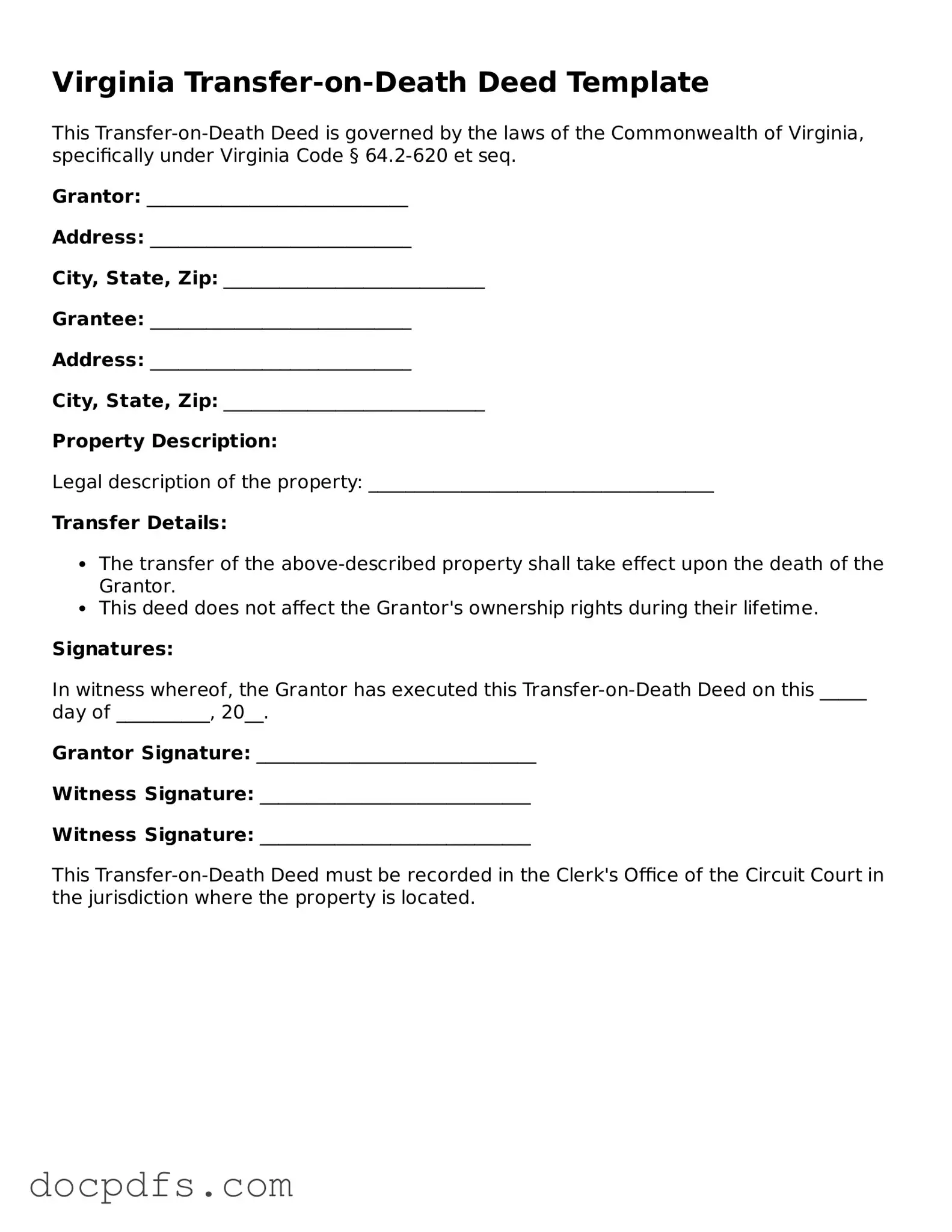

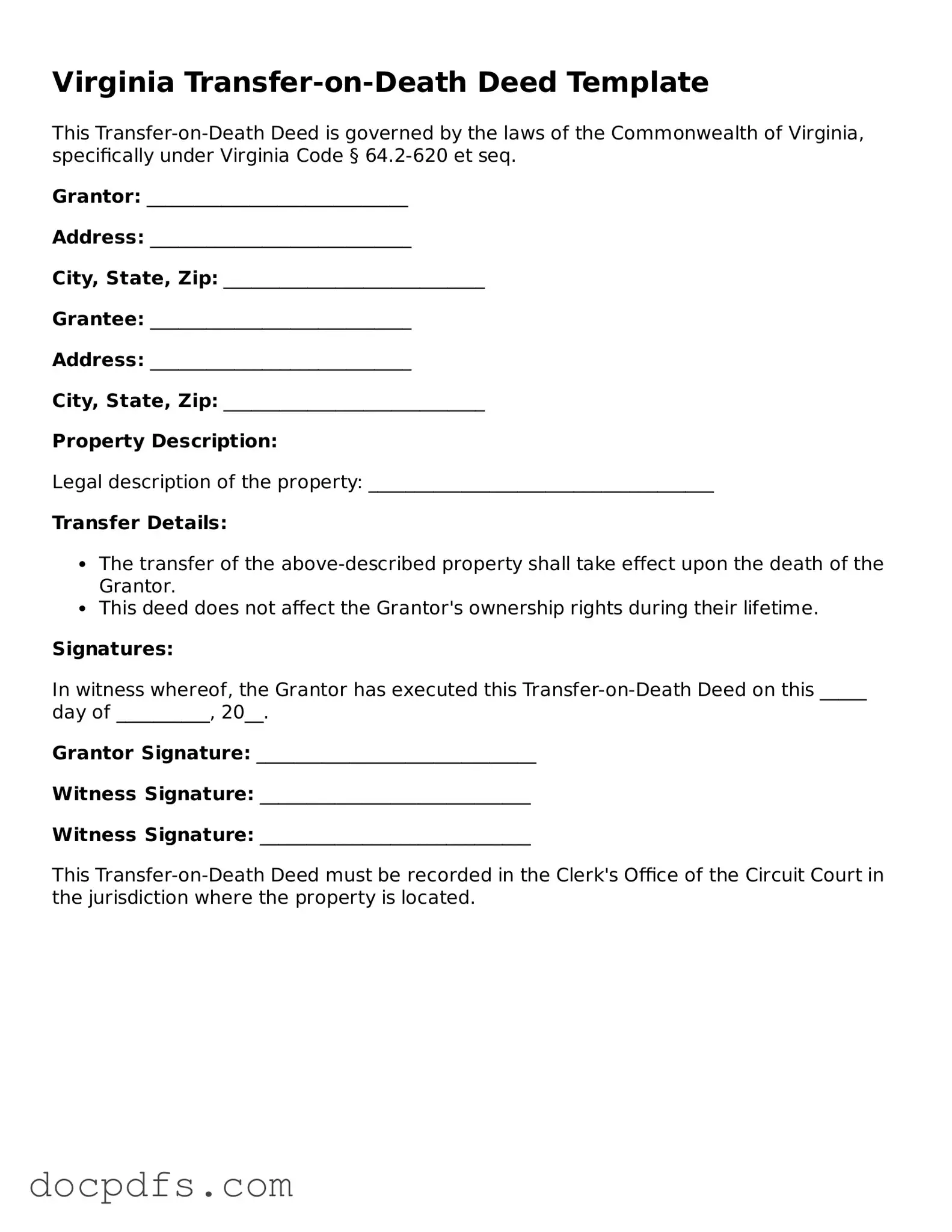

Free Virginia Transfer-on-Death Deed Form

A Virginia Transfer-on-Death Deed form allows property owners to transfer real estate to beneficiaries upon their death without the need for probate. This legal tool provides a straightforward way to ensure that your property is passed on according to your wishes. Understanding this form can help simplify the estate planning process and provide peace of mind for you and your loved ones.

Open Transfer-on-Death Deed Editor Now

Free Virginia Transfer-on-Death Deed Form

Open Transfer-on-Death Deed Editor Now

Open Transfer-on-Death Deed Editor Now

or

⇓ Transfer-on-Death Deed

Finish this form the fast way

Complete Transfer-on-Death Deed online with a smooth editing experience.