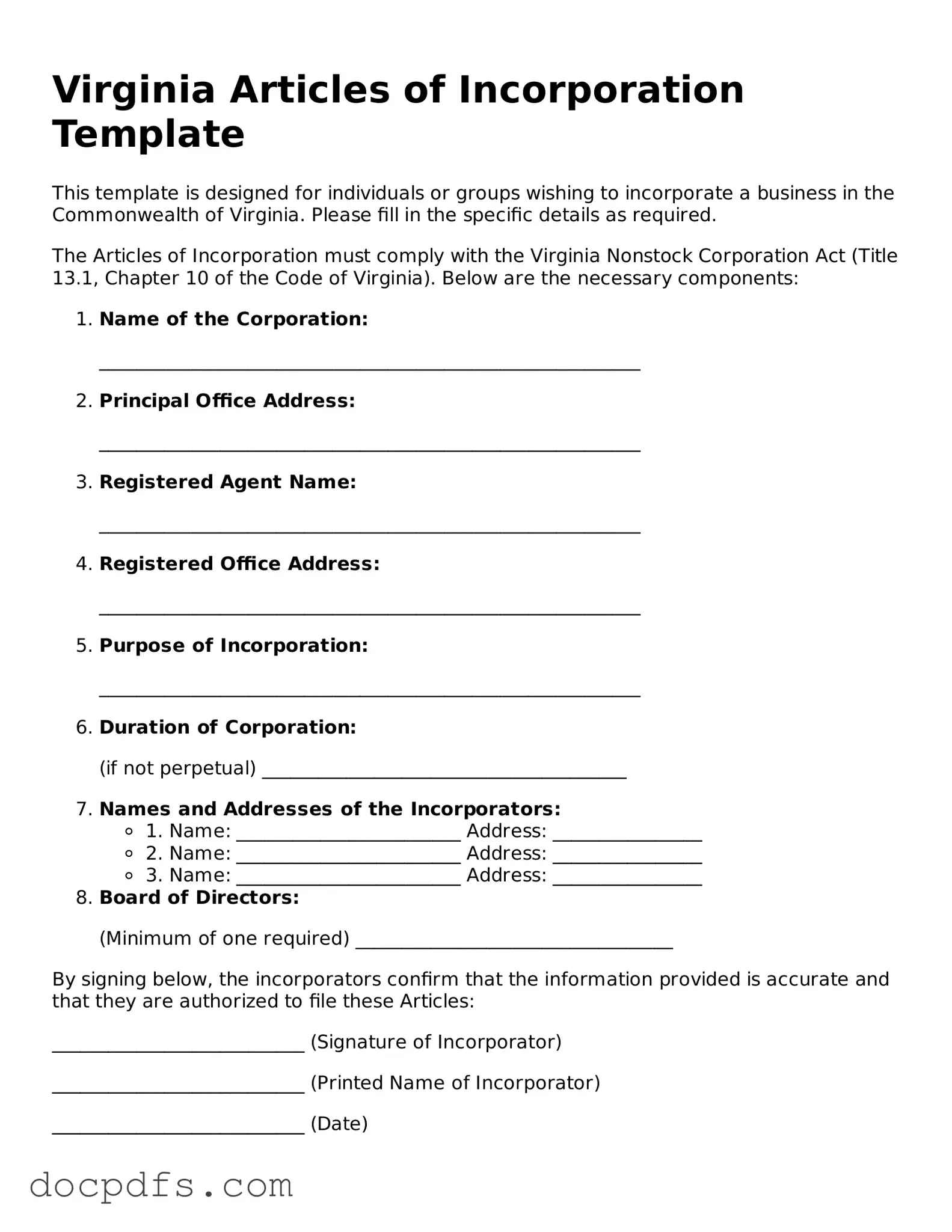

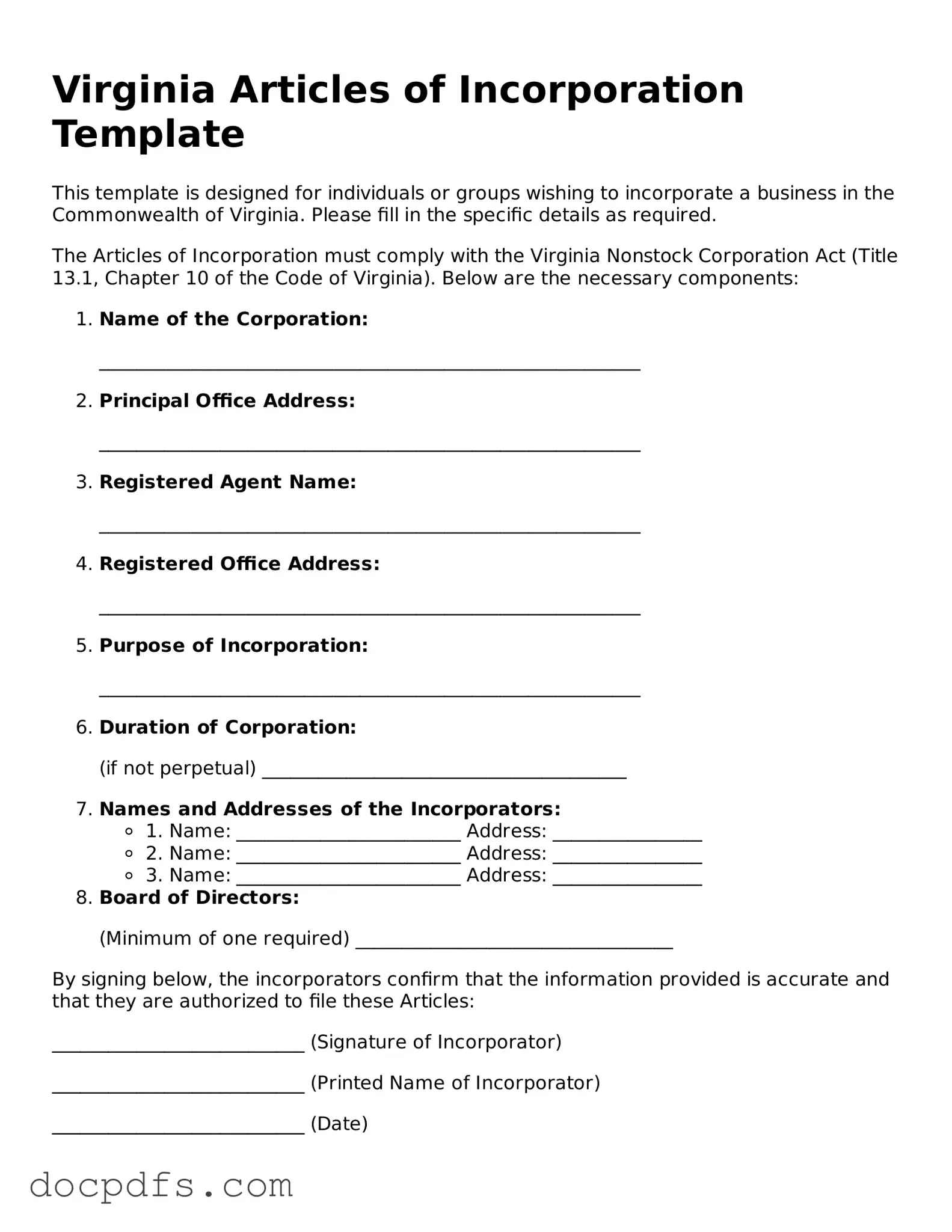

What is the Virginia Articles of Incorporation form?

The Virginia Articles of Incorporation form is a legal document that establishes a corporation in the state of Virginia. It outlines essential details about the corporation, such as its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this form is a crucial step in the process of forming a corporation.

Who needs to file the Articles of Incorporation?

Any individual or group looking to create a corporation in Virginia must file the Articles of Incorporation. This includes businesses of all types, whether for-profit or nonprofit. It is important to ensure that the corporation complies with state laws and regulations.

The Articles of Incorporation form requires several key pieces of information:

-

The name of the corporation.

-

The purpose of the corporation.

-

The registered agent's name and address.

-

The number of shares the corporation is authorized to issue.

-

The names and addresses of the incorporators.

Providing accurate information is vital to avoid delays in processing the application.

How do I submit the Articles of Incorporation?

You can submit the Articles of Incorporation form online through the Virginia Secretary of the Commonwealth's website or by mailing a paper form to their office. Ensure that you include the required filing fee, which varies depending on the type of corporation you are forming.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Virginia varies based on the type of corporation. Generally, the fee ranges from $25 to $100. It is advisable to check the Virginia Secretary of the Commonwealth's website for the most current fee schedule before submitting your application.

How long does it take for the Articles of Incorporation to be processed?

The processing time for the Articles of Incorporation can vary. Typically, it takes about 5 to 7 business days for the state to process online submissions. Paper submissions may take longer. If you need expedited processing, inquire about available options when you submit your form.

What happens after I file the Articles of Incorporation?

Once the Articles of Incorporation are filed and approved, your corporation will officially exist as a legal entity. You will receive a certificate of incorporation from the state. After this, you should take additional steps, such as obtaining an Employer Identification Number (EIN) from the IRS and setting up corporate bylaws, to ensure your corporation operates smoothly.