What are the Articles of Incorporation in Washington State?

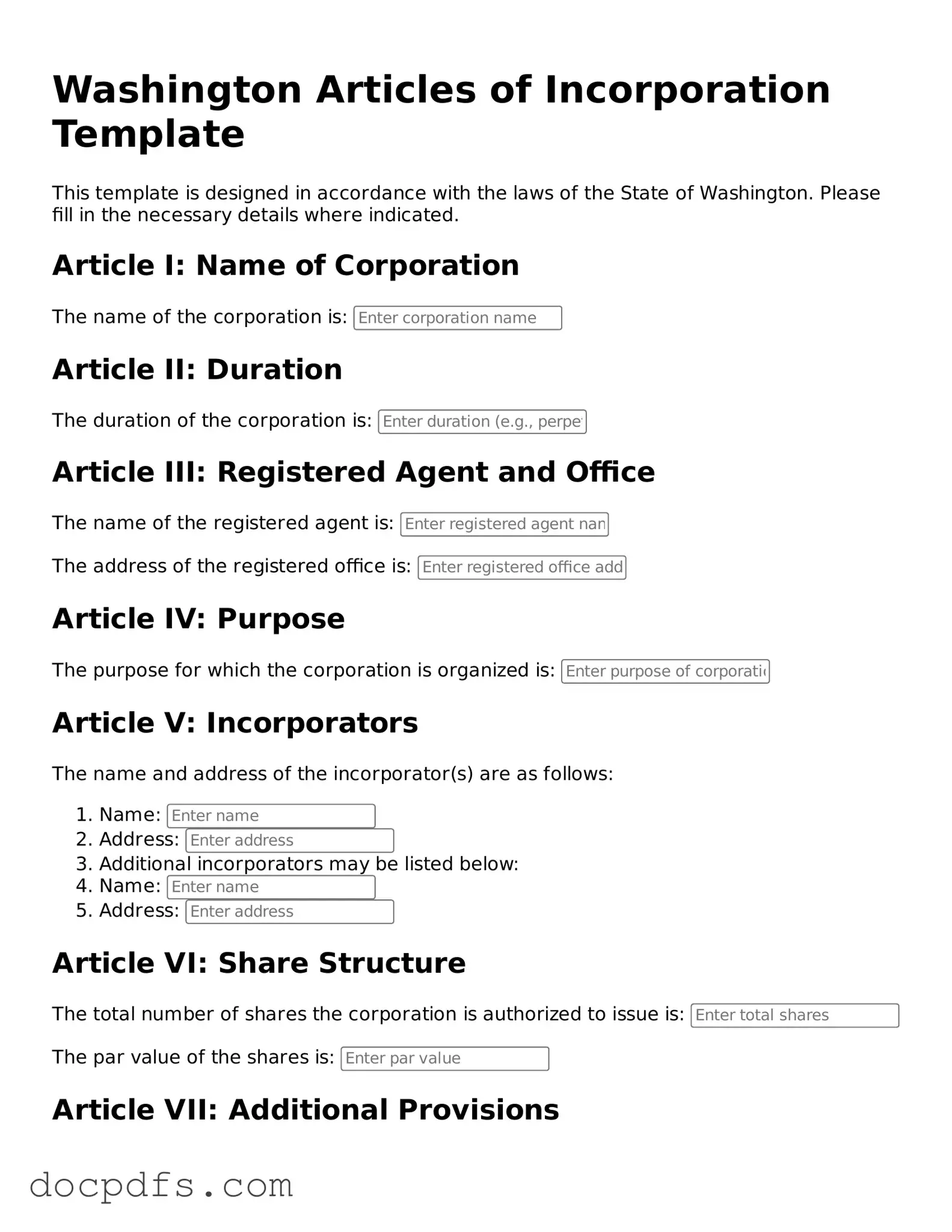

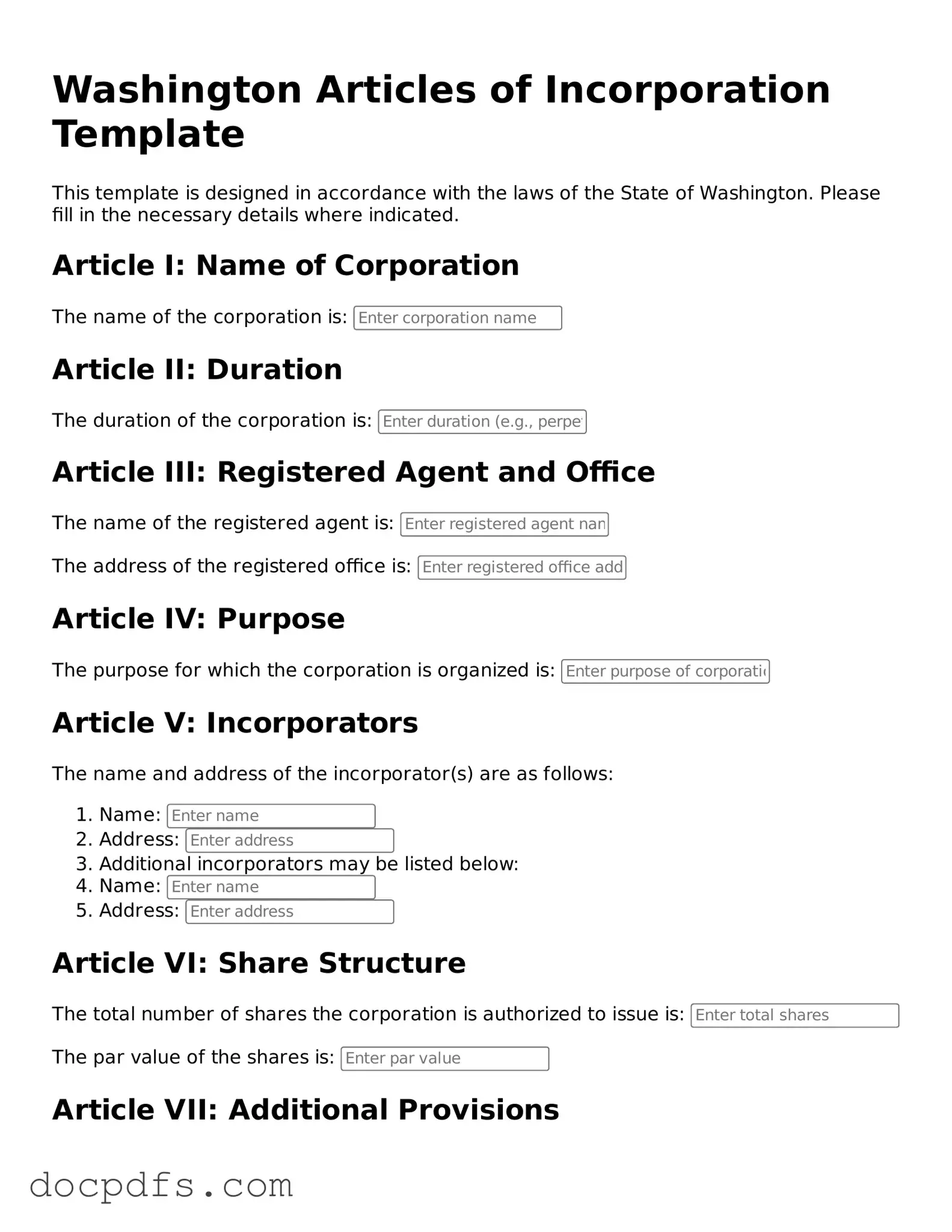

The Articles of Incorporation are legal documents filed with the Washington Secretary of State to establish a corporation. This document outlines essential information about the corporation, including its name, purpose, registered agent, and the number of shares authorized for issuance. Filing these articles is a crucial step in the formation of a corporation in Washington.

Who needs to file Articles of Incorporation?

Any individual or group looking to establish a corporation in Washington State must file Articles of Incorporation. This includes for-profit corporations, non-profit organizations, and professional corporations. It is important to note that sole proprietorships and partnerships do not require this filing.

What information is required in the Articles of Incorporation?

The Articles of Incorporation must include the following information:

-

The name of the corporation

-

The purpose of the corporation

-

The address of the corporation's principal office

-

The name and address of the registered agent

-

The number of shares the corporation is authorized to issue

-

The names and addresses of the incorporators

How do I file the Articles of Incorporation?

To file the Articles of Incorporation, individuals can complete the form online through the Washington Secretary of State's website or submit a paper form by mail. The filing fee must be paid at the time of submission. It is advisable to ensure that all information is accurate and complete to avoid delays in processing.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Washington varies depending on the type of corporation being formed. As of October 2023, the fee for a for-profit corporation is typically around $200, while non-profit corporations may have a lower fee. It is recommended to check the Washington Secretary of State's website for the most current fee schedule.

