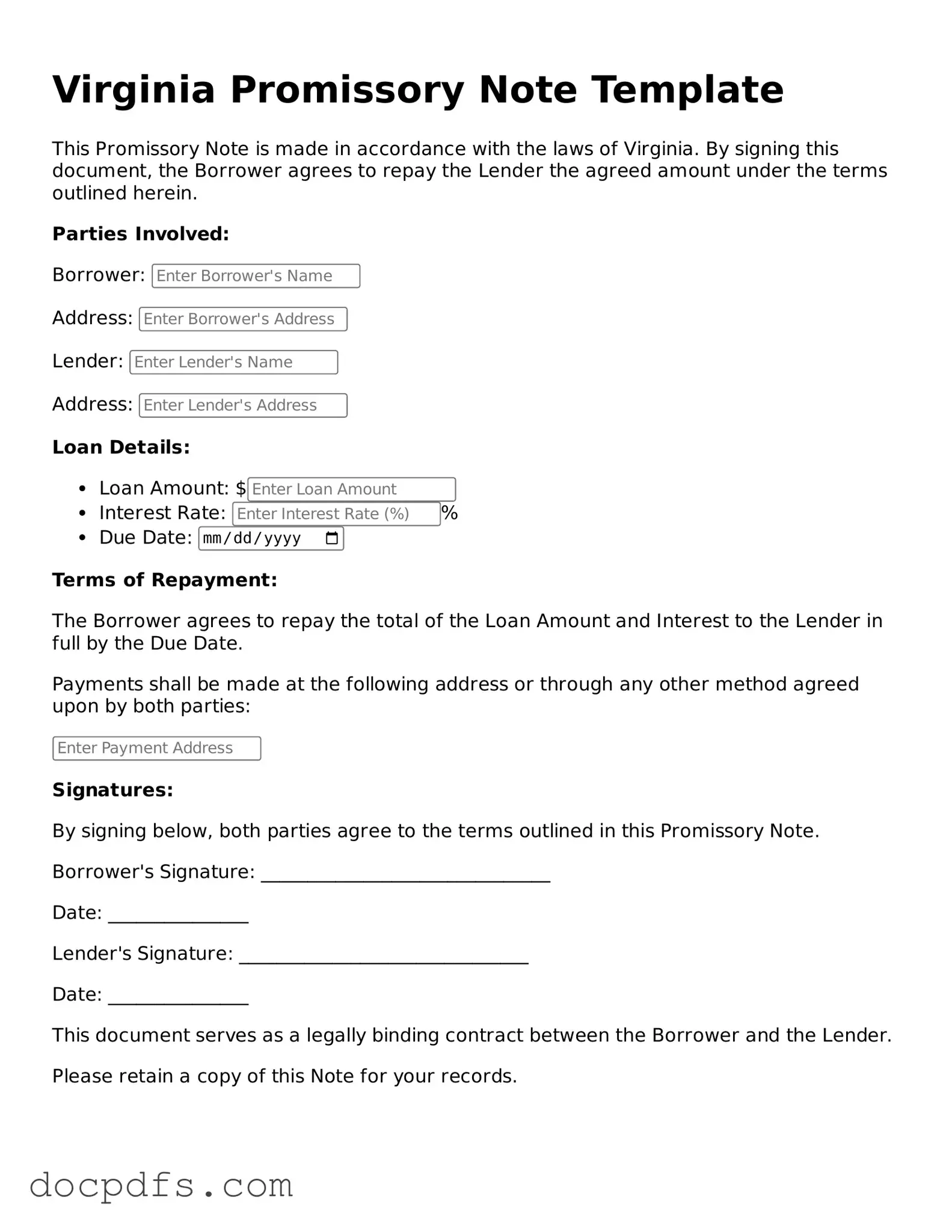

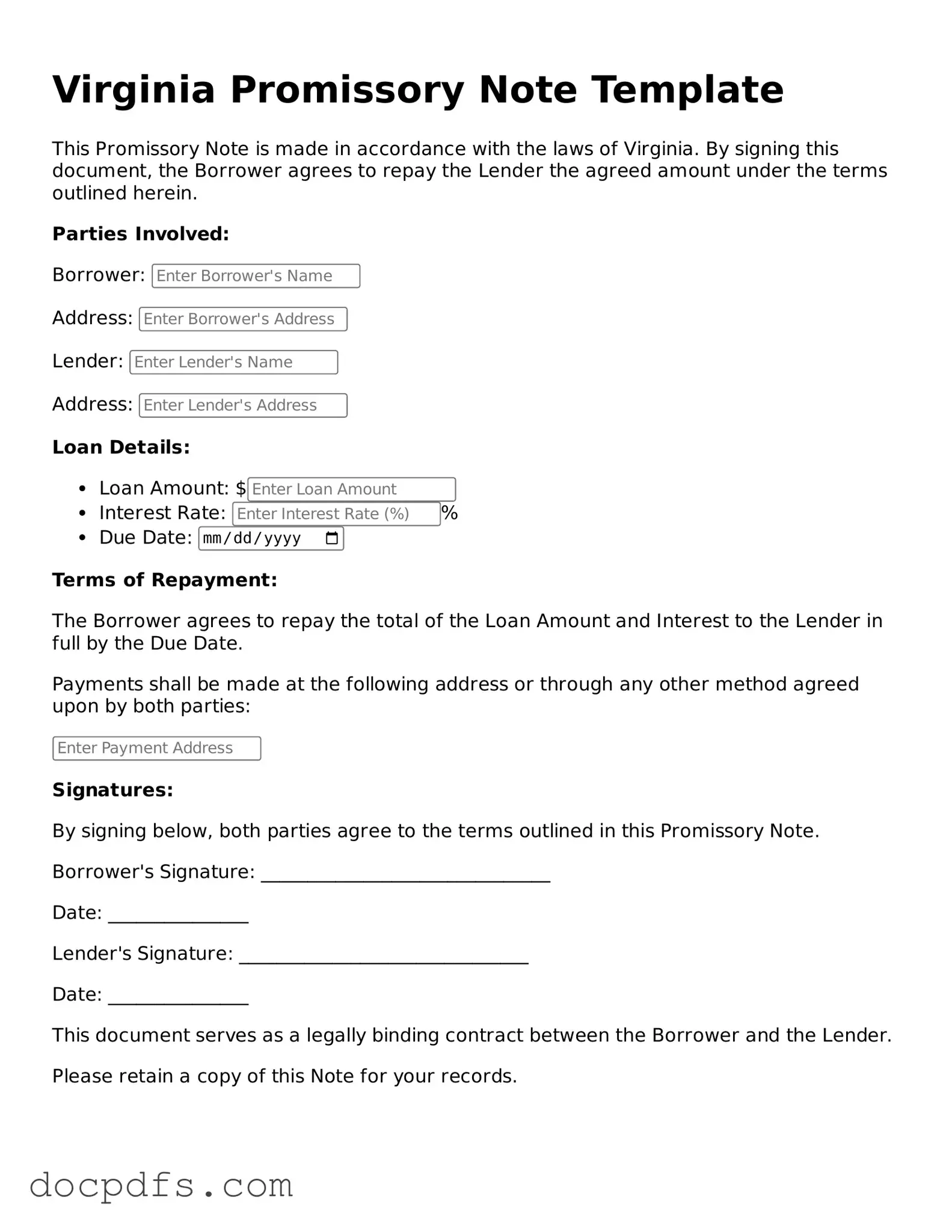

Free Virginia Promissory Note Form

A Virginia Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This form serves as a crucial tool for establishing clear expectations between the parties involved, ensuring that both the lender and borrower understand their rights and obligations. By using this form, individuals can create a formal record of the loan agreement, which can help prevent misunderstandings in the future.

Open Promissory Note Editor Now

Free Virginia Promissory Note Form

Open Promissory Note Editor Now

Open Promissory Note Editor Now

or

⇓ Promissory Note

Finish this form the fast way

Complete Promissory Note online with a smooth editing experience.