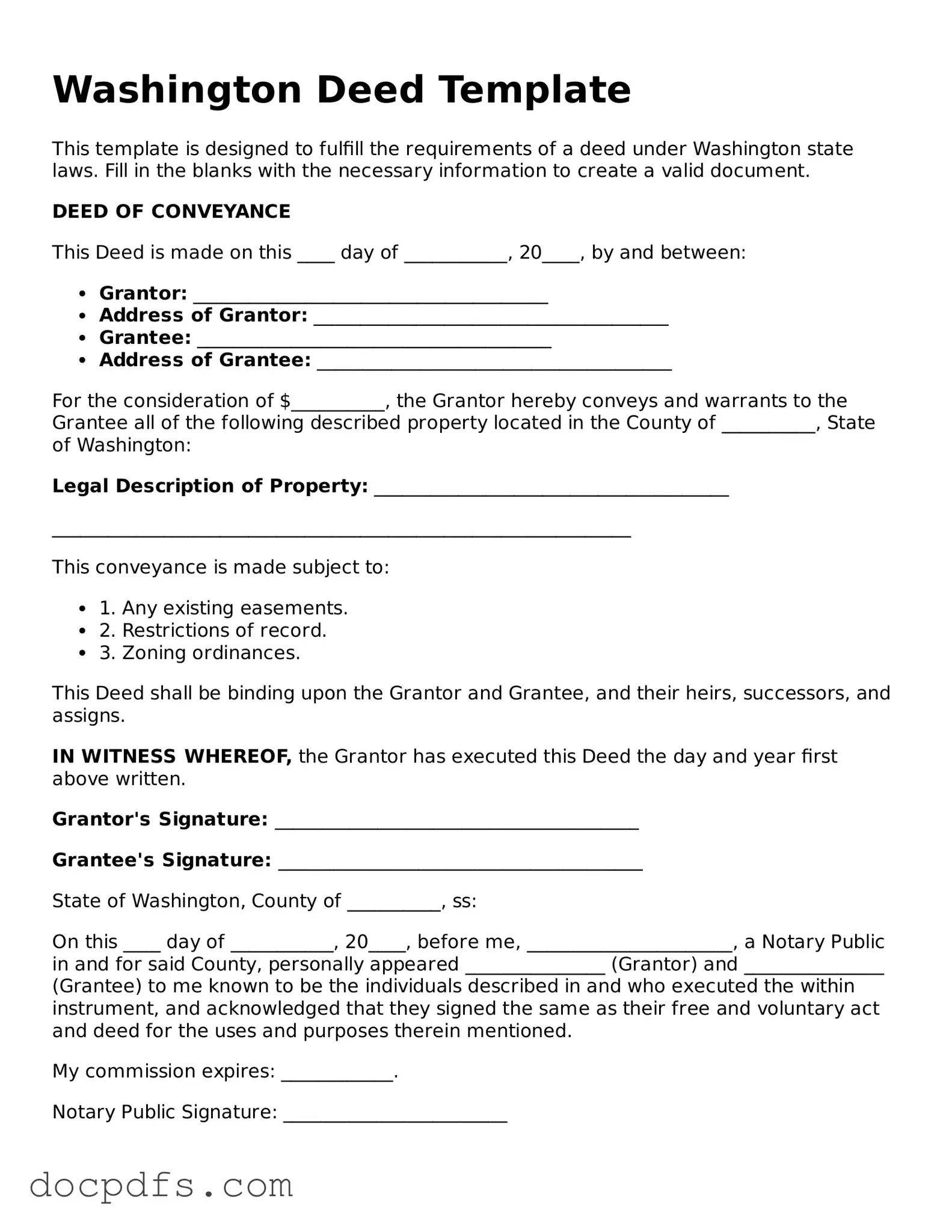

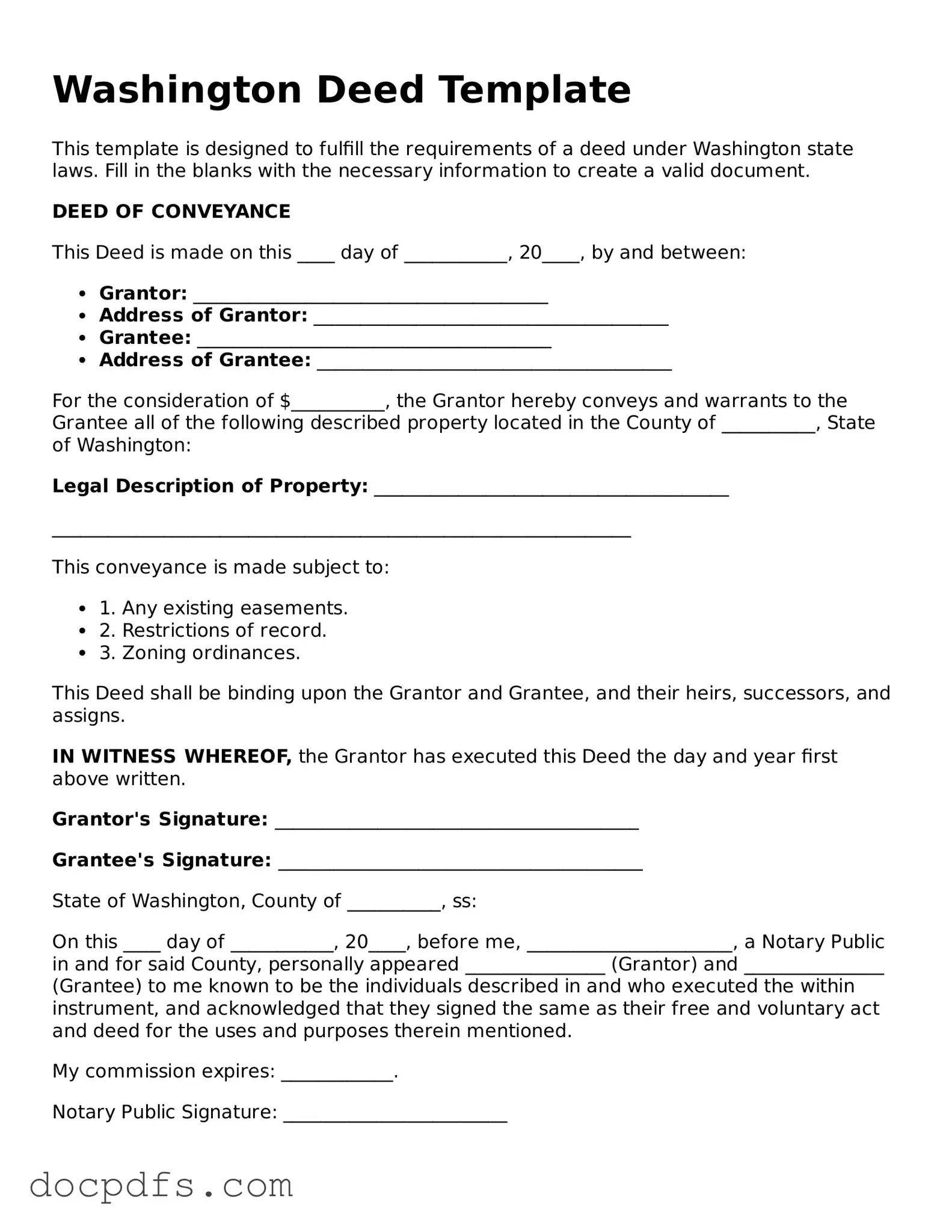

A Washington Deed form is a legal document used to transfer ownership of real property in the state of Washington. It serves as proof of the transfer and outlines the details of the transaction, including the names of the parties involved, the property description, and any conditions of the transfer.

What types of deeds are available in Washington?

There are several types of deeds in Washington, including:

-

Warranty Deed:

Provides the highest level of protection to the buyer, guaranteeing that the seller has clear title to the property.

-

Quitclaim Deed:

Transfers whatever interest the seller has in the property without any guarantees. This is often used between family members or in divorce settlements.

-

Special Warranty Deed:

Similar to a warranty deed but only covers the period during which the seller owned the property.

Do I need a lawyer to complete a Washington Deed?

While it is not legally required to have a lawyer to complete a deed in Washington, consulting with one can be beneficial. A lawyer can help ensure that the deed is properly prepared, executed, and recorded, reducing the risk of future disputes.

Filling out a Washington Deed form involves several steps:

-

Enter the names and addresses of the grantor (seller) and grantee (buyer).

-

Provide a legal description of the property being transferred.

-

Include any relevant details, such as the sale price or any conditions of the transfer.

-

Sign the deed in front of a notary public.

How do I record a Washington Deed?

To record a Washington Deed, take the signed and notarized document to the county auditor’s office where the property is located. There, you will need to pay a recording fee. Once recorded, the deed becomes part of the public record.

Are there any taxes associated with transferring property in Washington?

Yes, Washington imposes an excise tax on the sale of real estate. This tax is usually calculated as a percentage of the sale price. The seller is typically responsible for paying this tax, but the parties can negotiate who pays it as part of the sale agreement.

What happens if I don’t record my Washington Deed?

If you do not record your deed, the transfer of ownership may not be recognized by third parties. This can lead to complications, such as disputes over property rights or difficulties in selling the property in the future. Recording the deed helps protect your ownership rights.

Can I revoke a Washington Deed after it has been executed?

In general, once a deed is executed and recorded, it cannot be revoked unilaterally. However, a grantor may be able to create a new deed to transfer the property back or to another party. Legal advice is recommended to navigate this process effectively.