Can I amend the Articles of Incorporation after filing?

Yes, amendments to the Articles of Incorporation can be made after the initial filing. This process involves submitting an amendment form to the Secretary of State, along with any required fees. Common reasons for amendments include changes in the corporation's name, purpose, or structure.

How long does it take for the Articles of Incorporation to be processed?

The processing time for the Articles of Incorporation can vary. Typically, online submissions are processed more quickly, often within a few business days. Paper submissions may take longer, sometimes up to several weeks. It is advisable to check the current processing times on the Secretary of State's website.

What happens after my Articles of Incorporation are approved?

Once the Articles of Incorporation are approved, the corporation is officially formed. The Secretary of State will issue a certificate of incorporation, which serves as proof of the corporation's existence. After this, the corporation must comply with ongoing requirements, such as filing annual reports and maintaining good standing.

Are there any ongoing requirements after filing the Articles of Incorporation?

Yes, corporations in Washington must adhere to several ongoing requirements, including:

-

Filing an annual report with the Secretary of State

-

Paying any applicable fees and taxes

-

Maintaining a registered agent and office

Failure to meet these requirements can result in penalties or loss of good standing.

Where can I find additional resources or assistance?

Additional resources and assistance can be found on the Washington Secretary of State's website. This site offers comprehensive information on the incorporation process, downloadable forms, and contact information for further inquiries. Additionally, consulting with a legal professional or a business advisor can provide valuable guidance.